What’s the best crypto to invest in right now? With the ever-evolving landscape of the cryptocurrency market, making informed investment decisions can be daunting. This guide provides a comprehensive overview of the factors to consider, potential investment options, and strategies for navigating the crypto investment landscape.

As the world of digital assets continues to expand, understanding the nuances of cryptocurrency investing becomes increasingly important. Whether you’re a seasoned investor or just starting your crypto journey, this guide aims to empower you with the knowledge and insights you need to make sound investment decisions.

Cryptocurrency Market Overview: What’s The Best Crypto To Invest In Right Now

The cryptocurrency market has experienced significant growth in recent years, with a total market capitalization exceeding $1 trillion. Factors influencing the market include economic conditions, regulatory changes, and technological advancements. Positive economic conditions, supportive regulations, and the development of new technologies have contributed to the growth of the market.

Factors to Consider When Investing in Cryptocurrency

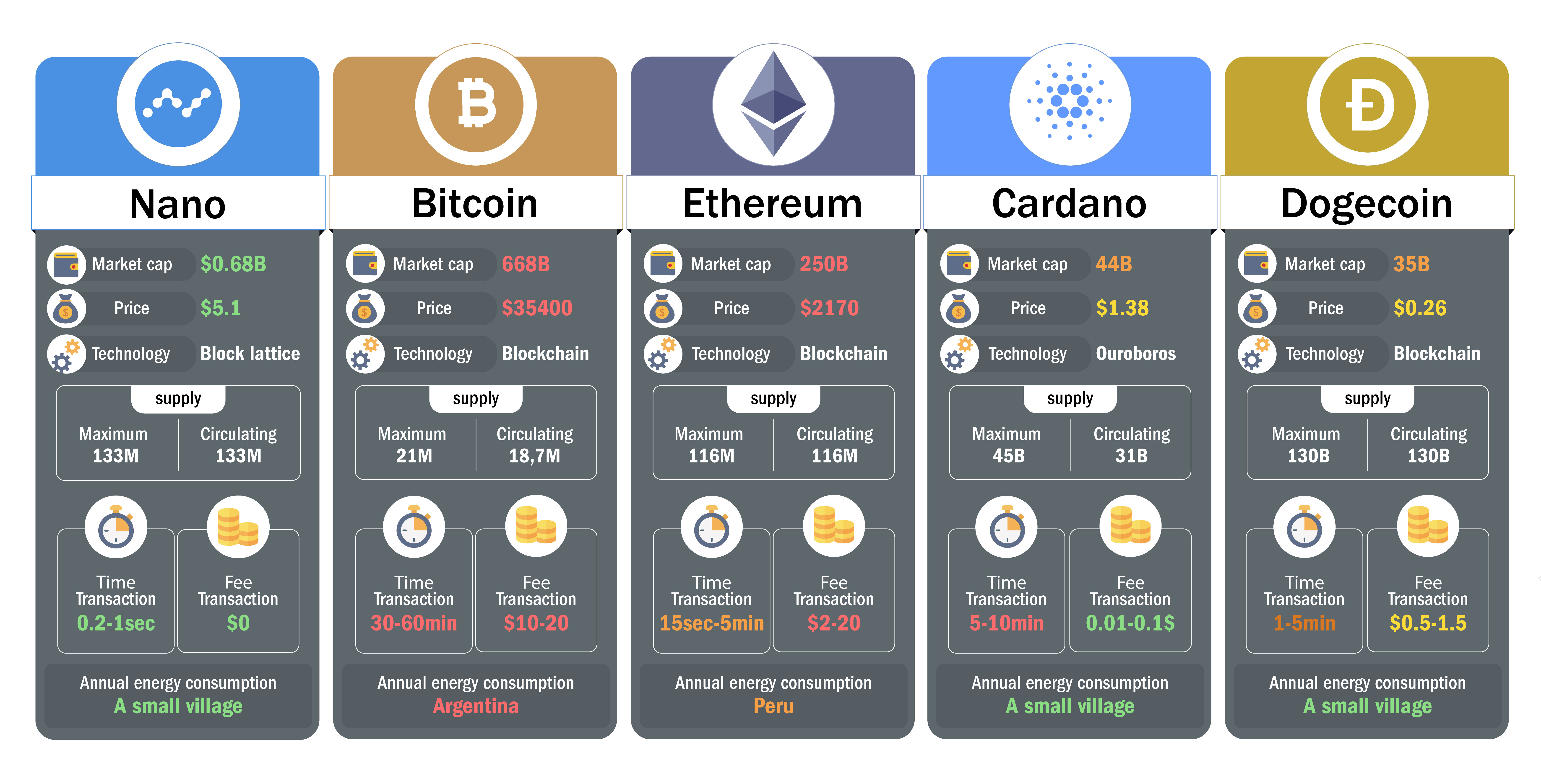

When evaluating cryptocurrencies for investment, it is important to consider key factors such as market capitalization, trading volume, project development team, technology, and use cases. Market capitalization refers to the total value of all outstanding coins or tokens, providing an indication of the size and liquidity of the cryptocurrency.

Trading volume represents the number of coins or tokens traded over a specific period, indicating the level of activity and interest in the cryptocurrency.

Project Development Team

The team behind a cryptocurrency project plays a crucial role in its success. Investors should research the experience, qualifications, and track record of the development team to assess their ability to execute the project’s vision.

Technology and Use Cases, What’s the best crypto to invest in right now

The underlying technology and use cases of a cryptocurrency are important considerations. Investors should evaluate the scalability, security, and efficiency of the blockchain technology used by the cryptocurrency. Additionally, the potential use cases and adoption of the cryptocurrency can provide insights into its long-term growth potential.

Potential Investment Options

Bitcoin (BTC)

Bitcoin is the largest cryptocurrency by market capitalization. It is known for its decentralized nature, limited supply, and growing acceptance as a store of value and medium of exchange.

Ethereum (ETH)

Ethereum is the second largest cryptocurrency by market capitalization. It is a platform for decentralized applications, smart contracts, and decentralized finance (DeFi).

Binance Coin (BNB)

Binance Coin is the native token of the Binance cryptocurrency exchange. It is used to pay for trading fees and access exclusive features on the exchange.

Tether (USDT)

Tether is a stablecoin pegged to the value of the US dollar. It is designed to provide stability and reduce volatility in the cryptocurrency market.

