If public investment financed through borrowing complements private investment, it can be a powerful tool for economic growth. Public investment can provide the infrastructure, education, and other public goods that businesses need to thrive. It can also help to stimulate private investment by creating a more favorable investment climate.

However, there is also the potential for public investment to crowd out private investment. This can happen if the government borrows too much money, which can drive up interest rates and make it more expensive for businesses to borrow money.

It is important to carefully consider the potential costs and benefits of public investment before making a decision about whether or not to proceed.

Economic Principles

Public investment refers to government spending on infrastructure, education, healthcare, and other projects that provide benefits to the general public. It plays a crucial role in the economy by:

- Improving productivity

- Enhancing human capital

- Creating jobs

- Stimulating economic growth

Public investments can complement private investment by addressing market failures and providing the necessary infrastructure for businesses to thrive. For example, government investment in transportation networks, energy grids, and research and development can create spillover benefits that enhance the productivity of private firms.

Crowding-Out Effect

The crowding-out effect occurs when public borrowing for investment reduces private investment. This can happen when the government competes with private entities for funds in the financial markets, driving up interest rates and making it more expensive for businesses to borrow.

However, empirical evidence suggests that the crowding-out effect is often limited or non-existent, especially when public investment is used to fund projects that complement private investment and promote economic growth.

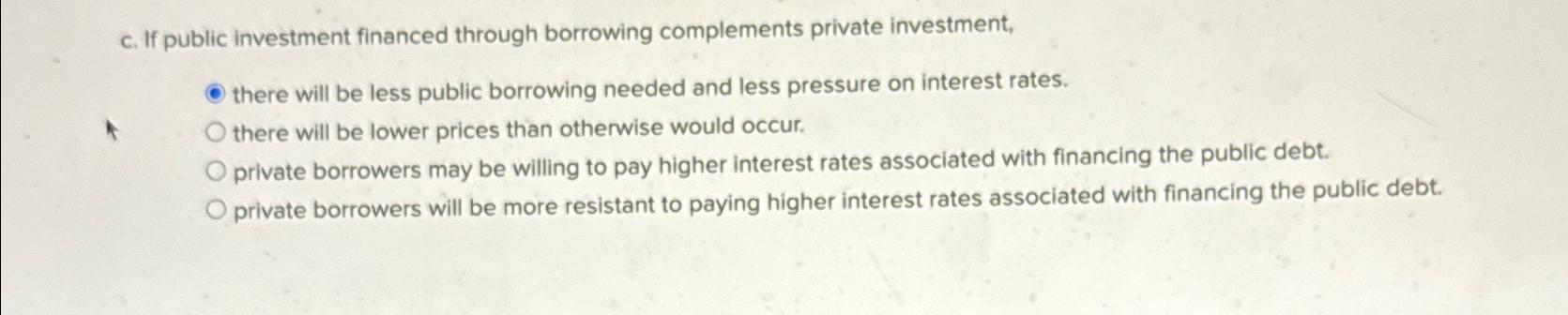

Fiscal Policy Considerations, If public investment financed through borrowing complements private investment

Fiscal policy refers to government spending and taxation policies. Expansionary fiscal policy involves increasing government spending or reducing taxes to stimulate economic growth, while contractionary fiscal policy does the opposite.

Governments can use fiscal policy to manage public investment and its impact on private investment. For example, during economic downturns, expansionary fiscal policy can be used to increase public investment and stimulate private sector activity.

Impact on Economic Growth

Research has shown that public investment can complement private investment and contribute to economic growth. Public investments in infrastructure, education, and research and development can:

- Increase productivity

- Boost innovation

- Create new jobs

- Enhance human capital

The long-term effects of public investment on economic growth can be substantial, leading to increased productivity, higher incomes, and improved living standards.

Sectoral Analysis

Public investment has been shown to complement private investment in various sectors, including:

- Infrastructure:Government investment in transportation networks, energy grids, and water systems can improve the efficiency and productivity of private businesses.

- Education:Public investment in education and training programs can enhance the skills of the workforce, making them more productive and employable.

- Research and Development:Government funding for research and development can support innovation and create new technologies that benefit both the public and private sectors.

Case Studies

Several case studies demonstrate the success of public investment financed through borrowing in complementing private investment and promoting economic growth.

- South Korea:Government investment in infrastructure, education, and research and development played a crucial role in the country’s rapid economic growth in the post-war period.

- Singapore:Public investments in housing, transportation, and education have contributed to the country’s high living standards and economic success.

- United States:The construction of the interstate highway system in the 1950s and 1960s is a classic example of how public investment can stimulate private sector activity and economic growth.

Ultimate Conclusion: If Public Investment Financed Through Borrowing Complements Private Investment

The decision of whether or not to finance public investment through borrowing is a complex one. There are a number of factors to consider, including the potential costs and benefits of the investment, the state of the economy, and the government’s fiscal situation.

However, if done carefully, public investment can be a powerful tool for economic growth.

Public investment financed through borrowing can complement private investment by providing additional resources for infrastructure, education, and other public goods. This can lead to increased economic growth and improved living standards. For instance, a new road project funded by government borrowing can improve connectivity and reduce transportation costs, which can benefit businesses and households alike.

To learn more about different types of investments, refer to which of the following is an example of investment .

FAQ Summary

What is public investment?

Public investment is investment made by the government. It can include spending on infrastructure, education, healthcare, and other public goods.

What is private investment?

Private investment is investment made by businesses and individuals. It can include spending on new factories, equipment, and research and development.

How can public investment complement private investment?

Public investment can complement private investment by providing the infrastructure, education, and other public goods that businesses need to thrive. It can also help to stimulate private investment by creating a more favorable investment climate.

What is the crowding-out effect?

The crowding-out effect is the potential for public investment to reduce private investment. This can happen if the government borrows too much money, which can drive up interest rates and make it more expensive for businesses to borrow money.