How to use whole life insurance as an investment – Welcome to the realm of financial empowerment! In this comprehensive guide, we delve into the intricacies of using whole life insurance as an investment, unlocking a world of opportunities for financial growth and security. Join us as we explore the nuances of this multifaceted financial instrument, empowering you to make informed decisions and harness its potential for your financial well-being.

Embarking on this journey, we will uncover the secrets of cash value accumulation, unravel the complexities of investment options, and shed light on the intricacies of policy loans. Moreover, we will delve into the tax implications, ensuring you navigate the complexities of the financial landscape with confidence.

Introduction

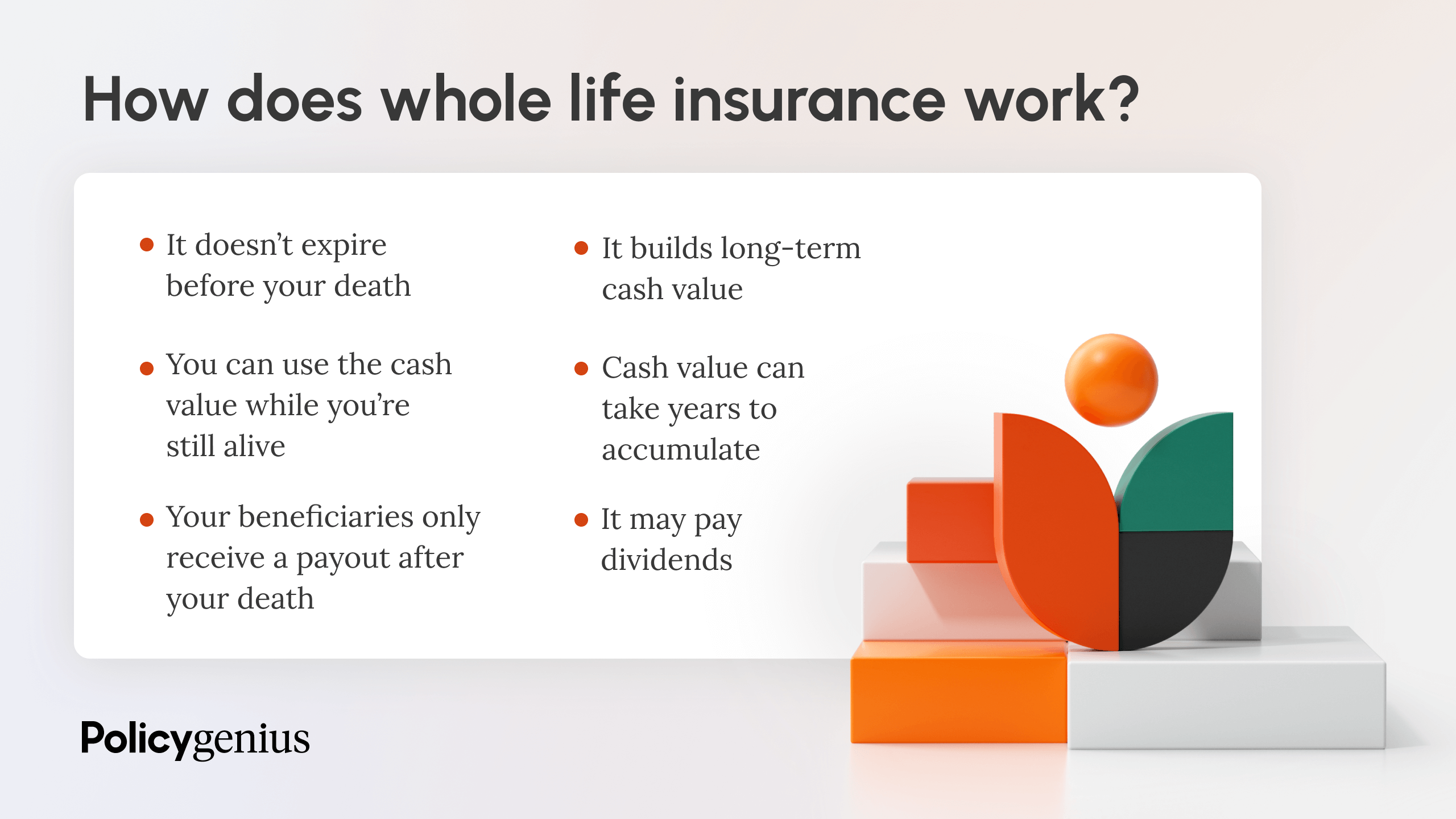

Whole life insurance is a unique financial product that combines life insurance protection with a savings component. It offers the potential for long-term cash value growth and a death benefit that can provide financial security for beneficiaries. However, it’s important to understand both the potential benefits and drawbacks before considering whole life insurance as an investment.

Cash Value Accumulation

Whole life insurance policies accumulate cash value over time. A portion of each premium paid goes towards building this cash value, which can grow through dividends and interest. The cash value can be accessed through policy loans or withdrawals, providing a source of funds for financial needs.

Investment Options

Whole life insurance policies typically offer a range of investment options within the cash value component. These options may include stocks, bonds, mutual funds, and other investment vehicles. The investment options available and their performance can vary depending on the insurance company and the specific policy.

Policy Loans, How to use whole life insurance as an investment

Policy loans allow you to borrow against the cash value of your whole life insurance policy. This can be a convenient way to access funds for financial emergencies or other needs. However, it’s important to understand the interest rates and repayment terms associated with policy loans, as they can impact the overall growth of your cash value.

Death Benefit

The death benefit provided by a whole life insurance policy is a guaranteed payout to your beneficiaries upon your death. The death benefit can be used to cover expenses such as funeral costs, outstanding debts, and future financial needs for your loved ones.

Tax Implications

