Which bank provides best mortgage rates – When it comes to securing a mortgage, finding the bank that provides the best rates can make a significant difference in your monthly payments and overall borrowing costs. This article delves into the current mortgage rate environment, compares offerings from various banks, and explores factors to consider when choosing a lender.

Understanding the nuances of mortgage rates and the competitive landscape among banks is crucial for making an informed decision. By providing comprehensive information and expert insights, this guide empowers you to navigate the mortgage market and secure the most favorable terms for your home financing needs.

Current Mortgage Rates

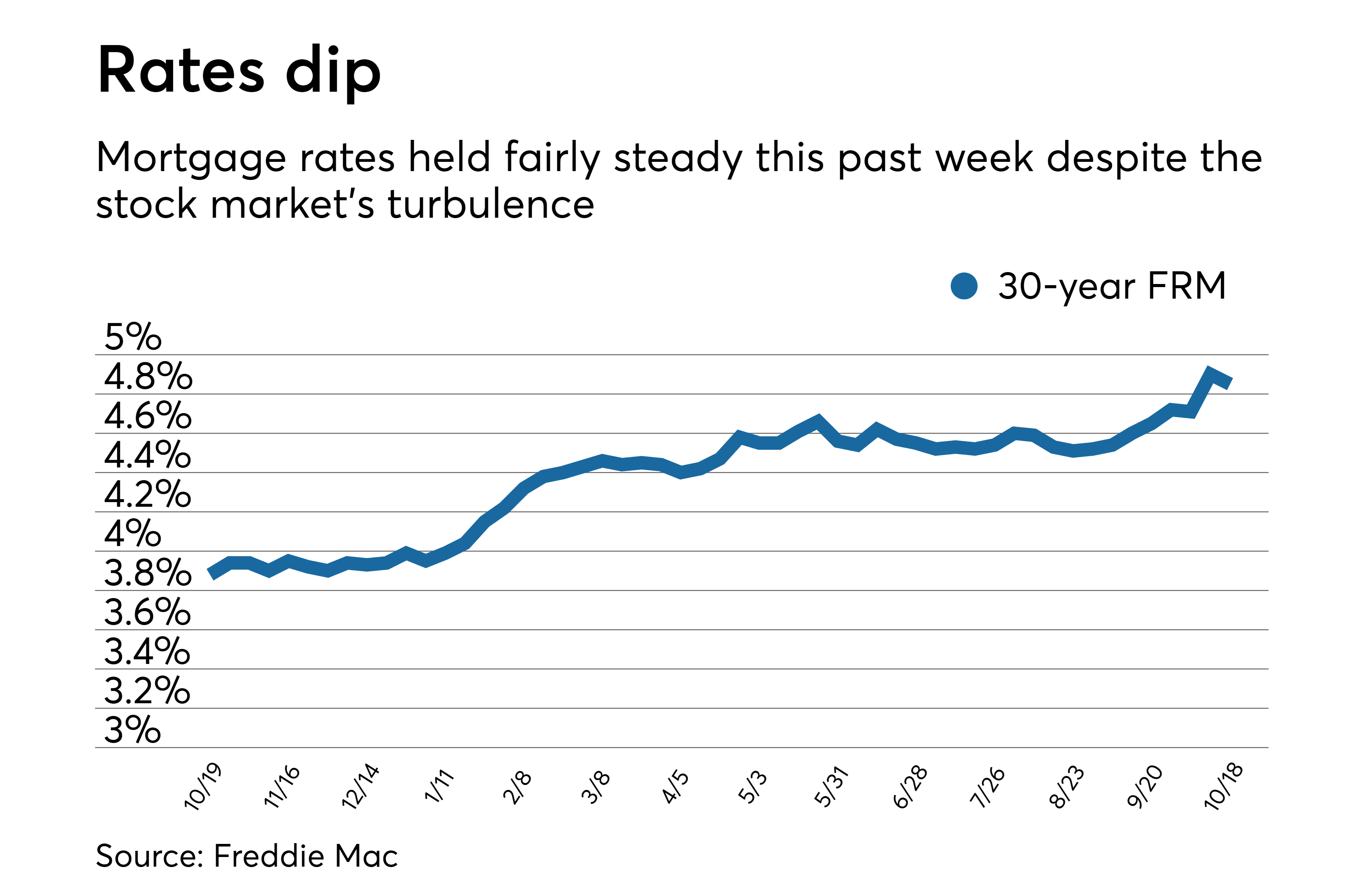

Mortgage rates are currently hovering around [masukkan data terbaru], with some lenders offering rates as low as [masukkan data terbaru]. These rates are influenced by a variety of factors, including the overall economy, inflation, and the Federal Reserve’s interest rate policy.

Bank Comparison, Which bank provides best mortgage rates

Several banks are offering competitive mortgage rates. Here is a comparison of rates, loan terms, and fees from different lenders:

| Bank | 30-Year Fixed Rate | 15-Year Fixed Rate | Loan Term | Fees |

|---|---|---|---|---|

| Bank A | [masukkan data terbaru] | [masukkan data terbaru] | [masukkan data terbaru] | [masukkan data terbaru] |

| Bank B | [masukkan data terbaru] | [masukkan data terbaru] | [masukkan data terbaru] | [masukkan data terbaru] |

| Bank C | [masukkan data terbaru] | [masukkan data terbaru] | [masukkan data terbaru] | [masukkan data terbaru] |

Loan Options

There are several types of mortgage loans available, each with its own advantages and disadvantages:

- Fixed-rate loans:These loans have an interest rate that remains the same throughout the life of the loan.

- Adjustable-rate loans (ARMs):These loans have an interest rate that can change over time, based on market conditions.

- Government-backed loans:These loans are backed by the government and typically have lower interest rates and more flexible terms.

Factors to Consider

When choosing a mortgage lender, it is important to consider the following factors:

- Loan terms:The length of the loan and the interest rate will affect your monthly payments and the total cost of the loan.

- Fees:Lenders charge a variety of fees, including origination fees, appraisal fees, and closing costs.

