Noncash investing and financing activities may be disclosed in a variety of ways, depending on the specific nature of the activities and the requirements of applicable accounting standards. These activities can have a significant impact on a company’s financial statements, and it is important for investors and other stakeholders to understand how they are accounted for and disclosed.

In this article, we will discuss the concept of noncash investing and financing activities, provide examples of such activities, and explain the accounting treatment and disclosure requirements for these activities. We will also analyze the impact of noncash activities on the income statement, balance sheet, and cash flow statement.

Noncash Investing Activities

Noncash investing activities are transactions that affect the assets and liabilities of a company without involving the use of cash. These activities are typically recorded in the investing section of the cash flow statement.

Examples of noncash investing activities include:

- Acquisition of fixed assets through the issuance of shares

- Sale of fixed assets for noncash consideration

- Exchange of assets

- Conversion of debt to equity

The accounting treatment of noncash investing activities depends on the nature of the transaction. For example, the acquisition of fixed assets through the issuance of shares would be recorded as an increase in fixed assets and an increase in share capital.

Noncash investing and financing activities may be disclosed in a variety of financial statements, including the balance sheet, income statement, and statement of cash flows. For example, the balance sheet may report the acquisition of property, plant, and equipment through noncash transactions, while the income statement may report the recognition of revenue or expense from noncash transactions.

To learn more about how much money to invest in stocks per paycheck, click here . Furthermore, the statement of cash flows may report the impact of noncash transactions on the company’s cash position.

Noncash Financing Activities

Noncash financing activities are transactions that affect the financing of a company without involving the use of cash. These activities are typically recorded in the financing section of the cash flow statement.

Examples of noncash financing activities include:

- Issuance of shares

- Repurchase of shares

- Issuance of bonds

- Repayment of bonds

The accounting treatment of noncash financing activities depends on the nature of the transaction. For example, the issuance of shares would be recorded as an increase in share capital and an increase in cash. The repurchase of shares would be recorded as a decrease in share capital and a decrease in cash.

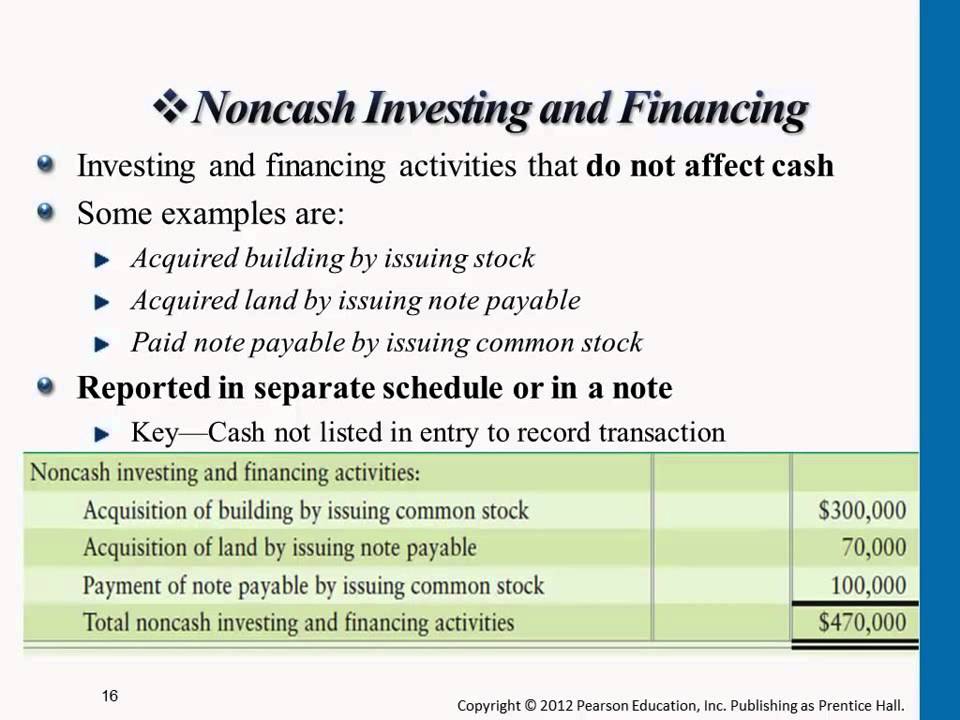

Disclosure of Noncash Activities

The disclosure of noncash activities is required by the International Financial Reporting Standards (IFRS). The disclosure requirements are designed to provide users of financial statements with a clear understanding of the nature and extent of noncash activities.

The benefits of disclosing noncash activities include:

- Increased transparency

- Improved comparability

- Enhanced understanding of a company’s financial performance

Noncash activities are typically disclosed in the notes to the financial statements. The disclosure should include a description of the noncash activities, the accounting treatment of the activities, and the impact of the activities on the financial statements.

Impact of Noncash Activities on Financial Statements: Noncash Investing And Financing Activities May Be Disclosed In

Noncash activities can have a significant impact on the financial statements. The impact of noncash activities on the income statement, balance sheet, and cash flow statement is discussed below.

Income Statement

Noncash activities can affect the income statement by:

- Increasing or decreasing revenue

- Increasing or decreasing expenses

- Increasing or decreasing net income

Balance Sheet

Noncash activities can affect the balance sheet by:

- Increasing or decreasing assets

- Increasing or decreasing liabilities

- Increasing or decreasing equity

Cash Flow Statement, Noncash investing and financing activities may be disclosed in

Noncash activities can affect the cash flow statement by:

- Increasing or decreasing operating cash flow

- Increasing or decreasing investing cash flow

- Increasing or decreasing financing cash flow

Final Wrap-Up

In conclusion, noncash investing and financing activities can have a significant impact on a company’s financial statements. It is important for investors and other stakeholders to understand how these activities are accounted for and disclosed in order to make informed decisions about the company.

Detailed FAQs

What are noncash investing activities?

Noncash investing activities are transactions that result in the acquisition or disposal of long-term assets without the use of cash. Examples of noncash investing activities include the acquisition of property, plant, and equipment through the issuance of stock or the sale of a subsidiary.

What are noncash financing activities?

Noncash financing activities are transactions that result in the issuance or repayment of debt or equity without the use of cash. Examples of noncash financing activities include the issuance of bonds or the conversion of debt to equity.

What are the disclosure requirements for noncash investing and financing activities?

The disclosure requirements for noncash investing and financing activities vary depending on the specific nature of the activities and the requirements of applicable accounting standards. Generally, companies are required to disclose the nature and amount of noncash investing and financing activities in their financial statements.