What banks offer best mortgage rates – Navigating the mortgage market can be daunting, but finding the best mortgage rates doesn’t have to be. Join us as we explore the banks offering the most competitive rates, empowering you to make informed decisions and secure the financing that aligns with your financial goals.

Understanding the factors that influence mortgage rates and the various loan options available is crucial. By comparing rates and considering your individual circumstances, you can unlock significant savings and set yourself up for financial success.

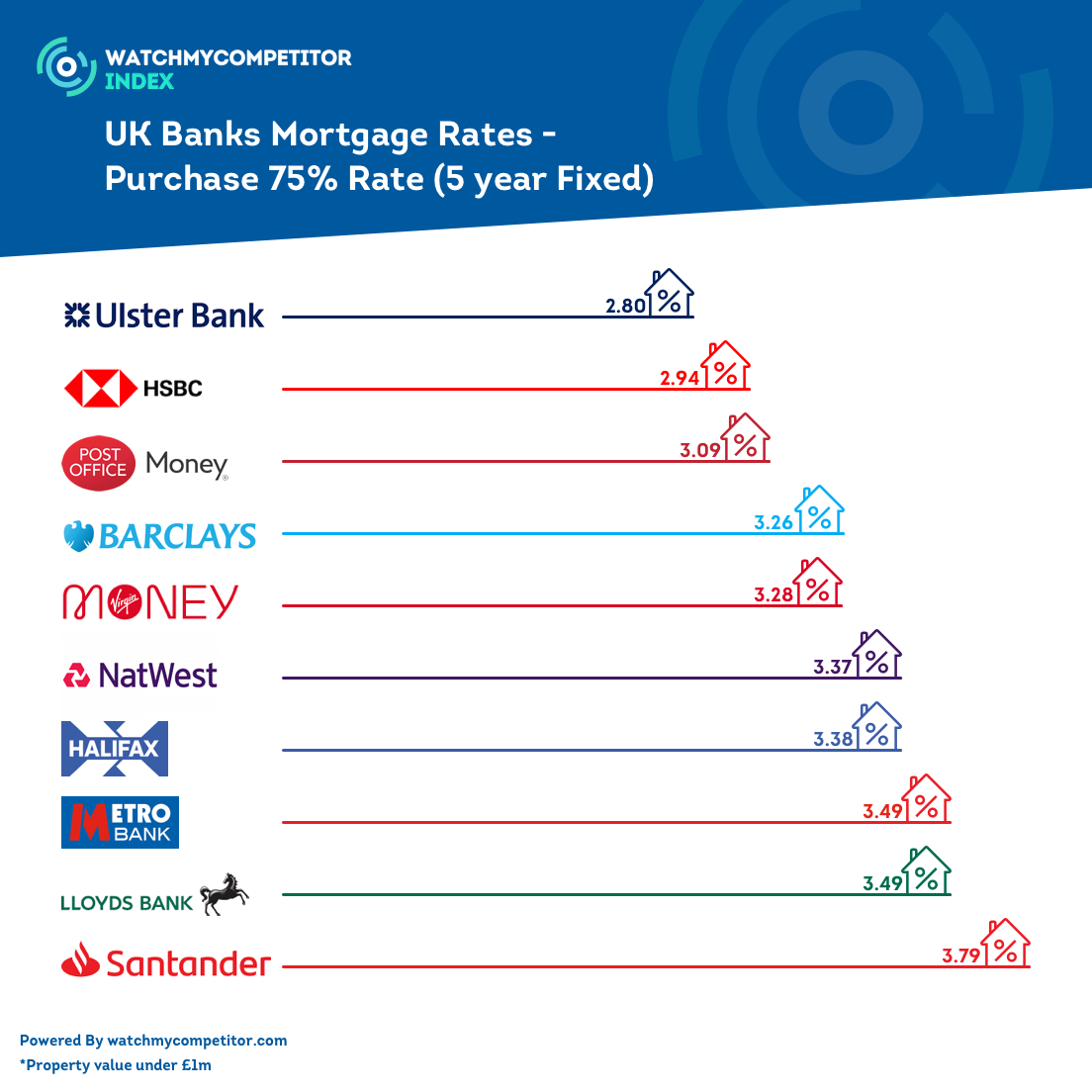

Mortgage Rate Comparison

Comparing mortgage rates from different banks is crucial for securing the best possible deal on your home loan. By shopping around, you can identify banks that offer competitive rates that align with your financial situation and loan requirements.

