Best mortgage rates new brunswick – Navigating the mortgage landscape can be a daunting task, but in New Brunswick, securing the best mortgage rates is within reach. This comprehensive guide delves into the intricacies of the provincial mortgage market, empowering you with the knowledge to make informed decisions and find the most favorable rates for your financial journey.

When it comes to finding the best mortgage rates in New Brunswick, there are a few things you can do to ensure you’re getting the best deal. One is to shop around and compare rates from different lenders. Another is to consider getting pre-approved for a mortgage, which can give you an edge in the competitive housing market.

For those seeking comprehensive insights into property management, I highly recommend exploring Unveiling the Secrets of Central Valley Property Management: A Comprehensive Guide . This invaluable resource delves into the intricacies of managing properties, empowering you with practical strategies and expert advice.

Returning to our focus on New Brunswick mortgage rates, it’s crucial to remember that market conditions can fluctuate. Staying informed about the latest trends and consulting with a reputable mortgage broker can help you navigate the mortgage landscape and secure the best rates available.

New Brunswick’s mortgage market is influenced by various factors, including the Bank of Canada’s interest rate decisions, economic conditions, and housing market dynamics. Understanding these factors and their impact on mortgage rates is crucial for optimizing your mortgage strategy.

New Brunswick Mortgage Market Overview

The New Brunswick mortgage market is currently experiencing stable interest rates, with competitive options available to borrowers. The average five-year fixed mortgage rate in New Brunswick is currently around 5%, while the average variable rate is around 4%. These rates are comparable to those offered in other provinces, making New Brunswick an attractive option for homebuyers.

Key factors influencing mortgage rates in New Brunswick include the Bank of Canada’s interest rate decisions, economic conditions, and housing market dynamics. The Bank of Canada’s recent decision to raise interest rates has led to a slight increase in mortgage rates, but they remain relatively low compared to historical levels.

Factors Affecting Mortgage Rates in New Brunswick

- Bank of Canada’s interest rate decisions

- Economic conditions

- Housing market dynamics

- Government policies

- Lender competition

Types of Mortgages Available in New Brunswick: Best Mortgage Rates New Brunswick

There are several types of mortgages available in New Brunswick, each with its own advantages and disadvantages. The most common types include:

Fixed-Rate Mortgages, Best mortgage rates new brunswick

Fixed-rate mortgages offer a fixed interest rate for the entire term of the loan, typically 5 years. This provides borrowers with certainty and predictability in their monthly mortgage payments. However, fixed-rate mortgages may have higher interest rates than variable-rate mortgages.

Variable-Rate Mortgages

Variable-rate mortgages have interest rates that fluctuate with the prime rate set by the Bank of Canada. This can lead to lower monthly payments when interest rates are low, but it also means that payments can increase if interest rates rise.

Adjustable-Rate Mortgages

Adjustable-rate mortgages combine features of both fixed-rate and variable-rate mortgages. They typically offer a fixed interest rate for an initial period, after which the rate adjusts periodically based on a predetermined index.

