Best mortgage rates high street – In the ever-evolving mortgage market, finding the best mortgage rates on the high street can be a daunting task. This guide will provide you with the insights and strategies you need to secure the most competitive mortgage rates, whether you’re a first-time buyer or looking to remortgage.

From comparing high street lenders to online lenders, understanding the nuances of fixed-rate and variable-rate mortgages, and navigating the maze of mortgage fees and closing costs, we’ll cover everything you need to know to make an informed decision.

Current Mortgage Market Overview

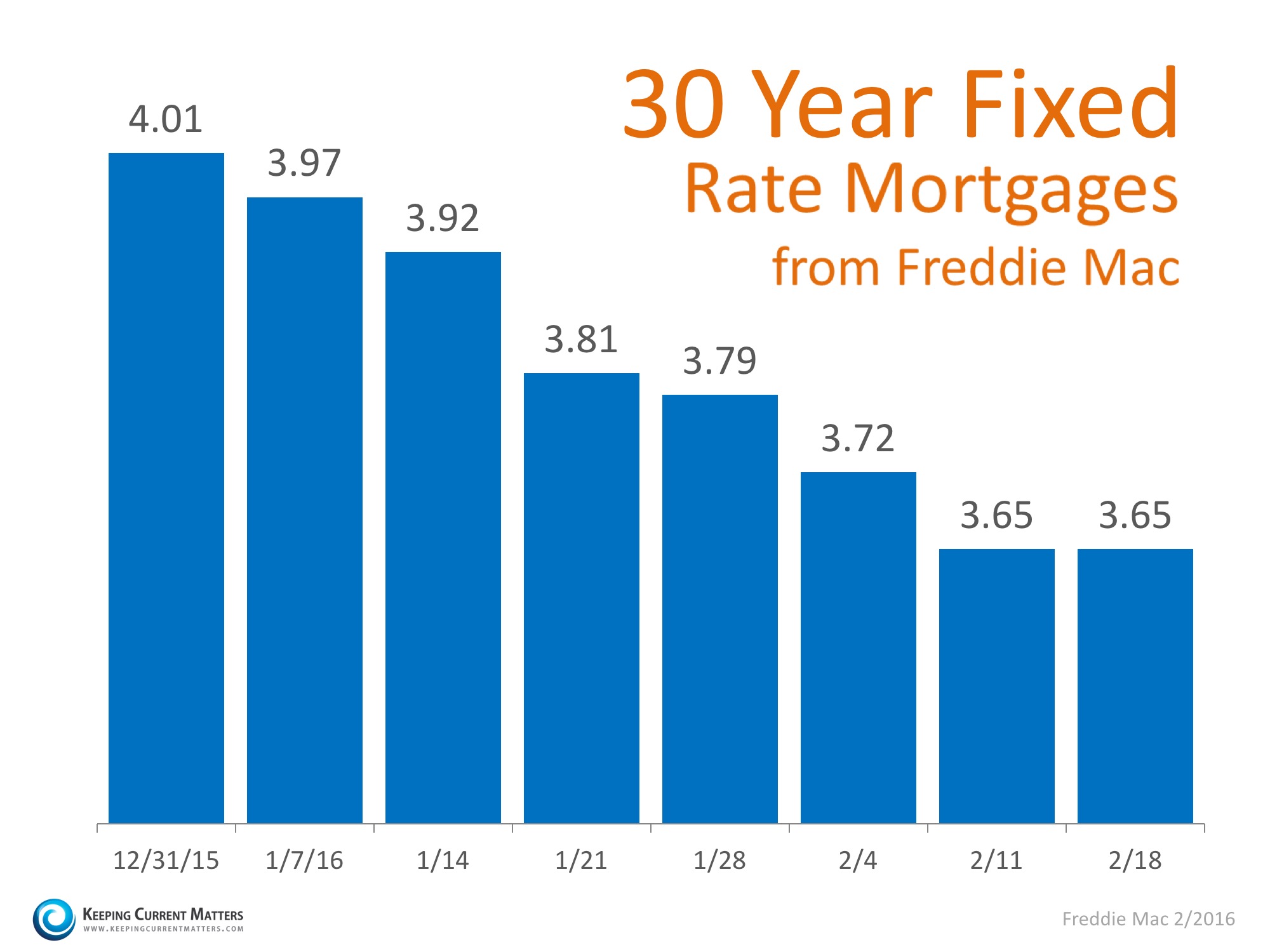

The mortgage market is constantly evolving, influenced by various factors such as economic conditions, interest rates, and government policies. Currently, the market is experiencing a rise in mortgage rates, driven by the Federal Reserve’s efforts to combat inflation.

