Are i bonds still a good investment in 2023 – As we delve into the realm of investing, it’s imperative to assess the viability of various options, and one that has garnered attention is I bonds. In this comprehensive analysis, we’ll explore the nuances of I bonds, evaluating their potential as a sound investment choice in the current economic climate.

Through a meticulous examination of economic indicators, interest rate trends, and inflation’s impact, we’ll uncover the factors that shape I bond returns. Furthermore, we’ll delve into the intricacies of I bond features and benefits, including their unique fixed-rate structure and inflation-adjusted component.

1. Economic Environment and Interest Rate Outlook

The current economic environment is characterized by high inflation and rising interest rates. The Federal Reserve has embarked on a path of monetary tightening to curb inflation, which has led to an increase in I bond yields.

The Federal Reserve’s interest rate policy is a key factor in determining I bond returns. As interest rates rise, so do I bond yields. However, it is important to note that I bonds also have an inflation-adjusted component, which means that their returns are linked to the rate of inflation.

Inflation has been a major concern for investors in recent months. The high inflation rate has eroded the value of savings and investments. I bonds offer a unique hedge against inflation because their returns are adjusted based on the Consumer Price Index (CPI).

2. I Bond Features and Benefits

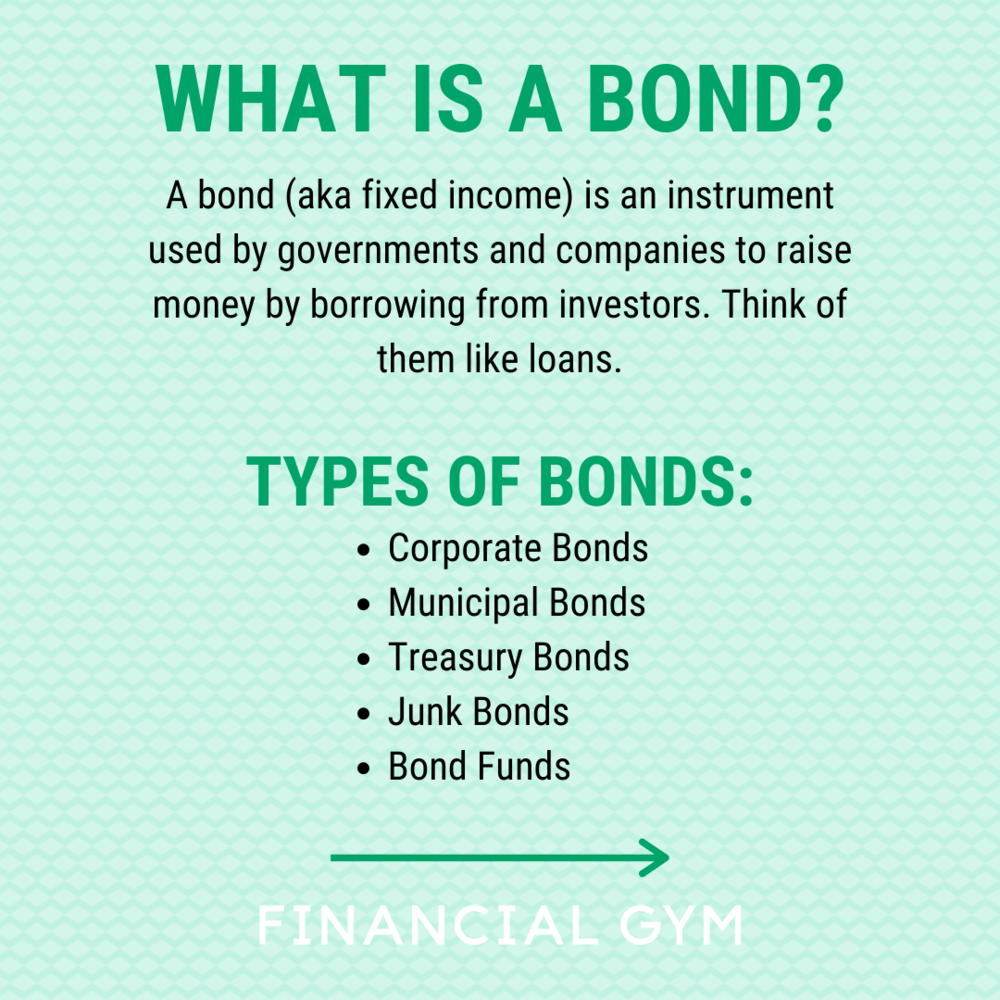

I bonds are a type of savings bond issued by the U.S. Treasury. They offer a fixed rate of return that is set at the time of purchase. In addition, I bonds have an inflation-adjusted component that is based on the CPI.

While I bonds offer a competitive fixed rate in the current market, it’s also prudent to consider the potential benefits of real estate investments. As the economy recovers and interest rates stabilize, investing in real estate could provide long-term growth opportunities and diversification benefits.

However, the decision ultimately depends on your individual financial goals and risk tolerance. I bonds remain a solid option for preserving capital and earning a guaranteed return, but exploring real estate investments may be a worthwhile consideration as well.

I bonds are sold in denominations of $25, $50, $100, $500, and $1,000. The minimum purchase amount is $25, and the maximum purchase amount is $10,000 per year per person.

I bonds are redeemable after one year. However, if you redeem an I bond within five years of purchase, you will forfeit the last three months of interest.

I bonds are exempt from state and local income taxes. However, they are subject to federal income taxes.

3. Investment Strategies and Alternatives: Are I Bonds Still A Good Investment In 2023

I bonds can be a valuable addition to a diversified investment portfolio. They offer a unique combination of safety, liquidity, and inflation protection.

One strategy for investing in I bonds is to purchase them in a laddered fashion. This means buying I bonds with different maturity dates so that you can have access to your money at different times.

Another strategy is to use I bonds as a short-term investment. I bonds can be redeemed after one year, so they can be a good place to park your money while you wait for better investment opportunities.

There are a number of other fixed-income investments that you can consider as alternatives to I bonds. These include CDs, Treasury bonds, and municipal bonds.

4. Considerations for Individual Investors

Whether or not I bonds are a good investment for you depends on your individual circumstances.

If you are looking for a safe and liquid investment with inflation protection, then I bonds may be a good option for you. However, if you are looking for a high-return investment, then you may want to consider other options.

It is important to remember that I bonds are not a perfect investment. They have a number of limitations, including the purchase limits and the redemption penalties.

Before investing in I bonds, it is important to carefully consider your investment goals and risk tolerance.

Epilogue

-min.png)

As we conclude our exploration of I bonds as an investment option in 2023, it’s evident that their suitability depends on individual circumstances and investment goals. By carefully considering the factors discussed, investors can make informed decisions that align with their financial objectives.

Essential Questionnaire

Are I bonds a good investment for everyone?

The suitability of I bonds depends on individual risk tolerance, investment horizon, and financial goals.

How are I bonds taxed?

I bond interest is subject to federal income tax, but not state or local income tax.

What are the purchase limits for I bonds?

Individuals can purchase up to $10,000 in electronic I bonds and an additional $5,000 in paper I bonds per calendar year.