With what is the best investment account for a child at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights. What are the best options available? How can you ensure your child’s financial future? This comprehensive guide will delve into the intricacies of investment accounts for children, empowering you with the knowledge to make informed decisions and secure their financial well-being.

The content of the second paragraph that provides descriptive and clear information about the topic

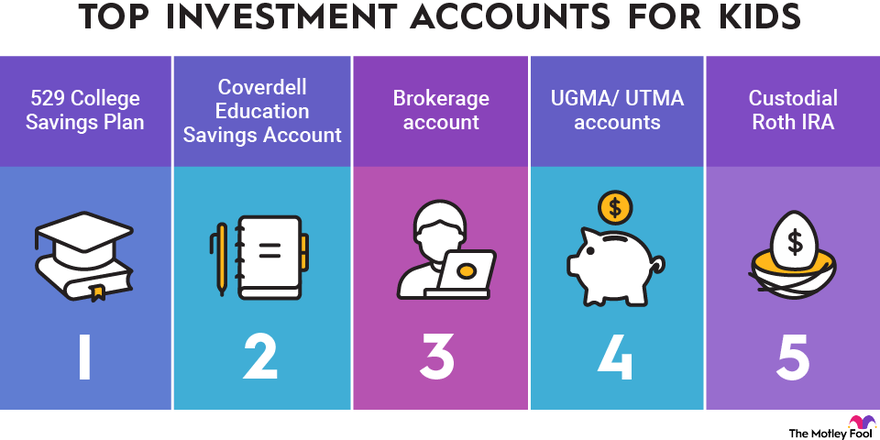

Account Types

There are several types of investment accounts available for children, each with its own advantages and disadvantages:

Custodial Accounts

- Managed by an adult (custodian) until the child reaches a certain age (usually 18 or 21).

- Assets belong to the child, but the custodian controls the account.

- Simple to set up and manage.

- Limited investment options.

UTMA/UGMA Accounts

- Similar to custodial accounts, but the assets are irrevocably transferred to the child at a specified age (usually 18 or 21).

- The child gains full control of the account at that age.

- More investment options than custodial accounts.

- Potential tax implications if the child earns a significant amount of income.

529 Plans

- Tax-advantaged savings plans designed for education expenses.

- Earnings grow tax-free, and withdrawals for qualified education expenses are also tax-free.

- Wide range of investment options.

- Restrictions on withdrawals for non-education expenses.

Investment Options

Within each account type, there are various investment options available, including:

Stocks, What is the best investment account for a child

- Represent ownership in a company.

- Potential for high returns, but also high risk.

- Suitable for long-term investments.

Bonds

- Loans made to companies or governments.

- Generally lower returns than stocks, but also lower risk.

- Provide regular income payments.

Mutual Funds

- Collections of stocks or bonds managed by a professional.

- Diversify investments and reduce risk.

- Wide range of options with varying risk and return potential.

ETFs

- Similar to mutual funds, but traded on stock exchanges.

- Offer low costs and real-time pricing.

- Provide exposure to a specific market or sector.

Final Wrap-Up: What Is The Best Investment Account For A Child

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Key Questions Answered

What are the different types of investment accounts available for children?

There are various types of investment accounts available for children, including custodial accounts, UTMA/UGMA accounts, and 529 plans. Each type has its own advantages and disadvantages, so it’s important to choose the one that best suits your child’s needs.

What are the tax implications of investing for a child?

To start investing for your child’s future, consider opening a custodial investment account. These accounts allow minors to own and manage investments under the supervision of an adult. Once the account is set up, you can begin investing in stocks, bonds, or other assets.

For guidance on investing in the stock market, refer to our comprehensive guide: how do i invest money in the stock market . This guide provides detailed information on selecting stocks, managing risk, and maximizing returns. By following these steps, you can create a solid financial foundation for your child’s future.

The tax implications of investing for a child depend on the type of account you choose. Some accounts, such as 529 plans, offer tax-free growth, while others, such as custodial accounts, may be subject to the Kiddie Tax. It’s important to consult with a tax professional to determine the best investment strategy for your child.

How can I choose age-appropriate investments for my child?

When choosing investments for your child, it’s important to consider their age and risk tolerance. Younger children may be more comfortable with lower-risk investments, such as savings accounts or CDs, while older children may be able to handle more risk.

It’s also important to consider your child’s financial goals. If you’re saving for their college education, you may want to invest in a 529 plan. If you’re saving for their future, you may want to invest in a custodial account.