Why is it important to save and invest for retirement? As we navigate the complexities of life, this question takes center stage, guiding us toward a secure and fulfilling future. Understanding the significance of retirement planning is paramount, as it empowers us to face the financial challenges that lie ahead and reap the rewards of a well-planned retirement.

The journey to a comfortable retirement begins with recognizing the potential financial risks that accompany this stage of life. From rising healthcare costs to inflation, it is essential to acknowledge the need for a robust financial foundation to sustain our well-being in the years to come.

1. Understanding the Importance of Retirement Planning

Retirement is a significant life stage that requires careful planning to ensure financial stability and well-being. During retirement, individuals face various financial challenges, including:

- Reduced income due to the cessation of employment

- Increased healthcare expenses

- Rising living costs

- Unexpected financial emergencies

These challenges highlight the need for proactive retirement planning to mitigate potential financial risks and secure a comfortable lifestyle during this phase of life.

2. Benefits of Saving and Investing for Retirement: Why Is It Important To Save And Invest For Retirement

Early saving and investment for retirement offer numerous advantages:

- Compounding Interest:Invested funds grow exponentially over time due to the reinvestment of earnings, significantly increasing retirement savings.

- Tax Advantages:Many retirement savings plans provide tax benefits, such as tax-deferred growth and tax-free withdrawals, which enhance savings accumulation.

By leveraging these benefits, individuals can build a substantial retirement nest egg and reduce the financial burden during their golden years.

3. Strategies for Retirement Planning

| Strategy | Description |

|---|---|

| Defined Benefit Plans | Employer-sponsored plans that guarantee a specific retirement income based on years of service and salary. |

| Defined Contribution Plans | Employer-sponsored plans where employees contribute a portion of their salary, with matching contributions from the employer. |

| Individual Retirement Accounts (IRAs) | Tax-advantaged accounts for individuals to save for retirement on their own. |