Despite the increase in rates, there are still a range of mortgage products available to borrowers, including fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans. The availability of these products varies depending on the lender and the borrower’s financial situation.

High Street Lenders vs. Online Lenders

When it comes to obtaining a mortgage, borrowers have the option of choosing between high street lenders and online lenders. High street lenders have physical branches where customers can meet with a loan officer in person, while online lenders operate exclusively online.

Both types of lenders offer advantages and disadvantages. High street lenders often provide a more personalized experience and may be able to offer lower interest rates. However, they may have more limited product offerings and may require more documentation.

Online lenders, on the other hand, offer convenience and often have a wider range of mortgage products available. They may also have lower overhead costs, which can translate into lower interest rates for borrowers.

Strategies for Securing the Best Mortgage Rates

Securing the best possible mortgage rate can save borrowers thousands of dollars over the life of their loan. There are several strategies that borrowers can employ to improve their chances of getting a low rate.

Improving credit scores is one of the most important steps borrowers can take. Lenders use credit scores to assess a borrower’s creditworthiness and determine their interest rate. Borrowers can improve their credit scores by paying their bills on time, reducing their debt-to-income ratio, and avoiding unnecessary credit inquiries.

Fixed-Rate vs. Variable-Rate Mortgages: Best Mortgage Rates High Street

Fixed-rate mortgages offer a fixed interest rate for the life of the loan, while variable-rate mortgages have interest rates that can fluctuate over time. Fixed-rate mortgages provide stability and predictability, while variable-rate mortgages may offer lower interest rates initially.

The choice between a fixed-rate and variable-rate mortgage depends on the borrower’s individual circumstances and risk tolerance. Borrowers who prefer stability and predictability may prefer a fixed-rate mortgage, while borrowers who are comfortable with the potential for interest rate fluctuations may prefer a variable-rate mortgage.

Mortgage Fees and Closing Costs

Obtaining a mortgage typically involves a number of fees and closing costs. These fees can vary depending on the lender, the loan amount, and the location of the property.

Some of the most common mortgage fees include the origination fee, the appraisal fee, and the title insurance fee. Closing costs may also include attorney fees, recording fees, and transfer taxes.

Mortgage Protection Insurance

Mortgage protection insurance (MPI) is a type of insurance that can help borrowers protect their homes and families in the event of unexpected events, such as job loss, disability, or death.

There are different types of MPI available, each with its own benefits and limitations. Borrowers should carefully consider their individual needs and financial situation when deciding whether or not to purchase MPI.

Government-Backed Mortgages

Government-backed mortgages are loans that are insured or guaranteed by the federal government. These loans are designed to make it easier for borrowers to qualify for a mortgage and often have lower interest rates than conventional loans.

There are several different types of government-backed mortgages available, including FHA loans, VA loans, and USDA loans. Each type of loan has its own eligibility requirements and benefits.

Conclusion

By following the tips and advice Artikeld in this guide, you’ll be well-equipped to secure the best mortgage rates on the high street, saving you money and helping you achieve your homeownership goals.

Clarifying Questions

What are the advantages of using a high street lender?

High street lenders often have a more personal touch and can provide face-to-face advice. They may also be more flexible in their lending criteria.

What are the disadvantages of using an online lender?

If you’re seeking the most competitive mortgage rates on the high street, it’s imperative to research thoroughly. Discover who offers the best mortgage rates in Ontario and compare their offerings against high street lenders. By exploring various options, you can secure the most advantageous mortgage solution tailored to your financial needs.

Online lenders may have lower interest rates, but they can be less flexible in their lending criteria. They also may not offer the same level of personal service as high street lenders.

What is the difference between a fixed-rate and a variable-rate mortgage?

With a fixed-rate mortgage, your interest rate will stay the same for the entire term of the loan. With a variable-rate mortgage, your interest rate will fluctuate with market conditions.