What is a good return on investment for rental property – When it comes to evaluating the financial viability of rental properties, understanding what constitutes a good return on investment (ROI) is paramount. This article delves into the intricacies of ROI for rental properties, exploring key factors that influence it, industry benchmarks, and strategies for maximizing returns.

Whether you’re a seasoned investor or just starting out, this comprehensive guide will provide valuable insights to help you make informed decisions.

Definition and Measurement of Return on Investment (ROI): What Is A Good Return On Investment For Rental Property

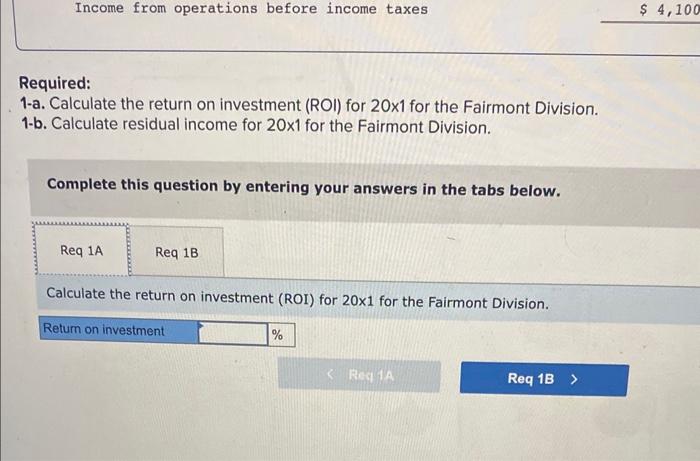

Return on investment (ROI) is a crucial metric in real estate investing, representing the financial return an investor receives from a rental property relative to the initial investment. Understanding ROI helps investors evaluate the profitability and potential of a property and make informed decisions.

There are several methods for calculating ROI in rental properties:

- Cash-on-Cash Return:Calculated as the annual pre-tax cash flow from the property divided by the initial cash investment.

- Cap Rate:Calculated as the annual net operating income (NOI) divided by the property’s current market value.

- Internal Rate of Return (IRR):Calculated as the discount rate that equates the present value of the property’s cash flows to the initial investment.

Factors Influencing ROI

Numerous factors influence the ROI of rental properties, including:

- Location:Location is a significant determinant of rental demand, property values, and operating expenses.

- Property Type:Single-family homes, multi-family units, and commercial properties have different ROI profiles due to varying rental rates, expenses, and appreciation potential.

- Rental Income:Rental income is the primary source of cash flow and a key factor in ROI. Higher rental rates generally lead to higher ROI.

- Operating Expenses:Operating expenses include property taxes, insurance, maintenance, and repairs. Lower operating expenses increase NOI and thus ROI.

- Appreciation Potential:Appreciation refers to the increase in property value over time. Properties with strong appreciation potential can generate significant capital gains, boosting overall ROI.

Benchmarking and Industry Standards, What is a good return on investment for rental property

Industry benchmarks for ROI in rental properties vary depending on market conditions and property type. According to the National Association of Realtors (NAR), the average ROI for rental properties in the United States is between 6% and 12%.

However, it’s important to note that ROI can vary significantly within different markets and property types. For example, rental properties in desirable urban areas with high rental demand may have higher ROIs than those in rural areas.

Strategies for Maximizing ROI

There are several strategies that investors can employ to maximize ROI in rental properties:

- Increasing Rental Income:This can be achieved through market research to determine optimal rental rates, providing amenities to attract tenants, and implementing rent increases when appropriate.

- Reducing Operating Expenses:Negotiating lower insurance premiums, finding cost-effective vendors for maintenance and repairs, and implementing energy-efficient measures can help reduce expenses.

- Enhancing Property Value:Renovations, upgrades, and regular maintenance can increase the property’s value and attract higher-paying tenants.

Considerations for Different Investment Goals

ROI expectations may vary depending on investment goals:

- Short-Term Income Generation:Investors seeking immediate cash flow may prioritize properties with high cash-on-cash return.

- Long-Term Wealth Accumulation:Investors aiming to build wealth over time may focus on properties with strong appreciation potential and lower operating expenses.

Final Review

In conclusion, determining a good ROI for rental properties requires a multifaceted approach that considers various factors, including location, property type, operating expenses, and appreciation potential. By understanding these factors and implementing effective strategies, investors can maximize their returns and achieve their financial goals.

Remember, the journey to a successful rental property investment begins with a clear understanding of ROI and the ability to make informed decisions that align with your investment objectives.

A good return on investment for rental property typically ranges from 5% to 10%, depending on factors such as location, property type, and market conditions. If you’re looking to invest in real estate but don’t have a lot of money, there are several strategies you can use to get started.

One option is to consider investing in a REIT (real estate investment trust), which allows you to invest in a portfolio of properties without having to purchase them directly. Another option is to look into owner financing , which allows you to purchase a property with little to no down payment.

By researching and exploring different investment strategies, you can find a way to invest in real estate that fits your financial situation and goals.

Common Queries

What is the average ROI for rental properties?

The average ROI for rental properties varies depending on location, property type, and other factors. However, a good ROI is generally considered to be between 5% and 10%.

How can I calculate the ROI for a rental property?

There are several methods for calculating ROI, including cash-on-cash return, cap rate, and internal rate of return (IRR). Each method provides a different perspective on the property’s profitability.

What factors affect the ROI of a rental property?

Factors that affect ROI include location, property type, rental income, operating expenses, and appreciation potential. Understanding these factors is crucial for making informed investment decisions.