Welcome to the realm of North Carolina property tax vehicle, where we delve into the intricacies of assessing, paying, and understanding the consequences of unpaid taxes on vehicles within the state. This comprehensive guide will navigate you through the nuances of property tax, providing valuable insights and practical advice.

As you embark on this journey, you’ll gain a clear understanding of how property taxes are determined for vehicles, the various methods available for payment, and the repercussions of failing to meet your obligations. We’ll also explore the process of protesting an assessment and provide a wealth of resources to assist you in obtaining the information you need.

North Carolina Property Tax Vehicle Assessment

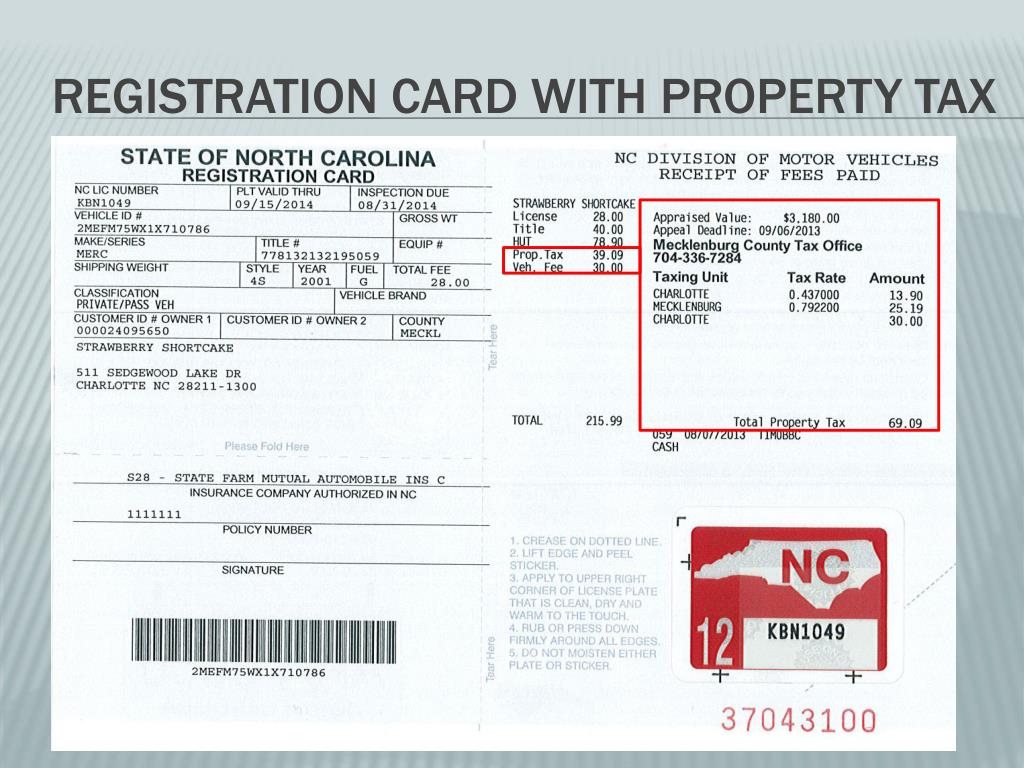

North Carolina law requires all vehicles to be assessed for property taxes. The assessed value is based on the vehicle’s fair market value as of January 1st of each year.

The county tax assessor is responsible for determining the assessed value of vehicles. The assessor considers several factors when making this determination, including the vehicle’s make, model, year, condition, and mileage.

Exemptions and Deductions

There are a few exemptions and deductions that may apply to vehicle property taxes in North Carolina. These include:

- The first $3,500 of the assessed value of a passenger vehicle is exempt from property taxes.

- Vehicles owned by disabled veterans are exempt from property taxes.

- Vehicles used for business purposes may be eligible for a deduction from the assessed value.

Methods for Paying North Carolina Property Tax Vehicle

There are several ways to pay property taxes on vehicles in North Carolina. These include:

Online, North carolina property tax vehicle

You can pay your property taxes online through the North Carolina Department of Revenue’s website.

By Mail

You can mail your property tax payment to the county tax collector’s office.

In Person

You can pay your property taxes in person at the county tax collector’s office.

Deadlines and Penalties

Property taxes are due on September 1st of each year. If you do not pay your property taxes by the due date, you will be charged a penalty.

Consequences of Unpaid North Carolina Property Tax Vehicle

If you do not pay your property taxes on your vehicle, the county tax collector may take the following actions:

- Place a tax lien on your vehicle.

- Foreclose on your vehicle.

- Suspend your vehicle registration.

Protesting North Carolina Property Tax Vehicle Assessment

If you believe that your vehicle’s assessed value is incorrect, you can protest the assessment.

To protest your assessment, you must file a petition with the county tax assessor. The petition must be filed within 30 days of the date you receive your property tax bill.

The county tax assessor will review your petition and make a decision on whether or not to adjust your assessment.

Appealing a Protest Decision

If you are not satisfied with the county tax assessor’s decision, you can appeal the decision to the county board of equalization and review.

Resources for North Carolina Property Tax Vehicle Information

The following resources can provide you with more information about property taxes on vehicles in North Carolina:

- North Carolina Department of Revenue: https://www.ncdor.gov/taxes/property/vehicle-property-tax

- North Carolina Association of County Commissioners: https://www.ncacc.org/

- Your county tax collector’s office

Conclusive Thoughts

In conclusion, managing North Carolina property tax vehicle is a crucial aspect of vehicle ownership. By understanding the assessment process, payment options, and consequences of unpaid taxes, you can ensure compliance and avoid potential penalties. Remember to utilize the resources available and seek assistance when needed to navigate the complexities of property tax.

Frequently Asked Questions

What factors are considered when assessing property taxes for vehicles in North Carolina?

Navigating North Carolina property tax vehicle regulations can be complex. Consider consulting with a charlotte real estate attorney for expert guidance. Their knowledge of local laws and tax codes can help ensure you meet your property tax obligations accurately and efficiently.

Factors include the vehicle’s make, model, year, and condition, as well as its original purchase price and any modifications or upgrades.

How can I pay my North Carolina property tax vehicle online?

You can pay online through the North Carolina Department of Revenue website using a credit card, debit card, or electronic check.

What are the consequences of not paying my North Carolina property tax vehicle on time?

Failure to pay property taxes can result in late fees, tax liens, and even foreclosure on the vehicle.