Finding the Best Mortgage Rates in New Brunswick

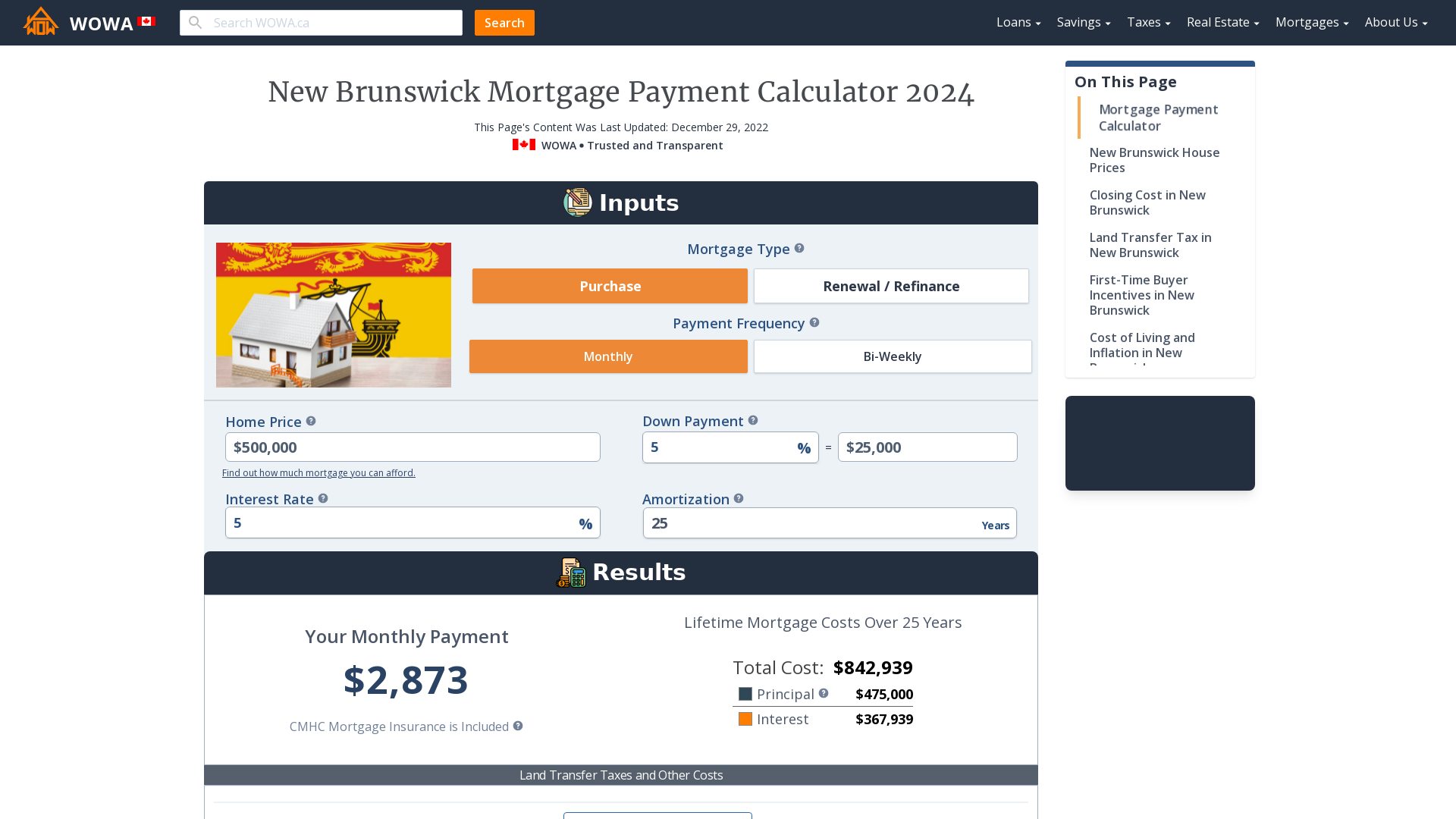

To find the best mortgage rates in New Brunswick, it is important to compare rates from multiple lenders. You can do this by using online mortgage calculators and tools, or by contacting lenders directly.

When comparing rates, be sure to consider the following factors:

- The interest rate

- The loan term

- The closing costs

- The lender’s reputation

It is also important to negotiate with lenders to secure the lowest possible rate. You can do this by:

- Shopping around for the best rates

- Getting pre-approved for a mortgage

- Making a larger down payment

- Improving your credit score

Mortgage Calculators and Tools

There are a number of online mortgage calculators and tools available that can help you estimate your monthly mortgage payments and compare different mortgage options. Some of the most popular tools include:

| Tool | Link |

|---|---|

| Mortgage Calculator | https://www.mortgagecalculator.org/ |

| Ratehub Mortgage Calculator | https://www.ratehub.ca/mortgage-calculator |

| CMHC Mortgage Affordability Calculator | https://www.cmhc-schl.gc.ca/en/consumers/home-buying/calculators/mortgage-affordability-calculator |

These tools can be helpful for getting a general idea of your mortgage costs, but it is important to speak to a mortgage professional to get personalized advice.

Final Conclusion

By exploring the different types of mortgages available, comparing rates from multiple lenders, and negotiating effectively, you can secure the best mortgage rates in New Brunswick. Remember to utilize the available mortgage calculators and tools to estimate monthly payments and compare options.

With the right knowledge and guidance, you can confidently navigate the mortgage process and achieve your homeownership aspirations.

General Inquiries

What are the different types of mortgages available in New Brunswick?

Fixed-rate, variable-rate, and adjustable-rate mortgages are the primary types available.

How can I find the best mortgage rates?

Compare rates from multiple lenders and negotiate effectively to secure the lowest possible rate.

What factors influence mortgage rates in New Brunswick?

Bank of Canada interest rates, economic conditions, and housing market dynamics are key factors.