Interest rate swaps commercial real estate loans – In the world of commercial real estate, interest rate swaps have emerged as a powerful tool for managing risk and optimizing financing strategies. This comprehensive guide delves into the intricacies of interest rate swaps, their applications in commercial real estate, and the key considerations for successful implementation.

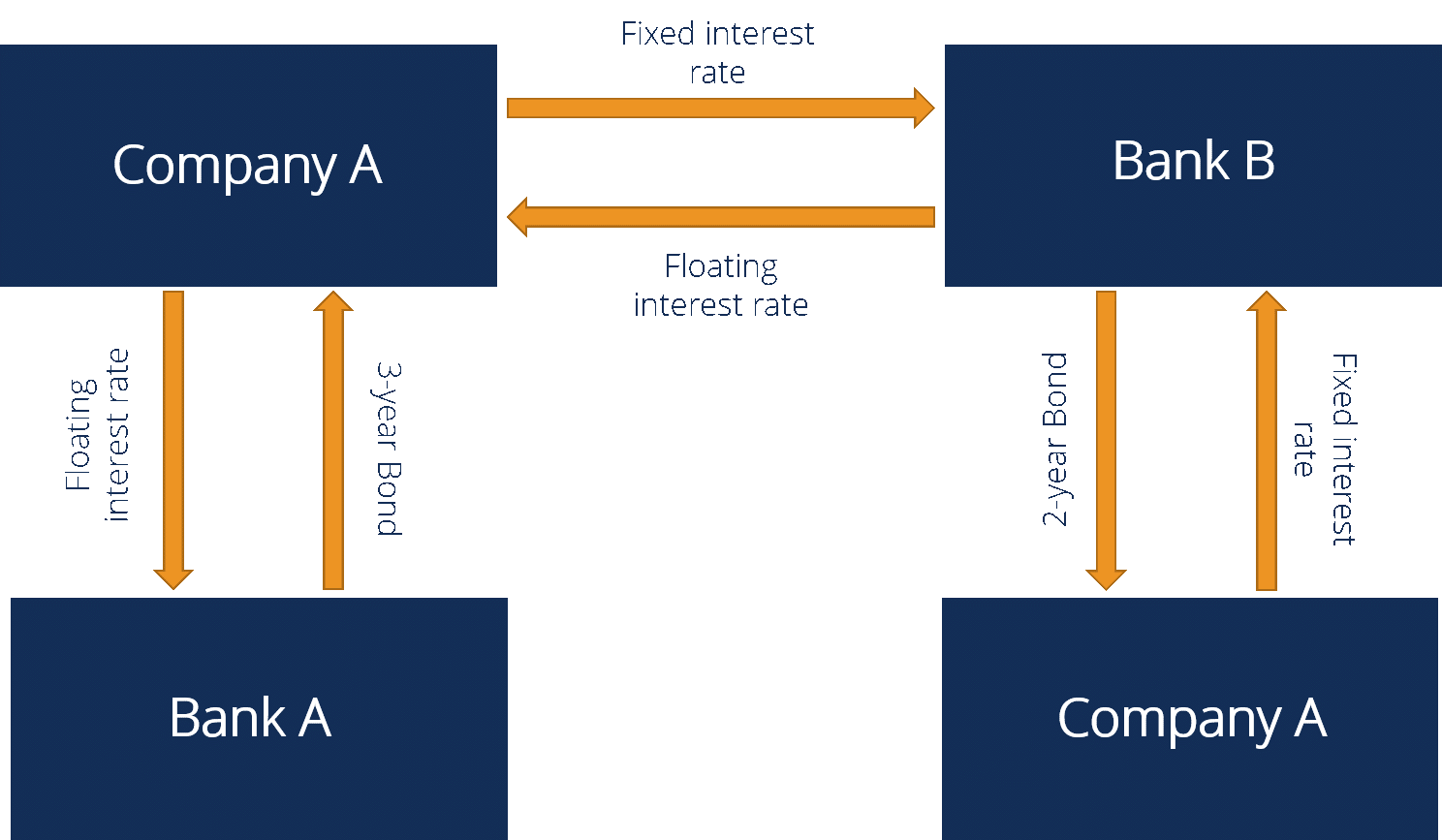

Interest rate swaps are financial instruments that allow parties to exchange interest rate payments based on different reference rates. In the context of commercial real estate loans, these swaps can be used to mitigate interest rate risk, lock in favorable rates, and enhance overall financial flexibility.

