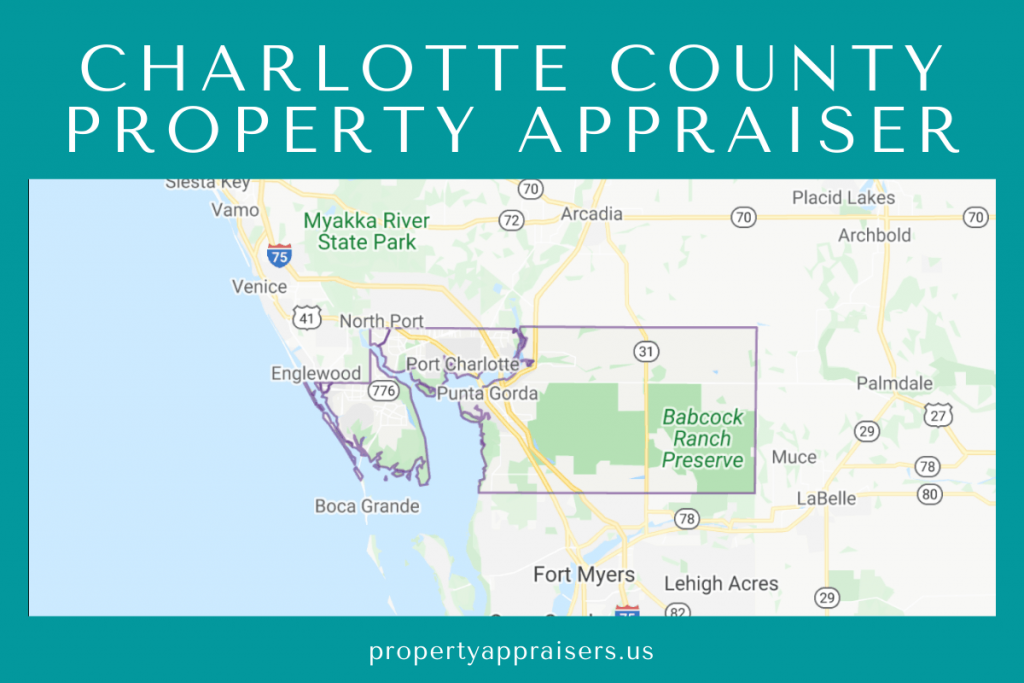

Delve into the intricacies of property appraisal in Charlotte County with the Charlotte County Property Appraiser’s Office. This comprehensive guide will shed light on their mission, responsibilities, and the processes involved in assessing property values, empowering you with the knowledge to navigate property-related matters with confidence.

From understanding the property assessment process to exploring property tax exemptions and appeals, this guide will equip you with the essential information to make informed decisions regarding your property.

Charlotte County Property Appraiser’s Office

The Charlotte County Property Appraiser’s Office is responsible for assessing the value of all real and personal property in Charlotte County, Florida. The office also collects property taxes and distributes them to local governments.

The Property Appraiser’s Office is located at 18500 Murdock Circle, Port Charlotte, FL 33948. The office can be reached by phone at (941) 624-2134 or by email at [email protected]. The office’s website is www.charlottecountyfl.gov/propertyappraiser.

The Property Appraiser’s Office is headed by Property Appraiser Ron Adams. Mr. Adams is a certified Florida appraiser and has been in the appraisal business for over 20 years.

Property Assessment Process

The property assessment process begins with the collection of data about each property in Charlotte County. This data includes information about the property’s size, location, and condition. The Property Appraiser’s Office also collects data about the sales prices of similar properties in the area.

Once the data has been collected, the Property Appraiser’s Office uses a computer-assisted mass appraisal system to assess the value of each property. The system takes into account a variety of factors, including the property’s size, location, condition, and the sales prices of similar properties in the area.

The Property Appraiser’s Office sends out property tax bills to all property owners in Charlotte County. The tax bills are based on the assessed value of each property.

Property Tax Exemptions

There are a number of property tax exemptions available in Charlotte County. These exemptions include:

- Homestead exemption

- Senior citizen exemption

- Disabled person exemption

- Veteran exemption

To qualify for a property tax exemption, you must meet certain eligibility requirements. For more information about property tax exemptions, please visit the Property Appraiser’s Office website or call the office at (941) 624-2134.

Property Tax Appeals

If you believe that your property has been assessed at an incorrect value, you can appeal the assessment. To appeal your assessment, you must file a petition with the Value Adjustment Board. The petition must be filed within 25 days of the date that you received your property tax bill.

The Value Adjustment Board will hold a hearing to review your appeal. At the hearing, you will have the opportunity to present evidence to support your claim that your property has been assessed at an incorrect value.

If the Value Adjustment Board agrees with you, it will issue an order reducing the assessed value of your property. The reduction in assessed value will result in a lower property tax bill.

Property Tax Payment

Property taxes in Charlotte County are due on November 1st of each year. You can pay your property taxes online, by mail, or in person at the Property Appraiser’s Office.

If you do not pay your property taxes by the due date, you will be charged a late penalty. The late penalty is 3% per month, up to a maximum of 18%. If you do not pay your property taxes for more than two years, your property may be sold at a tax sale.

The Charlotte County Property Appraiser provides valuable information for property owners and potential buyers alike. Their comprehensive database allows users to easily access property records, search for comparable sales, and estimate property values. For those interested in exploring real estate opportunities beyond Charlotte County, I recommend checking out austin real estate management , which offers a wide range of services for property management, leasing, and sales in the Austin area.

By utilizing the resources provided by both the Charlotte County Property Appraiser and austin real estate management, individuals can make informed decisions about their property investments.

Online Property Search, Charlotte county property appraiser

The Property Appraiser’s Office offers an online property search tool that allows you to search for information about properties in Charlotte County. You can search for properties by address, owner name, or parcel number.

The online property search tool provides information about the assessed value of each property, the property’s size, location, and condition. The tool also provides information about the sales prices of similar properties in the area.

Conclusion: Charlotte County Property Appraiser

Whether you’re a homeowner, a prospective buyer, or simply seeking a deeper understanding of property appraisal, this guide has provided you with a comprehensive overview of the Charlotte County Property Appraiser’s role. By leveraging the information presented here, you can effectively manage your property taxes, ensure accurate property assessments, and make informed decisions regarding your real estate investments.

Top FAQs

What is the mission of the Charlotte County Property Appraiser’s Office?

The Charlotte County Property Appraiser’s Office is responsible for assessing the value of all taxable property within Charlotte County, ensuring fair and equitable property tax assessments.

How can I contact the Charlotte County Property Appraiser’s Office?

You can contact the Charlotte County Property Appraiser’s Office by phone at (941) 637-2144, by email at [email protected], or by visiting their website at https://www.charlottecountyfl.gov/departments/property-appraiser.

What factors can affect property values?

Various factors can affect property values, including location, size, age, condition, amenities, and market trends.