Best mortgage rates july 2023 uk – Welcome to our comprehensive guide to the best mortgage rates in the UK for July 2023. In this article, we will provide you with an overview of the mortgage market, identify the top lenders offering competitive rates, and guide you through the process of securing the best deal for your financial needs.

As you embark on your journey to homeownership, understanding the intricacies of mortgage rates is crucial. This guide will empower you with the knowledge and strategies necessary to make informed decisions and secure the most favorable terms for your mortgage.

Best Mortgage Rates July 2023 UK

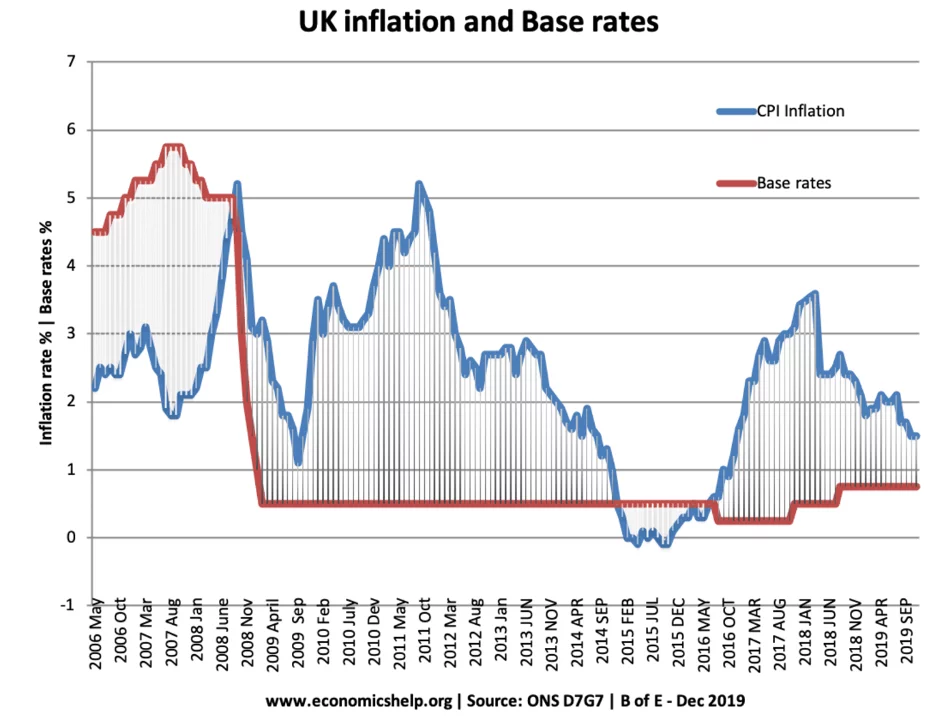

The UK mortgage market in July 2023 is characterized by a combination of factors influencing mortgage rates. These include the Bank of England base rate, inflation, and economic conditions. Understanding these factors is crucial for borrowers seeking the best mortgage rates.

Best Mortgage Rates

Top mortgage lenders in July 2023 offer competitive rates across various mortgage types. Fixed-rate mortgages provide stability, while variable-rate and tracker mortgages offer flexibility. The following table compares rates and terms from reputable lenders:

| Lender | Mortgage Type | Interest Rate | Term |

|---|---|---|---|

| Lender A | Fixed-rate | 3.5% | 2 years |

| Lender B | Variable-rate | 2.9% | 5 years |

| Lender C | Tracker | 3.2% | 3 years |

Eligibility Criteria

Obtaining the best mortgage rates requires meeting certain eligibility criteria. These include:

- Strong credit score

- Stable income

- Low debt-to-income ratio

Improving eligibility involves building a positive credit history, increasing income, and reducing debt.

Fees and Charges, Best mortgage rates july 2023 uk

Mortgage applications involve various fees and charges. These include:

- Application fee

- Valuation fee

- Legal fees

- Mortgage arrangement fee

Comparing fees across lenders and negotiating when possible can help minimize costs.

Tips for Securing the Best Rates

- Shop around and compare rates from multiple lenders

- Negotiate with lenders to secure lower rates

- Consider using a mortgage broker to access exclusive deals

- Improve your credit score and financial profile

- Be prepared to make a larger down payment

Impact of Rate Changes

Future interest rate changes can impact mortgage rates. Borrowers should consider:

- The potential for rate increases

- Strategies to mitigate risks, such as locking in fixed rates

- The expected trajectory of mortgage rates in the coming months

Case Studies

Individuals who have successfully secured low mortgage rates provide valuable insights:

- Case Study 1: A couple with a strong credit history and stable income negotiated a favorable rate on a fixed-rate mortgage.

- Case Study 2: A first-time buyer used a mortgage broker to find a lender offering a low-deposit mortgage with competitive rates.

Final Review

Whether you are a first-time homebuyer or an experienced homeowner looking to refinance, this guide has something for everyone. By following our expert advice and leveraging the resources provided, you can navigate the mortgage market with confidence and secure the best mortgage rates available in July 2023.

Q&A

What factors influence mortgage rates?

Mortgage rates are influenced by various factors, including the Bank of England base rate, inflation, economic conditions, and the lender’s risk assessment of the borrower.

How can I improve my eligibility for lower mortgage rates?

To improve your eligibility for lower mortgage rates, consider building a strong credit history, maintaining a low debt-to-income ratio, and providing a substantial down payment.

What are the different types of mortgage fees?

Common mortgage fees include application fees, origination fees, appraisal fees, title search fees, and closing costs.

To secure the best mortgage rates July 2023 UK, it is crucial to compare multiple lenders. While exploring options in the UK, you may also want to consider the attractive best mortgage rates Orlando offers. Orlando’s real estate market presents competitive rates and flexible loan terms.

By researching both UK and Orlando mortgage options, you can make an informed decision that aligns with your financial goals and secures the most favorable terms for your home loan.

How can I secure the best mortgage rates?

To secure the best mortgage rates, shop around with multiple lenders, compare loan terms and rates, negotiate with lenders, and consider using a mortgage broker.