Interest Rate Swaps in Commercial Real Estate: Interest Rate Swaps Commercial Real Estate Loans

Interest rate swaps are financial instruments that allow borrowers and lenders to exchange interest payments based on different interest rate indices. In commercial real estate, interest rate swaps are commonly used to manage the risk of interest rate fluctuations and to lock in favorable borrowing rates.

For example, a borrower with a floating-rate loan may enter into an interest rate swap to convert the floating rate into a fixed rate, providing certainty in interest payments over the life of the loan.

Case Studies of Successful Interest Rate Swap Implementations in Commercial Real Estate

- Case Study 1: A real estate investment trust (REIT) used an interest rate swap to hedge against rising interest rates on its portfolio of floating-rate mortgages, reducing its overall cost of borrowing.

- Case Study 2: A developer entered into an interest rate swap to lock in a favorable fixed rate for the construction of a new office building, protecting against potential interest rate increases during the construction period.

Types of Interest Rate Swaps for Commercial Real Estate Loans

There are several types of interest rate swaps available for commercial real estate loans, each with its own advantages and disadvantages.

Interest rate swaps for commercial real estate loans can be complex, but they can also be an effective way to manage risk. If you’re considering an interest rate swap, it’s important to do your research and talk to a qualified financial advisor.

For those with a 780 credit score, you may qualify for best mortgage rates . Interest rate swaps can be a valuable tool for managing risk, but it’s important to understand the risks involved before you enter into one.

Fixed-for-Floating Swaps

Fixed-for-floating swaps allow borrowers to exchange fixed interest payments for floating interest payments. This type of swap is beneficial when interest rates are expected to rise, as it locks in a lower fixed rate for the borrower.

Floating-for-Fixed Swaps

Floating-for-fixed swaps allow borrowers to exchange floating interest payments for fixed interest payments. This type of swap is beneficial when interest rates are expected to fall, as it allows the borrower to take advantage of lower floating rates.

Basis Swaps, Interest rate swaps commercial real estate loans

Basis swaps allow borrowers to exchange one floating interest rate index for another. This type of swap is used to manage the risk of spread fluctuations between different interest rate indices.

Impact of Interest Rate Swaps on Commercial Real Estate Loans

Interest rate swaps can have a significant impact on the overall cost and risk of commercial real estate loans.

Potential Benefits

- Locking in favorable interest rates

- Managing interest rate risk

- Improving loan terms

Potential Risks

- Counterparty risk

- Market risk

- Complexity

Effect on Overall Cost of Commercial Real Estate Loans

Interest rate swaps can affect the overall cost of commercial real estate loans by altering the interest payments made by the borrower. By locking in a fixed rate or exchanging one floating rate index for another, borrowers can potentially reduce their borrowing costs or manage their risk exposure.

Considerations for Using Interest Rate Swaps in Commercial Real Estate

When evaluating whether to use an interest rate swap for a commercial real estate loan, there are several key factors to consider:

- Interest rate outlook

- Loan terms

- Borrower’s risk tolerance

- Counterparty creditworthiness

It is also important to conduct thorough due diligence before entering into an interest rate swap agreement, including reviewing the following:

- Swap documentation

- Counterparty’s financial statements

- Market analysis

Best Practices for Managing Interest Rate Swaps in Commercial Real Estate

Effective risk management is crucial for interest rate swaps in commercial real estate.

Here is a step-by-step guide to managing interest rate swaps:

- Monitor market conditions

- Review swap documentation regularly

- Stress test swap positions

- Hedge against counterparty risk

Best practices for monitoring and adjusting interest rate swap positions include:

- Tracking swap performance

- Rebalancing swap positions

- Communicating with counterparties

Ultimate Conclusion

Understanding the nuances of interest rate swaps is crucial for commercial real estate professionals seeking to navigate the complexities of financing and risk management. By carefully evaluating the potential benefits and risks, considering the various types of swaps available, and adhering to best practices, investors and lenders can harness the power of interest rate swaps to optimize their commercial real estate portfolios.

Query Resolution

What are the primary benefits of using interest rate swaps in commercial real estate?

Interest rate swaps offer several advantages, including mitigating interest rate risk, locking in favorable rates, and enhancing overall financial flexibility.

What are the different types of interest rate swaps available for commercial real estate loans?

There are various types of interest rate swaps, such as fixed-to-floating, floating-to-fixed, basis swaps, and cross-currency swaps, each with its own unique characteristics and applications.

How can I evaluate whether an interest rate swap is suitable for my commercial real estate loan?

To determine the suitability of an interest rate swap, it is essential to consider factors such as the loan terms, interest rate environment, risk tolerance, and financial objectives.