To gather and compare mortgage rates effectively, consider the following tips:

- Obtain pre-approval from multiple banks to establish your eligibility and creditworthiness.

- Use online mortgage calculators and comparison tools to get an estimate of rates from various lenders.

- Contact banks directly to inquire about their current mortgage rates and loan programs.

- Negotiate with banks to secure the best possible rate based on your credit score and financial profile.

Factors Affecting Mortgage Rates

Several factors influence mortgage rates, including:

Credit Score

Your credit score is a key determinant of your mortgage rate. A higher credit score indicates a lower risk to lenders, resulting in lower interest rates.

Loan Amount

The loan amount you borrow also impacts your mortgage rate. Larger loan amounts generally come with higher interest rates.

Loan Term

The length of your loan term affects your mortgage rate. Longer loan terms typically have higher interest rates than shorter terms.

Debt-to-Income Ratio

Your debt-to-income ratio (DTI) measures the percentage of your monthly income that goes towards debt payments. A higher DTI can result in a higher mortgage rate.

Bank-Specific Mortgage Rates

| Bank | Loan Type | Term | Current Rate |

|---|---|---|---|

| Bank A | Fixed-Rate | 30 Years | 4.50% |

| Bank B | Adjustable-Rate | 5/1 ARM | 3.25% |

| Bank C | FHA Loan | 30 Years | 3.75% |

Note: Rates are for illustrative purposes only and may vary based on individual circumstances and market conditions.

Mortgage Loan Options

There are several types of mortgage loans available, each with its own advantages and disadvantages:

Fixed-Rate Mortgage

Fixed-rate mortgages offer a consistent interest rate throughout the loan term, providing stability and predictability in monthly payments.

Adjustable-Rate Mortgage (ARM)

ARMs have interest rates that fluctuate based on market conditions. This can result in lower initial rates but also carries the risk of higher payments in the future.

FHA Loan

FHA loans are government-backed loans designed for first-time homebuyers and borrowers with lower credit scores. They typically have lower down payment requirements and more flexible credit guidelines.

Refinancing Options: What Banks Offer Best Mortgage Rates

Refinancing a mortgage can be a strategic move to lower your interest rate and improve your financial situation:

Benefits of Refinancing, What banks offer best mortgage rates

- Lower interest rates

- Reduced monthly payments

- Shorter loan term

Drawbacks of Refinancing

- Closing costs

- Potential prepayment penalties

- Impact on your credit score

Online Mortgage Lenders

Online mortgage lenders offer an alternative to traditional banks:

Advantages of Online Lenders

- Convenience and accessibility

- Potentially lower rates due to lower overhead costs

- Simplified application process

Disadvantages of Online Lenders

- Limited personal interaction

- May not offer the same range of loan products as traditional banks

- Potential for scams or fraudulent activity

Summary

In conclusion, the quest for the best mortgage rates requires careful consideration of factors such as credit score, loan amount, and debt-to-income ratio. By comparing rates from multiple banks, you can find the lender that offers the most favorable terms and aligns with your financial situation.

Whether you’re a first-time homebuyer or looking to refinance, the insights provided in this article will guide you towards securing the best possible mortgage.

Top FAQs

What factors affect mortgage rates?

Mortgage rates are influenced by various factors, including credit score, loan amount, loan term, debt-to-income ratio, and economic conditions.

What are the different types of mortgage loans?

Common mortgage loan types include fixed-rate mortgages, adjustable-rate mortgages, FHA loans, and VA loans. Each type offers unique advantages and considerations.

When it comes to securing the best mortgage rates, it’s crucial to explore various financial institutions. While researching banks that offer competitive rates, you may also want to consider exploring our comprehensive guide, Unveiling the Secrets of Central Valley Property Management . This valuable resource provides insights into managing properties in the Central Valley, empowering you with knowledge that can potentially impact your mortgage eligibility and financial decision-making.

What are the benefits of refinancing a mortgage?

Refinancing can potentially lower your monthly payments, reduce the interest rate, shorten the loan term, or access equity in your home.