Which is an example of a short term investment brainly – Which is an example of a short-term investment brainly? As this question takes center stage, we embark on a journey to explore the realm of short-term investments, their intricacies, and their potential impact on your financial well-being. Brace yourself for an immersive experience as we unravel the complexities of this fascinating topic, arming you with knowledge that will empower your investment decisions.

Short-term investments, such as money market accounts or certificates of deposit, offer a low-risk way to grow your money over a short period of time. However, if you have lost money in a fraudulent investment scheme, it is important to seek professional help.

There are many resources available online, including the i need a hacker to recover my investments comments forum, where you can connect with others who have experienced similar situations. By understanding which investments are considered short-term and knowing where to turn for help, you can protect your financial future.

In the world of finance, short-term investments occupy a unique niche, offering a balance between risk and reward that can be tailored to your individual circumstances. Whether you’re a seasoned investor or just starting your financial journey, understanding the nuances of short-term investments is crucial for maximizing your returns and achieving your financial goals.

Short-Term Investments

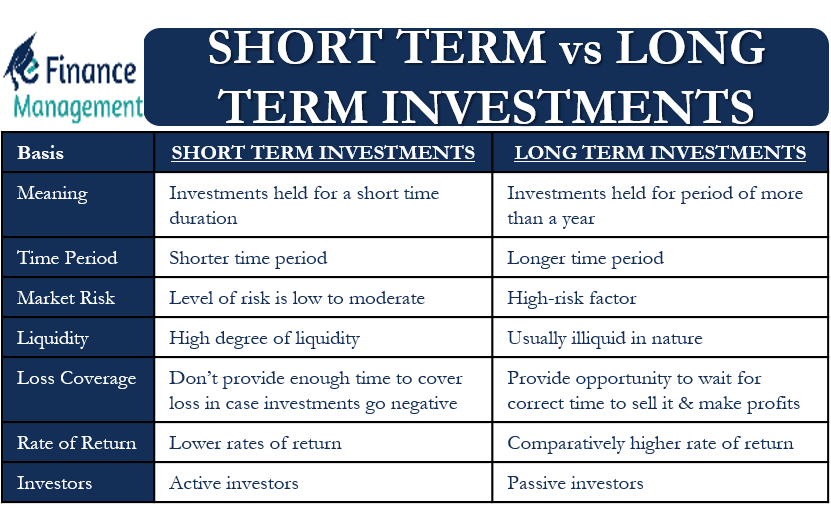

Short-term investments are a type of financial asset that has a maturity period of less than one year. They are typically considered to be low-risk investments, as they are backed by the full faith and credit of the issuer. Some common examples of short-term investments include:

- Money market accounts

- Certificates of deposit (CDs)

- Treasury bills

- Commercial paper

- Banker’s acceptances

When choosing a short-term investment, it is important to consider the following factors:

- The interest rate

- The maturity date

- The credit rating of the issuer

- The liquidity of the investment

Final Thoughts

As we conclude our exploration of short-term investments, it’s essential to remember that knowledge is the key to unlocking financial success. By embracing a proactive approach to investing, you can harness the power of short-term investments to build a secure financial future.

Remember, the journey to financial freedom is paved with informed decisions and a willingness to embrace new opportunities. We encourage you to continue your learning and stay abreast of the latest trends in the investment landscape. May your financial endeavors bear abundant fruit!

Q&A: Which Is An Example Of A Short Term Investment Brainly

What is the definition of a short-term investment?

A short-term investment is an investment with a maturity of less than one year. These investments are designed to provide liquidity and stability to a portfolio while potentially generating returns.

What are some examples of short-term investments?

Examples of short-term investments include money market accounts, certificates of deposit, and Treasury bills.

How do I choose the right short-term investment for me?

When selecting a short-term investment, consider your risk tolerance, investment horizon, and financial goals. It’s also important to diversify your portfolio to reduce risk.