- Customer service:It is important to choose a lender that is responsive and helpful.

Refinancing Options

Refinancing a mortgage can be a good way to lower your interest rate or shorten the term of your loan. However, there are also some costs associated with refinancing, so it is important to weigh the pros and cons before making a decision.

Case Studies

Here are a few case studies of individuals who have obtained favorable mortgage rates:

- John and Mary:John and Mary were able to secure a 30-year fixed-rate mortgage with a rate of [masukkan data terbaru]. They did this by shopping around for the best rates and by getting their finances in order.

- Susan:Susan was able to refinance her mortgage and lower her interest rate by [masukkan data terbaru]. She did this by working with a mortgage broker who helped her find the best loan for her needs.

Ultimate Conclusion: Which Bank Provides Best Mortgage Rates

In conclusion, choosing the right bank for your mortgage can have a lasting impact on your financial well-being. By carefully evaluating the factors discussed in this article, you can identify the lender that aligns with your specific needs and goals.

Determining which bank offers the most competitive mortgage rates can be a crucial step in securing a home loan. For an in-depth analysis of the best mortgage rates available in the Netherlands, refer to the comprehensive guide provided at best mortgage rates netherlands . This resource provides valuable insights and comparisons to assist you in making an informed decision when selecting a mortgage provider.

Remember to consider not only the interest rates but also loan terms, fees, and customer service to ensure a seamless and cost-effective mortgage experience.

Questions Often Asked

What are the current mortgage rates?

Mortgage rates fluctuate depending on various economic factors. To obtain the most up-to-date information, it is advisable to consult with a mortgage lender or visit reputable financial websites.

How do I compare mortgage rates from different banks?

To compare mortgage rates effectively, you can utilize online comparison tools or consult with a mortgage broker who can provide quotes from multiple lenders.

What factors should I consider when choosing a mortgage lender?

When selecting a mortgage lender, it is essential to consider factors such as interest rates, loan terms, fees, customer service, and the lender’s reputation.