Section 1245 property, a crucial concept in tax law, plays a significant role in determining tax consequences for certain types of assets. This comprehensive guide delves into the definition, purpose, tax implications, and special rules associated with Section 1245 property, providing a clear understanding of its impact on tax liability.

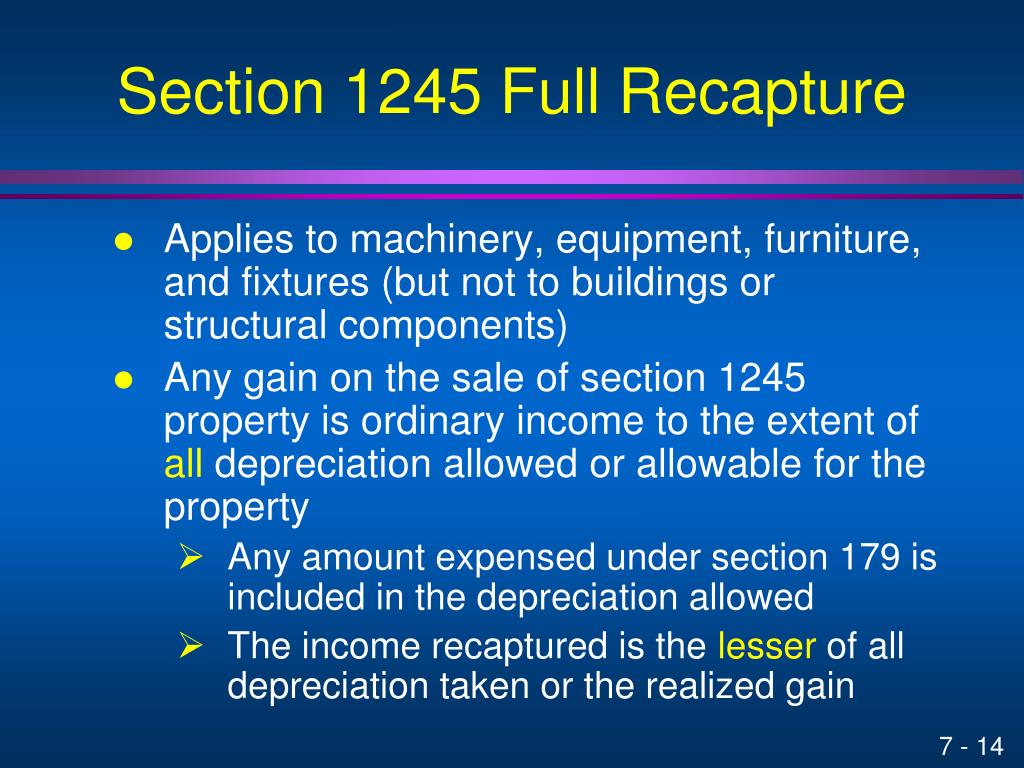

Section 1245 property encompasses tangible personal property, such as machinery, equipment, and vehicles, used in a trade or business and subject to depreciation. The tax implications of owning Section 1245 property include ordinary income treatment upon disposition, making it essential for taxpayers to be aware of the potential tax consequences.

Overview of Section 1245 Property

Section 1245 property refers to personal property that is subject to depreciation recapture under Section 1245 of the Internal Revenue Code (IRC). This property typically includes tangible assets used in a trade or business, such as machinery, equipment, and vehicles.

The primary purpose of Section 1245 is to prevent taxpayers from claiming excessive depreciation deductions and then selling the property at a gain without paying tax on the recaptured depreciation.

- Depreciation Recapture:When Section 1245 property is sold or disposed of, the gain realized is treated as ordinary income to the extent of the depreciation previously claimed on the property.

- Ordinary Income:Ordinary income is taxed at the taxpayer’s regular income tax rate, which can be higher than the capital gains tax rate.

- Capital Gain Treatment:If the gain on the sale of Section 1245 property exceeds the depreciation previously claimed, the excess gain is taxed at the more favorable capital gains tax rate.

Depreciation and Recapture of Section 1245 Property

Depreciation Calculation, Section 1245 property

Depreciation for Section 1245 property is typically calculated using the modified accelerated cost recovery system (MACRS). MACRS assigns a specific recovery period to each asset, which determines the rate at which depreciation can be claimed.

Recapture Concept

Recapture occurs when the gain realized on the sale or disposition of Section 1245 property exceeds the property’s adjusted basis. The adjusted basis is the original cost of the property minus any depreciation previously claimed.

Recapture Calculation

The amount of recapture is calculated as follows:

Recapture = Gain realized

Adjusted basis

The recaptured amount is then treated as ordinary income.

Disposition of Section 1245 Property

Tax Consequences

The tax consequences of disposing of Section 1245 property depend on whether the gain realized exceeds the depreciation previously claimed.

- Ordinary Income:If the gain exceeds the depreciation, the recaptured amount is taxed as ordinary income.

- Capital Gain:If the gain does not exceed the depreciation, the entire gain is taxed at the capital gains tax rate.

Minimizing Tax Liability

To minimize tax liability when disposing of Section 1245 property, consider the following strategies:

- Delay Disposition:Postponing the sale or disposition of the property allows for more depreciation to be claimed, reducing the amount of potential recapture.

- Installment Sale:Spreading the gain over multiple years through an installment sale can reduce the tax burden in each year.

Special Rules for Section 1245 Property

Anti-Churning Rules

The anti-churning rules prevent taxpayers from converting ordinary income into capital gains by selling Section 1245 property to related parties.

Section 1245 property, which includes real estate improvements such as buildings, is subject to depreciation recapture upon sale. These improvements may have real estate encumbrances such as liens or easements that affect their value. Understanding the impact of these encumbrances on section 1245 property is crucial for accurate tax reporting.

Exceptions

There are certain exceptions to the general rules for Section 1245 property, including:

- Inventory:Property held for sale to customers in the ordinary course of business is not considered Section 1245 property.

- Depreciation Method:If straight-line depreciation is used for the property, there is no recapture upon disposition.

Conclusion

In conclusion, Section 1245 property presents unique tax considerations that require careful attention. Understanding the definition, tax implications, and special rules associated with Section 1245 property empowers taxpayers to make informed decisions, minimize tax liability, and ensure compliance with tax regulations.

User Queries

What is the purpose of Section 1245 property classification?

Section 1245 property classification helps determine the tax treatment of certain assets upon disposition, ensuring that gains are taxed as ordinary income rather than capital gains.

How is depreciation calculated for Section 1245 property?

Depreciation for Section 1245 property is calculated using the straight-line method over the property’s useful life.

What is the concept of recapture as it applies to Section 1245 property?

Recapture refers to the recognition of ordinary income upon disposition of Section 1245 property to the extent of prior depreciation deductions.