As the question of “How long does it take for an investment to double?” takes center stage, this opening passage beckons readers into a world of financial knowledge, promising an immersive and enlightening exploration of this intriguing topic.

Delving into the intricacies of investment growth, this comprehensive guide unravels the factors that influence the doubling time of investments, empowering readers with the insights necessary to make informed financial decisions.

Investment Growth Timeframe

The time it takes for an investment to double, also known as the doubling time, varies widely depending on several factors. These include the type of investment, the risk tolerance of the investor, and the prevailing market conditions.

Investment Type

- Stocks:Stocks have historically provided higher returns than other asset classes, but they also carry more risk. As a result, stocks typically have shorter doubling times than other investments.

- Bonds:Bonds are less risky than stocks, but they also offer lower returns. Consequently, bonds typically have longer doubling times than stocks.

- Real estate:Real estate can be a good long-term investment, but it is less liquid than stocks and bonds. Real estate doubling times can vary depending on the location and type of property.

Risk Tolerance

Investors with a higher risk tolerance are willing to take on more risk in exchange for the potential for higher returns. As a result, these investors may be willing to invest in stocks or other high-risk investments that have shorter doubling times.

Market Conditions

Market conditions can also affect investment doubling times. In a bull market, when stock prices are rising, doubling times may be shorter. In a bear market, when stock prices are falling, doubling times may be longer.

Historical Doubling Rates: How Long Does It Take For An Investment To Double

Historical data shows that the average doubling time for stocks has been around 10 years. However, this number can vary depending on the time period and the specific stock or index being considered.

Significance of Long-Term Investing and Compounding

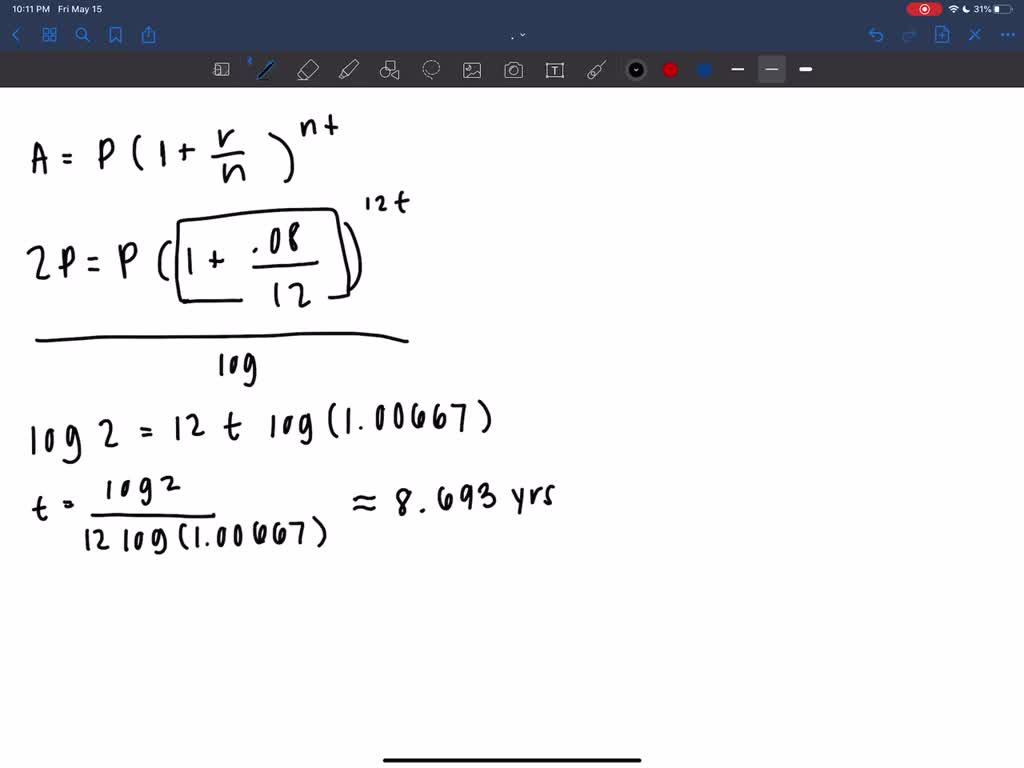

Long-term investing and compounding can significantly reduce the doubling time of an investment. Compounding is the process of earning interest on interest. Over time, the effect of compounding can be substantial.