Solana (SOL)

Solana is a high-performance blockchain known for its fast transaction speeds and low fees. It has gained popularity for its use in decentralized finance (DeFi) and non-fungible tokens (NFTs).

Risk Management and Diversification

Investing in cryptocurrencies involves significant risk. Investors should implement risk management strategies such as setting stop-loss orders, dollar-cost averaging, and diversifying their portfolios. Stop-loss orders automatically sell a cryptocurrency when it reaches a predetermined price, limiting potential losses. Dollar-cost averaging involves investing a fixed amount of money at regular intervals, reducing the impact of market volatility.

While exploring the realm of cryptocurrency investments, it’s prudent to consider alternative avenues for generating income online. For those seeking to embark on this journey without substantial capital, the article how can i make money online without any investment provides valuable insights into leveraging your skills and resources.

By delving into these methods, you can potentially supplement your crypto investment strategies and maximize your financial growth.

Diversification involves investing in a mix of cryptocurrencies and traditional assets to reduce overall risk.

Long-Term Investment Considerations

Cryptocurrencies have the potential for long-term value. Blockchain technology, the underlying technology of cryptocurrencies, is expected to continue to drive innovation and growth in the industry. Cryptocurrencies have the potential to become a store of value, a medium of exchange, and a platform for decentralized applications and services.

Ending Remarks

In the dynamic and ever-evolving world of cryptocurrency, staying informed and adapting to market trends is crucial. By considering the factors Artikeld in this guide, investors can navigate the crypto landscape with confidence and make informed decisions that align with their financial goals.

Remember, the best crypto to invest in right now may not be the same tomorrow, so ongoing research and due diligence are essential for long-term success.

Clarifying Questions

What factors should I consider when investing in cryptocurrency?

When evaluating cryptocurrencies for investment, consider market capitalization, trading volume, project development team, technology, and use cases.

What are some potential investment options in the cryptocurrency market?

Top cryptocurrencies based on market capitalization include Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Tether (USDT), and Solana (SOL), each with unique features and investment potential.

How can I manage risk in cryptocurrency investments?

Implement risk management strategies such as diversifying your portfolio, setting stop-loss orders, and dollar-cost averaging to mitigate potential losses.

What is the long-term potential of cryptocurrencies?

Cryptocurrencies have the potential to revolutionize finance and technology, with blockchain technology driving growth and innovation. Their potential as a store of value and medium of exchange is continuously evolving.