Whole life insurance has unique tax implications that can affect its value as an investment. Cash value growth is generally tax-deferred, meaning you don’t pay taxes on it until you withdraw or borrow against it. However, policy loans and death benefits may be subject to taxation, so it’s important to consider the tax implications before making any decisions.

Suitability and Considerations

Whole life insurance may not be suitable for everyone as an investment. It’s important to consider your financial situation, investment goals, and risk tolerance before purchasing a whole life insurance policy. It’s also important to choose an insurance company and policy that aligns with your specific needs.

Final Summary

As we conclude our exploration of whole life insurance as an investment, remember that financial freedom is not a destination but a journey. By embracing the knowledge imparted in this guide, you are equipped to make informed decisions, harness the power of whole life insurance, and embark on a path towards financial security and prosperity.

Embrace the opportunities that await you, and let your financial future soar to new heights.

Helpful Answers: How To Use Whole Life Insurance As An Investment

What is the fundamental concept behind using whole life insurance as an investment?

Whole life insurance offers a unique blend of insurance protection and investment potential. It accumulates cash value over time, which can be invested in various options, allowing you to grow your wealth while ensuring financial security for your loved ones.

How does cash value accumulate within a whole life insurance policy?

A portion of your premium payments is allocated towards the cash value, which grows tax-deferred. Dividends may also be credited to the cash value, further accelerating its growth.

One approach to investing in whole life insurance involves utilizing its cash value component. However, if you’re a novice investor, it may be prudent to consider investing in mutual funds. A comprehensive guide to this topic is available at how to invest in a mutual fund for beginners . This resource provides valuable insights for beginners, enabling them to make informed investment decisions.

Subsequently, you can return to exploring the nuances of whole life insurance as an investment vehicle, equipped with a deeper understanding of the financial markets.

What investment options are available within a whole life insurance policy?

Whole life insurance policies offer a range of investment options, including stocks, bonds, and mutual funds. Each option carries varying levels of risk and return, allowing you to tailor your investment strategy to your specific goals and risk tolerance.