Risk and Return Relationship

There is a direct relationship between investment risk and potential doubling time. Higher-risk investments typically have shorter doubling times, while lower-risk investments typically have longer doubling times.

Examples, How long does it take for an investment to double

- Low-risk investments:Certificates of deposit (CDs) and money market accounts are considered low-risk investments. They typically have doubling times of 10 years or more.

- High-risk investments:Venture capital and private equity investments are considered high-risk investments. They typically have doubling times of 5 years or less.

Investment Strategies for Doubling

There are several different investment strategies that can be used to double an investment. These strategies include:

Buy-and-Hold Strategy

The buy-and-hold strategy involves buying a stock or other investment and holding it for the long term. This strategy is based on the belief that the stock market will continue to grow over time.

The timeframe for doubling an investment can vary significantly depending on factors such as the type of investment and the prevailing market conditions. For a more in-depth analysis of how specific factors influence investment growth, please refer to the comprehensive article titled What does the information demonstrate about Gale’s investments . Returning to the topic of doubling investments, it’s important to note that the time it takes can be influenced by factors such as compound interest, market fluctuations, and investment strategies.

Value Investing Strategy

The value investing strategy involves buying stocks that are trading at a discount to their intrinsic value. This strategy is based on the belief that the stock market is inefficient and that undervalued stocks will eventually rise in price.

Growth Investing Strategy

The growth investing strategy involves buying stocks of companies that are expected to grow rapidly. This strategy is based on the belief that these companies will continue to grow and that their stock prices will rise accordingly.

Impact of Inflation and Taxes

Inflation and taxes can both affect the doubling time of an investment.

Inflation

Inflation is the rate at which prices increase over time. Inflation can reduce the purchasing power of an investment, which can make it take longer to double.

Taxes

Taxes can also reduce the doubling time of an investment. Taxes are levied on investment earnings, which can reduce the amount of money that is available to compound.

Case Studies and Examples

There are many real-world examples of investments that have doubled or taken longer to double.

Example 1

In 2010, an investor purchased $1,000 worth of Apple stock. In 2020, the value of the investment had grown to over $2,000, doubling in just 10 years.

Example 2

In 2000, an investor purchased $1,000 worth of Enron stock. In 2001, the company filed for bankruptcy and the stock became worthless. This investment never doubled and the investor lost their entire investment.

Tools and Resources

There are several popular investment calculators and tools that can be used to estimate the doubling time of an investment.

Investment Calculators

| Calculator | Description | Link |

|---|---|---|

| Moneychimp Doubling Time Calculator | Calculates the doubling time of an investment based on the annual rate of return. | https://www.moneychimp.com/calculator/doubling-time-calculator.htm |

| Investor.gov Investment Doubling Calculator | Calculates the doubling time of an investment based on the initial investment, the annual rate of return, and the inflation rate. | https://www.investor.gov/tools/calculators/compound-interest-calculator |

Final Wrap-Up

In conclusion, understanding the dynamics of investment doubling time is crucial for investors seeking to maximize their returns. By carefully considering the interplay of risk, return, and time, investors can develop tailored strategies that align with their financial goals and aspirations.

Remember, the journey to doubling your investments is not without its challenges, but with a clear understanding of the factors involved and a commitment to long-term planning, you can increase your chances of achieving financial success.

Question & Answer Hub

What is the average doubling time for investments?

The average doubling time for investments varies depending on factors such as asset class, risk tolerance, and market conditions. Historically, stocks have doubled approximately every 7-10 years, while bonds have doubled every 5-7 years.

How does risk affect investment doubling time?

Higher-risk investments generally have shorter doubling times than lower-risk investments. This is because higher-risk investments have the potential for greater returns, but also carry a greater risk of loss.

What is the impact of inflation on investment doubling time?

Inflation can erode the purchasing power of investment returns over time, which can increase the doubling time. For example, if inflation is 2% per year, it will take approximately 36 years for an investment to double in real terms.