2024 corporate & investment bank markets full-time analyst program – Embark on an enlightening journey into the dynamic world of the 2024 corporate and investment bank markets full-time analyst program. This program offers an exceptional opportunity for aspiring professionals to gain invaluable experience and lay the foundation for a successful career in the financial industry.

Throughout this comprehensive analysis, we will delve into the current market landscape, explore the intricacies of the analyst role, and uncover emerging trends shaping the future of corporate and investment banking.

As we navigate this multifaceted program, we will shed light on the essential skills and qualifications required to excel as a full-time analyst. Furthermore, we will examine the career progression opportunities available to analysts, empowering you with the knowledge to make informed decisions about your professional trajectory.

Market Overview

The 2024 corporate and investment bank markets are poised for growth, driven by strong economic fundamentals and increasing demand for financial services. Recent market trends include a rise in mergers and acquisitions (M&A) activity, increased issuance of corporate debt, and growing investor interest in alternative asset classes.

Key drivers of the industry include globalization, technological advancements, and regulatory changes. Challenges facing the industry include competition from fintech companies, geopolitical uncertainty, and market volatility.

Full-Time Analyst Program

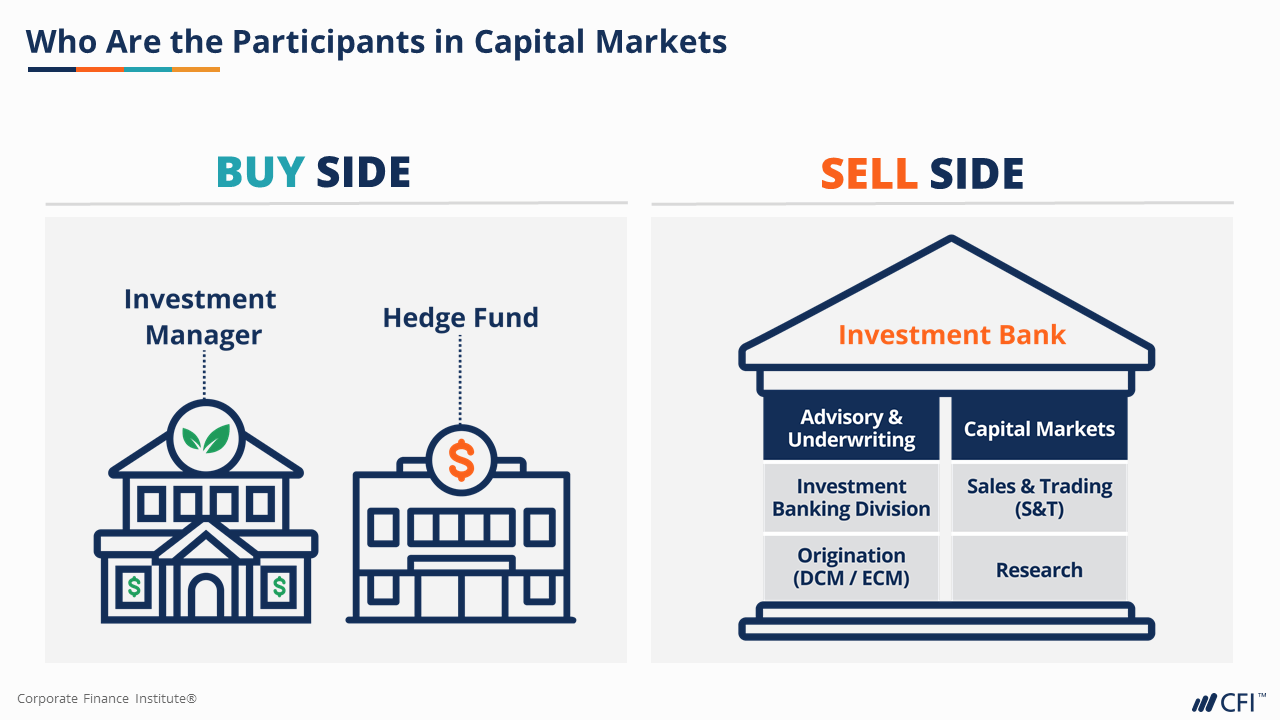

Full-time analyst programs at corporate and investment banks typically offer a structured training and development experience for recent graduates or early-career professionals. Analysts play a vital role in supporting investment bankers and other professionals in various areas, including financial analysis, deal execution, and client management.

To succeed in this role, analysts typically require a strong academic background in finance or a related field, excellent analytical and communication skills, and a high level of motivation and work ethic.

The 2024 corporate & investment bank markets full-time analyst program is designed to provide participants with a comprehensive understanding of the financial industry. The program includes rotations through various divisions within the bank, including investment banking, sales and trading, and research.

During their rotations, analysts will gain exposure to a wide range of financial products and services, including loans, bonds, and derivatives. They will also learn about the different types of loan documents and how to interpret them. For example, this loan document states that the property is an investment property.

This means that the property is not the borrower’s primary residence and is used to generate income. The 2024 corporate & investment bank markets full-time analyst program is a highly competitive program that offers participants the opportunity to launch a successful career in the financial industry.

Successful analysts often progress to roles as associates or vice presidents within the investment banking division or other areas of the firm.

Market Trends: 2024 Corporate & Investment Bank Markets Full-time Analyst Program

Emerging trends in the corporate and investment banking industry include the increasing use of technology, the growing importance of environmental, social, and governance (ESG) factors, and the rise of digital assets.

Technology is transforming the industry, with artificial intelligence (AI) and machine learning (ML) being used to automate tasks and improve decision-making. ESG factors are becoming increasingly important for investors, and banks are responding by offering a range of ESG-focused products and services.

Digital assets, such as cryptocurrencies and blockchain technology, are also gaining traction, and banks are exploring ways to integrate these assets into their offerings.

Industry Analysis

Leading corporate and investment banks include Goldman Sachs, JPMorgan Chase, and Morgan Stanley. These banks offer a wide range of products and services to corporations and investors, and they compete on factors such as financial performance, market share, and reputation.

By analyzing the financial performance, market share, and reputation of different banks, investors can identify potential investment opportunities or partnerships.

Data and Analytics

Data and analytics are essential to the corporate and investment banking industry. Analysts use data to make informed decisions about investments, mergers and acquisitions, and other financial transactions.

The tools and techniques used for data analysis include financial modeling, statistical analysis, and data visualization. By effectively leveraging data and analytics, analysts can gain a competitive advantage and make better decisions.

Last Word

In conclusion, the 2024 corporate and investment bank markets full-time analyst program presents an unparalleled opportunity for individuals seeking to establish a thriving career in the financial sector. By understanding the market dynamics, embracing the responsibilities of an analyst, and staying abreast of industry trends, you can position yourself for success in this competitive and rewarding field.

The future of corporate and investment banking holds immense potential, and analysts will play a pivotal role in shaping its trajectory.

Detailed FAQs

What are the key responsibilities of a full-time analyst in corporate and investment banking?

Full-time analysts are responsible for conducting financial analysis, preparing presentations, and assisting senior bankers in various aspects of deal execution, such as mergers and acquisitions, capital raising, and debt financing.

What are the essential skills required to succeed as a full-time analyst?

Analytical skills, financial modeling proficiency, strong communication and presentation abilities, and a deep understanding of financial markets are crucial for success in this role.

What are the career progression opportunities available to analysts?

Analysts can progress to roles such as associate, vice president, and director within investment banking divisions or move into other areas of finance, such as portfolio management or research.