With best mortgage rates 90 at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights. Here, we’ll delve into the intricacies of the mortgage market, exploring the factors that shape rates, the nuances of 90% loan-to-value ratios, and strategies for securing the most favorable terms.

To secure the best mortgage rates, it is essential to research and compare different lenders. Additionally, consulting with a reputable property management company like Kasef can provide valuable insights into local market conditions and help you make informed decisions. For a comprehensive guide on property management in Central Valley, explore Unveiling the Secrets of Central Valley Property Management . This guide offers expert advice and strategies for maximizing rental income and safeguarding your investment, ultimately enabling you to secure the most favorable mortgage rates for your property.

As we navigate this comprehensive guide, you’ll gain invaluable knowledge to empower your homeownership aspirations. Whether you’re a first-time buyer or a seasoned investor, this exploration will equip you with the tools and insights to make informed decisions and unlock the best mortgage rates 90 has to offer.

Mortgage Rates in the Current Market

The mortgage market is constantly evolving, influenced by a complex interplay of economic factors. In 2023, several key factors are shaping mortgage rates, including:

- Inflation:Rising inflation puts pressure on the Federal Reserve to increase interest rates, which in turn affects mortgage rates.

- Economic growth:A strong economy can lead to higher demand for mortgages, which can push rates up.

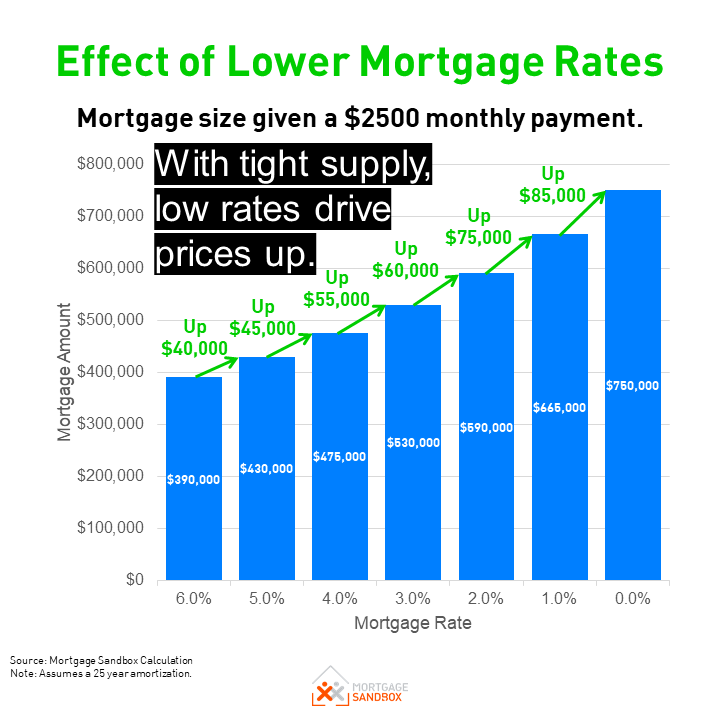

- Housing inventory:A shortage of available homes can drive up home prices and make it more expensive to get a mortgage.

As of [current date], the average 30-year fixed-rate mortgage rate is [current rate]. This rate is higher than it was a year ago, but it is still below the historical average.

The Federal Reserve’s monetary policy has a significant impact on mortgage rates. When the Fed raises interest rates, mortgage rates typically rise as well. This is because banks and other lenders base their mortgage rates on the interest rates set by the Fed.

Understanding the 90% Loan-to-Value Ratio

A 90% loan-to-value ratio (LTV) means that you are borrowing 90% of the value of your home. For example, if your home is worth $200,000, you can borrow up to $180,000 with a 90% LTV mortgage.

There are both advantages and disadvantages to 90% LTV mortgages.

Advantages of 90% LTV Mortgages

- Lower down payment:With a 90% LTV mortgage, you will only need to put down 10% of the home’s value.

- More affordable monthly payments:A lower down payment means lower monthly mortgage payments.

Disadvantages of 90% LTV Mortgages, Best mortgage rates 90

- Higher interest rates:Lenders typically charge higher interest rates on 90% LTV mortgages than on mortgages with lower LTVs.

- Private mortgage insurance (PMI):If you have a 90% LTV mortgage, you will likely be required to pay PMI. PMI is a type of insurance that protects the lender in the event that you default on your loan.

To be eligible for a 90% LTV mortgage, you will typically need to have a good credit score and a strong debt-to-income ratio.

Comparing Lenders and Loan Options: Best Mortgage Rates 90

When shopping for a mortgage, it is important to compare rates and terms from multiple lenders. This will help you find the best loan for your needs.

| Lender | 30-Year Fixed-Rate Mortgage | Loan Terms | Closing Costs |

|---|---|---|---|

| Bank of America | [rate] | [terms] | [closing costs] |

| Chase | [rate] | [terms] | [closing costs] |

| Wells Fargo | [rate] | [terms] | [closing costs] |

When comparing lenders, be sure to consider the following factors:

- Interest rate:The interest rate is the most important factor to consider when comparing mortgages.

- Loan terms:The loan term is the length of time that you will have to repay your loan. Common loan terms include 30 years, 20 years, and 15 years.

- Closing costs:Closing costs are the fees that you will pay to close your loan. These fees can vary depending on the lender and the loan amount.

Tips for Securing the Best Mortgage Rates

There are a number of things you can do to improve your chances of getting the best possible mortgage rate.

- Improve your credit score:Your credit score is one of the most important factors that lenders consider when setting interest rates.

- Reduce your debt-to-income ratio:Your debt-to-income ratio is the percentage of your monthly income that goes towards paying off debt. Lenders prefer borrowers with low debt-to-income ratios.

- Make a larger down payment:The larger your down payment, the lower your loan-to-value ratio will be. This can lead to lower interest rates.

Additional Considerations

In addition to the factors discussed above, there are a few other things to consider when getting a mortgage.

- Government-backed loans:Government-backed loans, such as FHA loans, VA loans, and USDA loans, can be a good option for borrowers who have lower credit scores or who cannot afford a large down payment.

- Adjustable-rate mortgages:Adjustable-rate mortgages (ARMs) have interest rates that can change over time. ARMs can be a good option for borrowers who expect interest rates to decline in the future.

- First-time homebuyer programs:There are a number of programs available to help first-time homebuyers with the cost of buying a home. These programs can include down payment assistance and closing cost assistance.

Closing Summary

In closing, the pursuit of the best mortgage rates 90 is a journey that requires careful planning, research, and a commitment to financial responsibility. By embracing the strategies Artikeld in this guide, you’ll increase your chances of securing a loan that aligns with your financial goals and sets you on the path to homeownership success.

Remember, the mortgage market is dynamic, so stay informed, compare rates diligently, and don’t hesitate to seek professional advice when needed. With the right approach, you’ll find the best mortgage rates 90 and turn your dream of homeownership into a reality.

Quick FAQs

What factors influence mortgage rates in 2023?

Mortgage rates in 2023 are influenced by various factors, including economic conditions, inflation, Federal Reserve policy, and global financial markets.

What are the advantages of a 90% loan-to-value ratio mortgage?

90% LTV mortgages allow borrowers to purchase a home with a down payment of only 10%, making homeownership more accessible.

How can I improve my credit score to secure a better mortgage rate?

To improve your credit score, consider paying bills on time, reducing debt, and avoiding unnecessary credit inquiries.