How do you calculate rate of return on investment (ROI)? This question lies at the heart of every successful investment decision. ROI is a crucial metric that measures the profitability of an investment, providing invaluable insights into its potential returns.

Understanding how to calculate ROI empowers investors with the knowledge to make informed choices, maximize returns, and minimize risks.

This comprehensive guide delves into the intricacies of ROI calculations, exploring different types of ROI, methods for calculating it, and factors that can impact its value. By the end of this narrative, you will possess the knowledge and skills to confidently assess the profitability of any investment opportunity.

Calculating Rate of Return on Investment (ROI)

Calculating ROI is a crucial step in evaluating the potential profitability of an investment. It provides investors with a clear understanding of the relationship between the gains and costs associated with an investment, enabling them to make informed decisions.

Formula for Calculating ROI

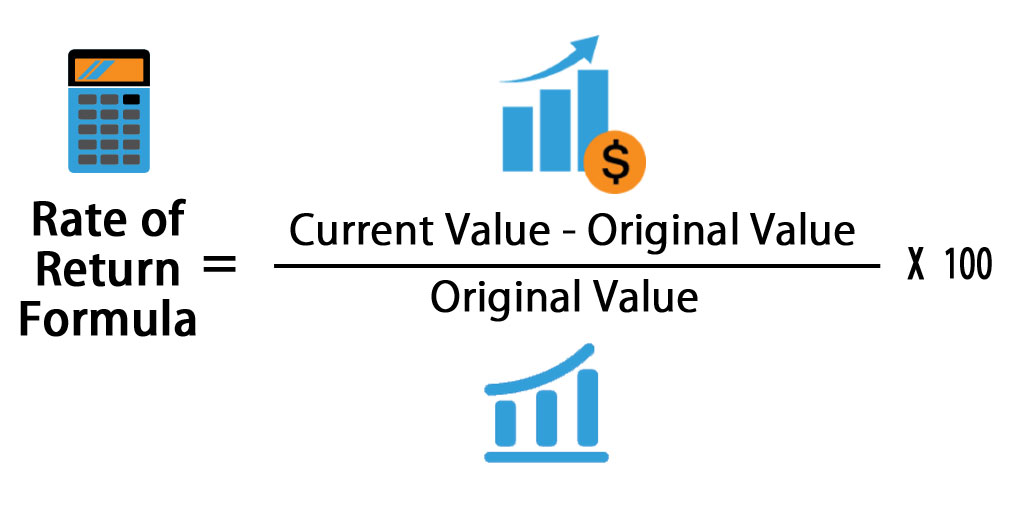

The formula for calculating ROI is as follows:

ROI = (Gain from Investment

Cost of Investment) / Cost of Investment

In calculating the rate of return on investment, it is important to consider the level of risk associated with the investment. Which is an example of a high risk investment ? High-risk investments often carry the potential for higher returns, but also come with the possibility of greater losses.

Therefore, it is crucial to assess the risk tolerance and financial goals before making any investment decisions.

Where:

- Gain from Investment: The difference between the selling price of the investment and the initial cost of acquiring it.

- Cost of Investment: The total amount invested, including the purchase price and any additional expenses incurred.

Types of ROI

There are various types of ROI, each focusing on different aspects of an investment’s return:

- Accounting ROI:Measures the financial return on an investment based on accounting principles.

- Economic ROI:Considers the broader economic impact of an investment, including both financial and non-financial benefits.

- Social ROI:Evaluates the social and environmental benefits of an investment.

Methods for Calculating ROI

Different methods can be used to calculate ROI, depending on the nature of the investment:

- Net Present Value (NPV):Considers the time value of money and discounts future cash flows to determine the present value of an investment.

- Internal Rate of Return (IRR):The discount rate that equates the present value of future cash flows to the initial investment cost.

- Payback Period:The amount of time it takes to recover the initial investment cost from the investment’s cash flows.

Factors Affecting ROI, How do you calculate rate of return on investment

Several factors can impact the ROI of an investment, including:

- Investment costs:The initial cost of acquiring the investment.

- Return on investment:The amount of profit or gain generated from the investment.

- Time horizon:The period over which the investment is held.

Using ROI to Make Investment Decisions

ROI plays a vital role in making investment decisions by providing investors with the following:

- Evaluating potential profitability:ROI helps investors assess the potential return on an investment compared to the risk involved.

- Comparing investment options:By comparing the ROI of different investment options, investors can identify the most profitable and suitable investments.

- Making informed decisions:ROI provides investors with a quantitative basis for making informed investment decisions.

Final Wrap-Up: How Do You Calculate Rate Of Return On Investment

In the realm of investing, ROI serves as a beacon, guiding investors towards profitable ventures and away from potential pitfalls. By understanding how to calculate ROI, you gain the power to make informed decisions, maximize returns, and achieve your financial goals.

Remember, ROI is not merely a number; it is a compass that navigates the investment landscape, leading you towards financial success.

FAQ Explained

What is the formula for calculating ROI?

ROI = (Gain from Investment – Cost of Investment) / Cost of Investment

What are the different types of ROI?

Accounting ROI, Economic ROI, Social ROI

How can I use ROI to make investment decisions?

ROI helps evaluate the potential profitability of investments, compare different investment options, and make informed investment decisions.