The net working capital invested in a project is generally a critical factor in its success. It is the difference between a project’s current assets and its current liabilities, and it represents the amount of money that a company has available to fund its day-to-day operations.

A project with a positive net working capital is more likely to be successful than a project with a negative net working capital.

There are a number of factors that can affect the net working capital of a project, including the project’s industry, its duration, and its supply chain dynamics. Companies can take a number of steps to optimize their net working capital, including managing their inventory, negotiating payment terms with suppliers, and forecasting cash flow.

Definition of Net Working Capital Invested in a Project

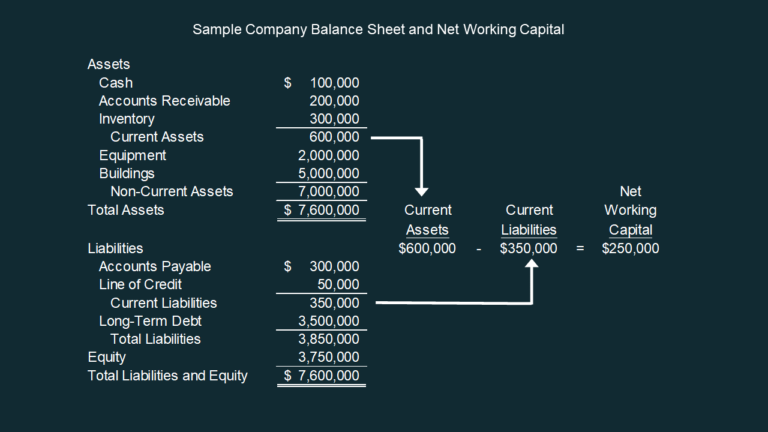

Net working capital invested in a project refers to the difference between a project’s current assets and current liabilities. It represents the amount of working capital required to support the project’s operations and ensure its financial viability.Current assets include cash, accounts receivable, and inventory, while current liabilities include accounts payable, short-term loans, and accrued expenses.

The difference between these two components determines the project’s net working capital.

Significance of Net Working Capital in Project Evaluation

Net working capital plays a crucial role in project evaluation as it impacts the project’s profitability and financial viability. A project with inadequate net working capital may face cash flow problems, operational disruptions, and ultimately reduced profitability. Conversely, excessive net working capital can lead to inefficient use of resources and lower returns on investment.

Factors Influencing Net Working Capital Investment

The amount of net working capital required for a project is influenced by several factors, including:

Industry-specific characteristics

Different industries have varying working capital requirements based on their operating models, supply chains, and inventory management practices.

Project duration

Longer project durations typically require higher levels of net working capital to support ongoing operations.

Supply chain dynamics

Complex supply chains with long lead times or unreliable suppliers can necessitate larger net working capital investments.

Methods for Estimating Net Working Capital Investment

Various methods are used to estimate net working capital investment for projects, each with its advantages and limitations:

Percentage of project cost

This method estimates net working capital as a fixed percentage of the project’s total cost.

Operating cycle approach

This method considers the project’s operating cycle, including inventory turnover, accounts receivable collection period, and accounts payable payment period.

Regression analysis

This method uses historical data to establish a relationship between net working capital and project characteristics, allowing for more accurate estimates.

Managing Net Working Capital during Project Execution

Effective net working capital management during project execution is essential for optimizing project cash flow and profitability. Strategies include:

Efficient inventory management

Implementing just-in-time inventory systems or negotiating favorable payment terms with suppliers can reduce inventory holding costs and improve cash flow.

The net working capital invested in a project is generally determined by the difference between the project’s current assets and current liabilities. For those interested in finding out more about investment opportunities, a valuable resource can be found here . Returning to the topic of net working capital, it’s worth noting that the amount invested can vary depending on the project’s size, industry, and risk profile.

Optimized payment terms

Establishing clear and favorable payment terms with contractors and suppliers can extend accounts payable periods, freeing up cash flow for other project activities.

Cash flow forecasting

Regular cash flow forecasting allows project managers to anticipate potential cash shortfalls and implement proactive measures to mitigate risks.

Impact of Net Working Capital on Project Success

Inadequate or excessive net working capital investment can have significant consequences on project outcomes:

Inadequate net working capital

Insufficient working capital can lead to cash flow problems, project delays, and increased financial risk.

Excessive net working capital

Excessive working capital can tie up resources unnecessarily, reducing project profitability and return on investment.

Last Word: The Net Working Capital Invested In A Project Is Generally

By understanding the importance of net working capital and taking steps to optimize it, companies can increase the chances of their projects succeeding.

Detailed FAQs

What is net working capital?

Net working capital is the difference between a project’s current assets and its current liabilities.

Why is net working capital important?

Net working capital is important because it represents the amount of money that a company has available to fund its day-to-day operations.

How can I optimize my net working capital?

There are a number of steps that companies can take to optimize their net working capital, including managing their inventory, negotiating payment terms with suppliers, and forecasting cash flow.