What is a cap rate for real estate – In the realm of real estate, the concept of cap rates holds immense significance for investors seeking to evaluate and compare potential investment opportunities. This guide delves into the intricacies of cap rates, exploring their definition, formula, influencing factors, and practical applications, empowering you with the knowledge to make informed investment decisions.

Cap rates, or capitalization rates, are essential metrics that provide a snapshot of a property’s income-generating potential in relation to its value. Understanding how to calculate and interpret cap rates is crucial for real estate investors, enabling them to identify undervalued or overvalued properties and make strategic investment choices.

What is a Cap Rate in Real Estate?

In real estate, the capitalization rate (cap rate) is a key metric used to evaluate the potential return on an investment. It represents the annual rate of return that an investor can expect to earn on the property, based on its net operating income (NOI) and purchase price.

Cap rates play a crucial role in real estate analysis, as they provide a standardized way to compare different properties and assess their potential profitability.

Formula and Calculation

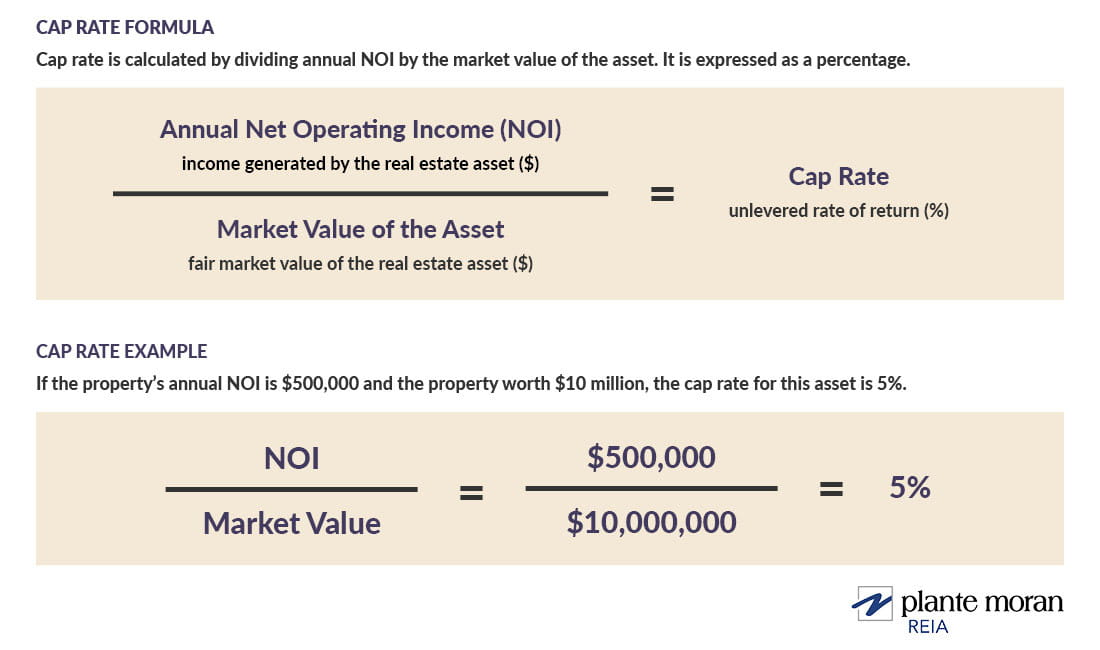

The cap rate formula is as follows:

Cap Rate = NOI / Purchase Price

Where:

- NOI is the net operating income of the property, calculated by subtracting operating expenses from gross income.

- Purchase Price is the total cost of acquiring the property, including the purchase price, closing costs, and any other expenses incurred.

For example, if a property has an NOI of $100,000 and was purchased for $1,000,000, the cap rate would be 10%.

Factors Influencing Cap Rate, What is a cap rate for real estate

Several factors can influence cap rates, including:

- Property Type:Different property types, such as apartments, office buildings, and retail spaces, typically have different cap rates.

- Location:The location of the property, including its proximity to amenities, transportation, and economic centers, can affect its cap rate.

- Market Conditions:The overall real estate market conditions, including interest rates, supply and demand, and economic outlook, can impact cap rates.

Investors consider these factors when evaluating real estate investments to determine the appropriate cap rate to use for their analysis.

Epilogue

In conclusion, cap rates are indispensable tools for real estate investors, offering a standardized method to assess the profitability and risk associated with potential investments. By considering the factors that influence cap rates and employing advanced analysis techniques, investors can refine their decision-making process and maximize their returns.

FAQ Section: What Is A Cap Rate For Real Estate

What is the formula for calculating a cap rate?

Cap rate = Net Operating Income (NOI) / Property Value

A cap rate is a measure of the potential return on investment for a real estate property. It is calculated by dividing the net operating income (NOI) by the current market value of the property. Cap rates are often used by investors to compare different investment opportunities.

For instance, if you are considering obtaining private commercial real estate loans to invest in a property, you may want to consider the cap rate of the property to assess its potential profitability.

How do I interpret a cap rate?

A higher cap rate generally indicates a higher potential return but also higher risk, while a lower cap rate suggests a lower return but lower risk.

What factors influence cap rates?

Factors such as property type, location, market conditions, and tenant quality all impact cap rates.