How much can i invest in a 401k per year – How much can I invest in a 401(k) per year? It’s a crucial question for anyone planning for a secure retirement. In this comprehensive guide, we’ll delve into the annual contribution limits, employer matching opportunities, investment options, fees and expenses, tax implications, and long-term planning considerations to help you make informed decisions about your 401(k) investments.

Understanding the nuances of 401(k) plans is essential to maximize your savings potential and secure a comfortable retirement. Let’s explore the details.

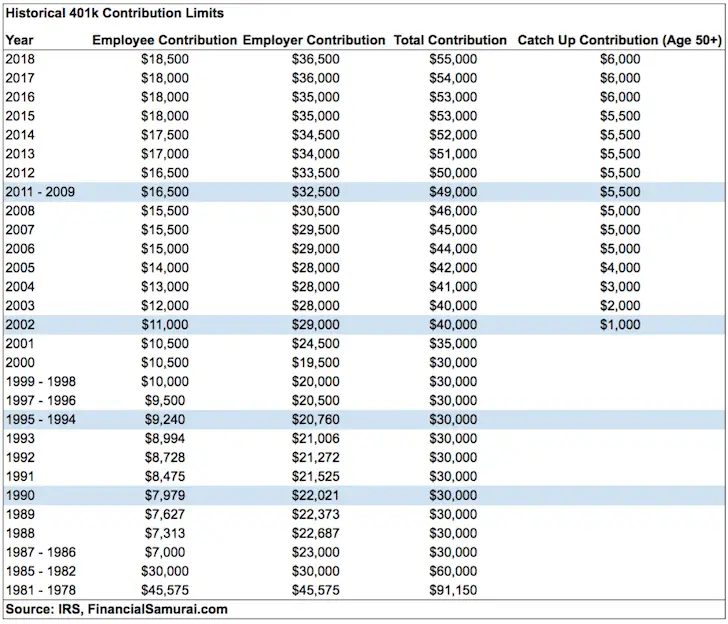

The maximum contribution limit for a 401(k) plan in 2023 is $22,500, or $30,000 for those age 50 or older. For those seeking alternative investment opportunities, it’s worth considering the burgeoning hydrogen industry. What is the best hydrogen company to invest in ? Several companies are making significant strides in this field, offering investors the potential for long-term growth.

However, it’s important to note that all investments carry some level of risk, and it’s essential to conduct thorough research before making any financial decisions.

Contribution Limits

401(k) plans have annual contribution limits that determine how much you can contribute each year. For 2023, the contribution limit is $22,500. Individuals over age 50 are eligible for catch-up contributions of an additional $7,500, bringing their total contribution limit to $30,000.

Employer Matching

Many employers offer matching contributions to their employees’ 401(k) plans. This means that the employer will contribute a certain amount of money to your account for every dollar you contribute. Employer matching can significantly increase your retirement savings, so it’s important to maximize your contributions to take advantage of this benefit.

Investment Options

401(k) plans typically offer a range of investment options, including stocks, bonds, and mutual funds. When choosing investments, it’s important to consider your financial goals, risk tolerance, and time horizon. A financial advisor can help you create an investment portfolio that meets your specific needs.

Fees and Expenses, How much can i invest in a 401k per year

401(k) plans may have fees and expenses associated with them, such as administrative fees, investment management fees, and trading fees. These fees can reduce your investment returns, so it’s important to understand them before investing.

Tax Implications

Contributions to a 401(k) plan are made pre-tax, which means that they are deducted from your paycheck before taxes are calculated. This can significantly reduce your current tax liability. Withdrawals from a 401(k) plan are taxed as ordinary income, so it’s important to consider the tax implications of withdrawing funds.

Long-Term Planning

When investing in a 401(k) plan, it’s important to consider your long-term financial goals. Your investment strategy should be designed to help you achieve those goals, even if they change over time. As you get closer to retirement, you may need to adjust your investment strategy to become more conservative.

Epilogue: How Much Can I Invest In A 401k Per Year

Investing in a 401(k) is a powerful tool for building a secure financial future. By understanding the contribution limits, employer matching options, investment choices, fees, tax implications, and long-term planning considerations, you can tailor your 401(k) strategy to align with your retirement goals.

Remember, the earlier you start investing, the more time your money has to grow, so take advantage of this valuable retirement savings vehicle today.

FAQ Resource

What are the annual contribution limits for 401(k) plans?

For 2023, the annual contribution limit for 401(k) plans is $22,500. Individuals age 50 and older can make catch-up contributions of up to $7,500, bringing the total contribution limit to $30,000.

How can employer matching contributions impact my investment options?

Employer matching contributions can significantly increase your retirement savings. Many employers offer matching contributions up to a certain percentage of your salary. Maximizing employer matching can help you grow your investments faster and reach your retirement goals sooner.

What investment options are available in 401(k) plans?

401(k) plans typically offer a range of investment options, including stocks, bonds, mutual funds, and target-date funds. Choosing investments that align with your financial goals and risk tolerance is crucial for long-term success.