| Annuities | Contracts that provide a guaranteed stream of income for life. |

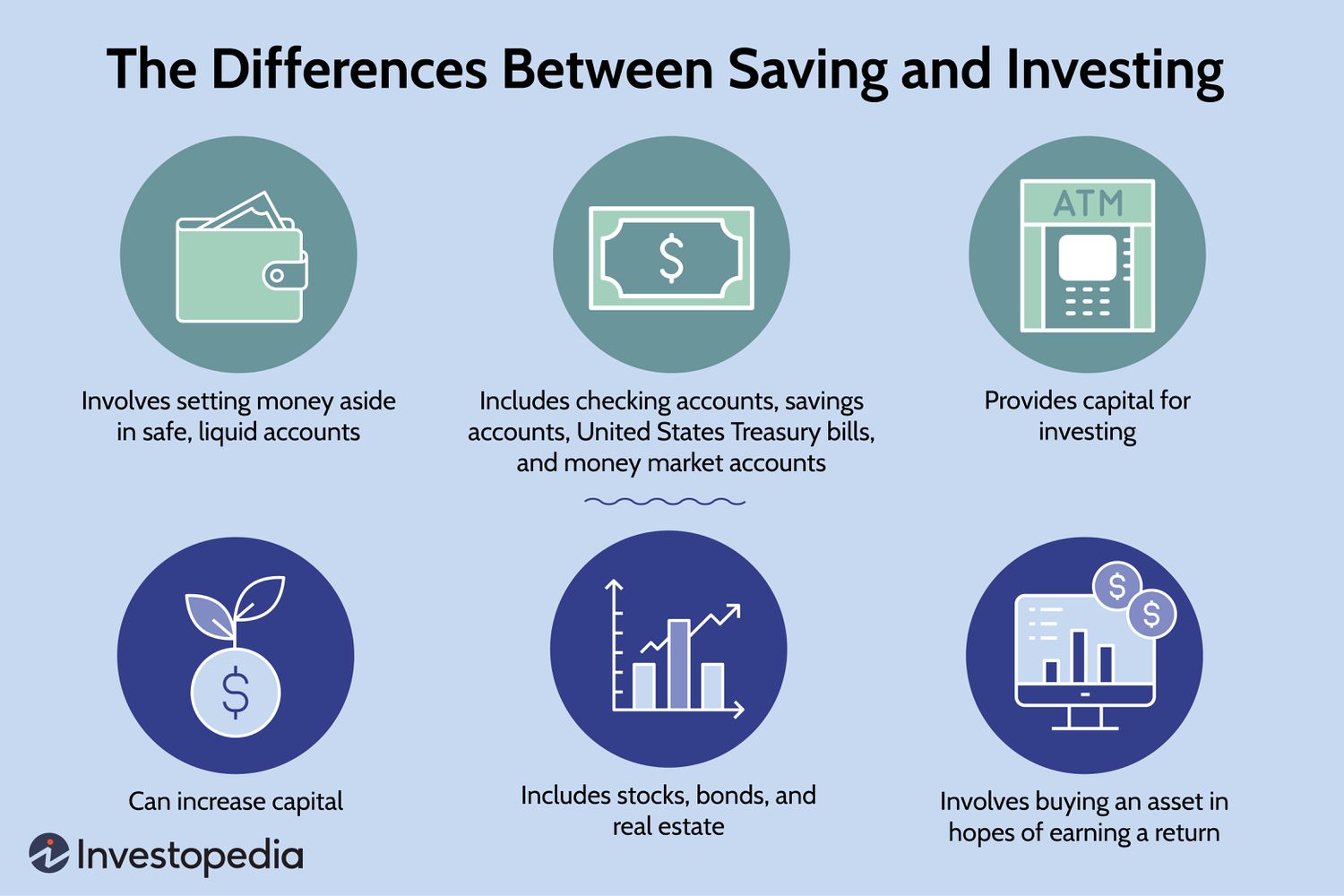

It is crucial to diversify retirement investments across different asset classes, such as stocks, bonds, and real estate, to manage risk and enhance returns.

4. Retirement Income Sources

Retirement income can come from various sources:

- Pensions:Defined benefit plans that provide a guaranteed income stream.

- Annuities:Contracts that offer a fixed or variable income stream for life.

- Social Security:A government-sponsored program that provides monthly income based on contributions made during employment.

- Supplemental Income Sources:Part-time work, investments, or rental income can supplement retirement income.

Understanding the advantages and disadvantages of each income source is essential for creating a comprehensive retirement plan.

5. Common Retirement Planning Mistakes

To avoid pitfalls in retirement planning:

- Inadequate Savings:Not saving enough money for retirement can lead to financial hardship during this phase of life.

- Poor Investment Choices:Investing in unsuitable assets can increase risk and jeopardize retirement savings.

- Early Withdrawal from Retirement Accounts:Withdrawing funds from retirement accounts before retirement can incur penalties and reduce future income.

- Lack of Long-Term Planning:Failing to consider healthcare expenses, inflation, and other financial challenges can lead to unexpected financial burdens.

By addressing these common mistakes, individuals can mitigate risks and enhance their retirement security.

Final Wrap-Up

In essence, saving and investing for retirement is not merely a prudent financial decision; it is an investment in our future selves. By embracing this responsibility today, we lay the groundwork for a secure and fulfilling retirement, ensuring that we can continue to enjoy life’s adventures without the burden of financial worries.

Quick FAQs

What are the benefits of saving and investing for retirement early?

Starting early allows for the power of compounding interest to work in your favor, maximizing your retirement savings over time.

How can I diversify my retirement investments?

To secure a comfortable retirement, it is essential to begin saving and investing early. To make informed financial decisions, consider pursuing a degree in finance or a related field, such as the specialized knowledge gained in a program like what degree do you need to be an investment banker . By planning and investing wisely, you can ensure a financially secure future and enjoy the fruits of your labor in your golden years.

Diversification involves spreading your investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk and enhance returns.

What are some common retirement planning mistakes to avoid?

Underestimating expenses, failing to adjust for inflation, and not reviewing your plan regularly are common pitfalls that can jeopardize your retirement security.