Fort Bend County property taxes are a crucial aspect of homeownership and business operations in the county. This comprehensive guide delves into the intricacies of the property tax system, empowering you with the knowledge to navigate its complexities effectively.

From understanding tax rates and exemptions to exploring payment options and navigating assessment and appeal processes, this guide provides a thorough examination of property taxes in Fort Bend County, ensuring you stay informed and compliant with your tax obligations.

Fort Bend County Property Tax Overview

Fort Bend County, Texas, has a property tax system that provides funding for essential local services such as schools, roads, and public safety. The county’s property tax rates, exemptions, and assessment methods are designed to ensure fair and equitable distribution of the tax burden among property owners.

Property taxes in Fort Bend County are assessed annually and are based on the appraised value of the property. The county’s appraisal district, the Fort Bend County Appraisal District, determines the appraised value of all taxable properties within the county.

For homeowners in Fort Bend County, understanding property taxes is crucial. If you’re considering investing in real estate, exploring options like mexico real estate rocky point can provide potential returns. However, it’s important to note that Fort Bend County property taxes should be carefully assessed as part of your financial planning.

Property Tax Rates and Calculations

The current property tax rate in Fort Bend County is 2.2882%. This rate is applied to the appraised value of the property to calculate the annual property tax bill.

For residential properties, the homestead exemption reduces the appraised value of the property by $25,000. This exemption can significantly reduce the amount of property taxes owed.

For commercial properties, there is no homestead exemption. However, there are a number of other exemptions that may be available, such as the business inventory exemption and the agricultural exemption.

Exemptions and Tax Relief Programs: Fort Bend County Property Taxes

Fort Bend County offers a number of property tax exemptions and tax relief programs to eligible property owners. These exemptions and programs can help to reduce the amount of property taxes owed.

- Homestead exemption: This exemption reduces the appraised value of a residential property by $25,000.

- Over-65 exemption: This exemption reduces the appraised value of a residential property by $10,000 for property owners who are 65 years of age or older.

- Disabled person exemption: This exemption reduces the appraised value of a residential property by $10,000 for property owners who are disabled.

- Business inventory exemption: This exemption exempts the value of business inventory from property taxes.

- Agricultural exemption: This exemption exempts the value of agricultural land from property taxes.

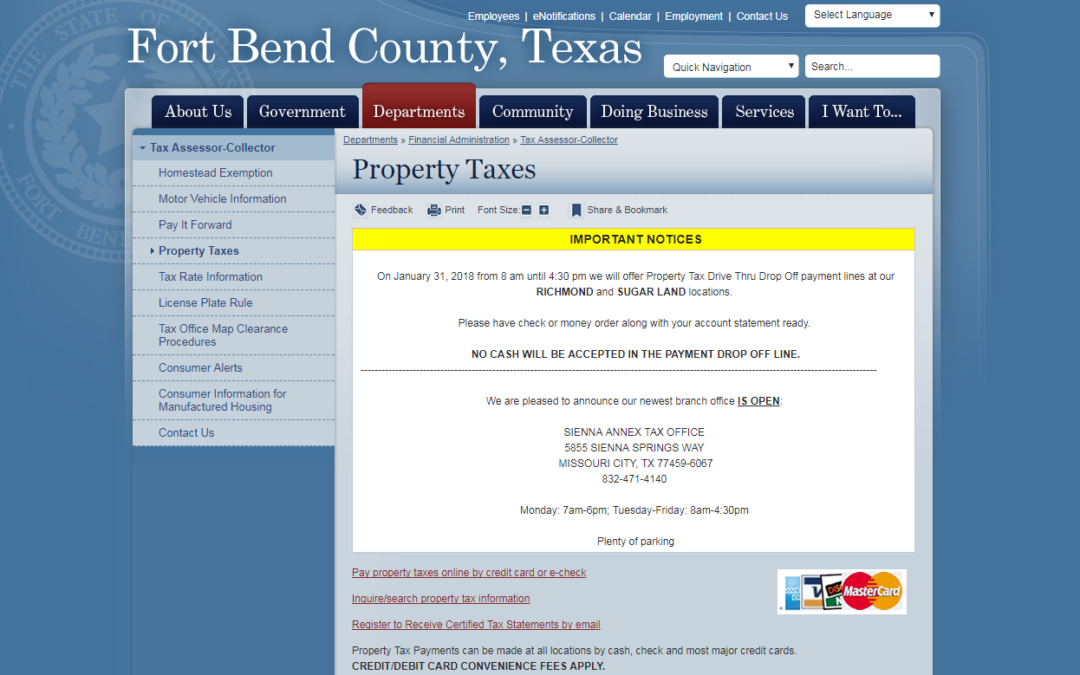

Property Tax Payment Options

Property taxes in Fort Bend County can be paid in a number of ways, including:

- Online: Property taxes can be paid online through the Fort Bend County Tax Assessor-Collector’s website.

- By mail: Property taxes can be mailed to the Fort Bend County Tax Assessor-Collector’s office.

- In person: Property taxes can be paid in person at the Fort Bend County Tax Assessor-Collector’s office.

Last Word

Property taxes in Fort Bend County are a multifaceted subject with implications for both homeowners and businesses. By understanding the nuances of the system, you can optimize your tax liability, protect your property rights, and contribute to the county’s fiscal well-being.

This guide serves as an invaluable resource, equipping you with the knowledge and tools to navigate the property tax landscape with confidence.

Query Resolution

What is the current property tax rate in Fort Bend County?

The current property tax rate in Fort Bend County is $0.5336 per $100 of assessed value.

Are there any exemptions available for property taxes in Fort Bend County?

Yes, there are several exemptions available, including the homestead exemption, senior citizen exemption, and disability exemption.

What are the payment options for property taxes in Fort Bend County?

Property taxes in Fort Bend County can be paid online, by mail, or in person at the tax assessor’s office.

How can I challenge my property tax assessment in Fort Bend County?

To challenge your property tax assessment in Fort Bend County, you must file an appeal with the Appraisal Review Board.