Non cash investing and financing activities may be disclosed in – Non-cash investing and financing activities may be disclosed in financial statements to provide a more comprehensive view of a company’s financial performance. These activities can include transactions such as the issuance of stock, the acquisition of assets through mergers or acquisitions, and the receipt of grants or loans.

Understanding the disclosure requirements and presentation of non-cash investing and financing activities is crucial for financial analysts and investors seeking to evaluate a company’s financial health.

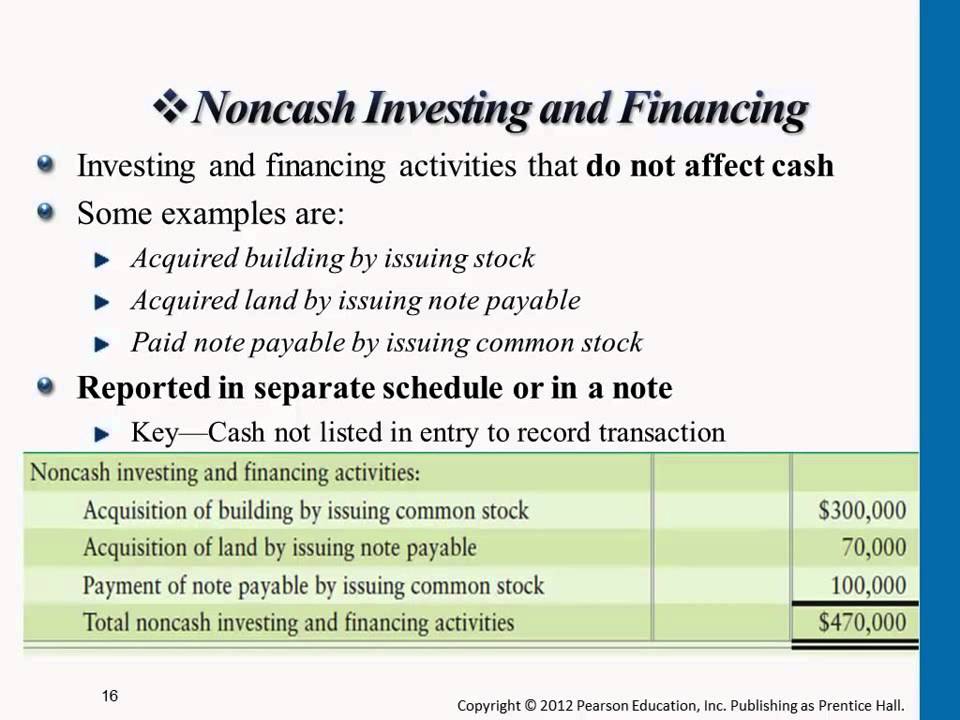

The accounting standards governing the disclosure of non-cash investing and financing activities aim to ensure transparency and comparability in financial reporting. These activities are typically disclosed in the notes to financial statements or in a separate statement of cash flows.

The purpose of these disclosure requirements is to provide users of financial statements with the information necessary to assess the company’s financial position and performance, as well as its ability to generate cash flows.

Non-Cash Investing and Financing Activities

Non-cash investing and financing activities are transactions that affect a company’s financial position without involving the exchange of cash. These activities can include issuing or repurchasing debt or equity securities, acquiring or selling assets, and entering into leases.

Non-cash investing and financing activities can have a significant impact on a company’s financial statements and overall financial performance. Therefore, it is important for investors and analysts to understand how these activities are disclosed and accounted for.

Disclosure Requirements

The accounting standards that govern the disclosure of non-cash investing and financing activities are the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP). These standards require companies to disclose all non-cash investing and financing activities in their financial statements, along with a description of the nature and purpose of each transaction.

The purpose of these disclosure requirements is to provide investors and analysts with the information they need to assess the impact of non-cash investing and financing activities on a company’s financial position and performance.

Financial Statement Presentation

Non-cash investing and financing activities can be presented in financial statements in a variety of ways. The most common method is to include them in a separate statement of cash flows. This statement shows the sources and uses of cash during a period, and it can be used to identify non-cash investing and financing activities.

Another method of presenting non-cash investing and financing activities is to include them in the balance sheet. This can be done by adding or subtracting the amount of the transaction from the appropriate account balance.

Impact on Financial Analysis

Non-cash investing and financing activities can have a significant impact on financial analysis. For example, a company that issues new debt may have to pay interest on that debt, which can reduce its profitability. Similarly, a company that acquires a new asset may have to depreciate that asset, which can also reduce its profitability.

Analysts use non-cash investing and financing activities to evaluate a company’s financial performance and make investment decisions. For example, an analyst may use the statement of cash flows to identify companies that are generating a lot of cash from operations.

These companies may be good investments because they are likely to have strong financial performance.

Case Studies, Non cash investing and financing activities may be disclosed in

There are many examples of companies that have used non-cash investing and financing activities to improve their financial performance. For example, Apple Inc. has used stock buybacks to reduce its share count and increase its earnings per share. This has helped Apple to improve its profitability and return on equity.

Another example is Amazon.com Inc., which has used debt financing to fund its growth. This has allowed Amazon to expand its business rapidly and become one of the largest companies in the world.

Outcome Summary: Non Cash Investing And Financing Activities May Be Disclosed In

In conclusion, non-cash investing and financing activities can have a significant impact on a company’s financial analysis. Analysts use this information to evaluate a company’s financial performance, assess its risk profile, and make informed investment decisions. Understanding the disclosure requirements and presentation of non-cash investing and financing activities is essential for financial professionals seeking to gain a comprehensive understanding of a company’s financial health.

Non-cash investing and financing activities may be disclosed in a variety of financial statements. For example, the easiest country to get permanent residency in Europe without investment is Portugal . Non-cash investing and financing activities can also be disclosed in the notes to financial statements.

Query Resolution

What are non-cash investing and financing activities?

Non-cash investing and financing activities are transactions that do not involve the exchange of cash. Examples include the issuance of stock, the acquisition of assets through mergers or acquisitions, and the receipt of grants or loans.

Why are non-cash investing and financing activities disclosed in financial statements?

Non-cash investing and financing activities are disclosed in financial statements to provide a more comprehensive view of a company’s financial performance and to comply with accounting standards.

How do non-cash investing and financing activities impact financial analysis?

Non-cash investing and financing activities can impact financial analysis by affecting a company’s financial ratios, profitability, and cash flow generation.