An investor interested in quarterly income should invest in various options that provide regular income streams. These options include dividend-paying stocks, preferred stocks, real estate investment trusts (REITs), bonds, money market accounts, certificates of deposit (CDs), high-yield savings accounts, quarterly income funds, and dividend reinvestment plans (DRIPs).

Each of these investment vehicles offers unique characteristics, risks, and potential returns, making it essential for investors to carefully evaluate their investment goals and risk tolerance before making investment decisions.

Understanding the different types of investments available, their income-generating mechanisms, and the factors that influence their performance is crucial for investors seeking quarterly income. This guide provides a comprehensive overview of each investment option, highlighting their advantages, disadvantages, and considerations for investors.

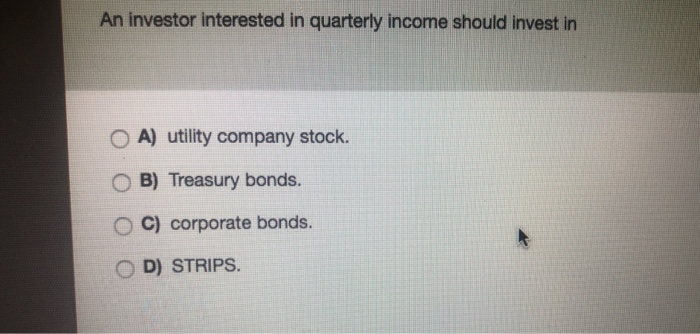

An Investor Interested in Quarterly Income Should Invest in…

Generating regular quarterly income is a key goal for many investors, particularly those nearing or in retirement. Several investment options offer the potential for quarterly income, each with its own characteristics and risk-return profile. This article explores some of the most common and effective options for investors seeking quarterly income.

Dividend-Paying Stocks, An investor interested in quarterly income should invest in

Dividend-paying stocks are a popular choice for investors seeking quarterly income. These stocks represent ownership in companies that distribute a portion of their profits to shareholders in the form of dividends. Industries and sectors known for offering high dividend yields include utilities, telecommunications, consumer staples, and healthcare.

Factors that influence dividend payments include company performance, earnings, and market conditions. Companies with a history of consistent dividend payments are generally considered more reliable for income generation.

Preferred Stocks

Preferred stocks are a type of hybrid security that combines features of both stocks and bonds. They typically offer a fixed dividend rate and have a higher priority claim on company assets than common stocks in the event of liquidation.

Preferred stocks provide regular quarterly income through dividend payments. They are generally considered less risky than common stocks but offer lower return potential.

Real Estate Investment Trusts (REITs)

REITs are companies that own and manage income-producing real estate properties. They offer investors the opportunity to participate in the real estate market without directly owning or managing property.

REITs generate quarterly income through rental payments from tenants. Different types of REITs include equity REITs, which invest in physical properties, and mortgage REITs, which invest in mortgages and mortgage-backed securities.

Bonds

Bonds are debt securities issued by governments, corporations, and other entities to raise capital. They represent a loan from the investor to the issuer, and in return, the issuer makes regular interest payments.

Bonds offer quarterly income through interest payments. Different types of bonds include corporate bonds, government bonds, and municipal bonds. Factors that influence bond prices and interest payments include credit ratings, market conditions, and economic outlook.

Epilogue

In conclusion, investors interested in quarterly income have a range of investment options to choose from. Each option offers varying levels of risk and return, and investors should carefully consider their financial goals and risk tolerance before making investment decisions.

By understanding the different investment vehicles available and the factors that influence their performance, investors can make informed choices that align with their financial objectives.

User Queries: An Investor Interested In Quarterly Income Should Invest In

What is the best investment for quarterly income?

The best investment for quarterly income depends on an investor’s individual circumstances and risk tolerance. Some options to consider include dividend-paying stocks, preferred stocks, REITs, bonds, and quarterly income funds.

How can I generate quarterly income without investing?

Generating quarterly income without investing is possible through options such as annuities, structured settlements, and reverse mortgages. However, it’s important to note that these options may have their own set of risks and considerations.

For investors seeking quarterly income, consider Warren Buffett’s recent investment of $25 billion in two rising stocks, as reported by Bloomberg . Buffett’s track record and keen eye for value make his investment decisions highly influential in the financial community.

By studying his moves, investors can gain valuable insights into potential opportunities for quarterly income generation.

What is the difference between a dividend and a bond payment?

Dividends are payments made to shareholders from a company’s profits, while bond payments are interest payments made to bondholders. Dividends are typically paid quarterly or annually, while bond payments are usually made semi-annually or annually.