Best mortgage rates uk halifax – When it comes to securing a mortgage, the best rates can make a significant difference in your monthly payments and overall financial well-being. Halifax, one of the UK’s leading mortgage lenders, offers competitive rates and a range of products tailored to meet diverse needs.

This comprehensive guide delves into the intricacies of Halifax mortgage rates, providing valuable insights and practical advice to help you navigate the complexities of the mortgage market and make informed decisions.

Mortgage Rates in the UK

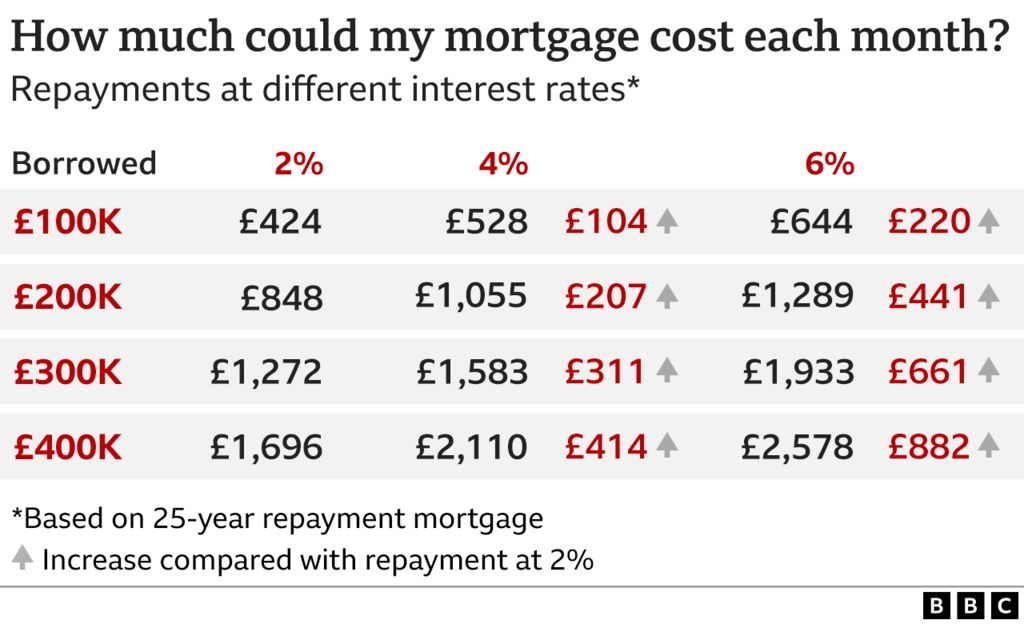

Mortgage rates in the UK are at their lowest in years, making it an attractive time to buy a home. The average two-year fixed-rate mortgage is now just 2.5%, while the average five-year fixed-rate mortgage is 2.8%. These rates are significantly lower than they were a year ago, when the average two-year fixed-rate mortgage was 3.5% and the average five-year fixed-rate mortgage was 4.0%.

There are a number of factors that influence mortgage rates, including the Bank of England’s base rate, the supply and demand for mortgages, and the level of risk associated with lending to different borrowers. The Bank of England’s base rate is the interest rate at which banks lend to each other, and it has a direct impact on mortgage rates.

When the base rate goes up, mortgage rates tend to go up as well. The supply and demand for mortgages also affects mortgage rates. When there is a lot of demand for mortgages, lenders can charge higher rates. Conversely, when there is less demand for mortgages, lenders may need to lower their rates in order to attract borrowers.

While Halifax offers competitive mortgage rates in the UK, it’s also worth exploring options in other regions. For instance, if you’re considering purchasing a property in Puerto Rico, you may want to compare their best mortgage rates . By researching different markets, you can make an informed decision that aligns with your financial goals and aspirations for homeownership, whether in the UK or abroad.

Types of Mortgage Rates

There are two main types of mortgage rates: fixed-rate mortgages and variable-rate mortgages. Fixed-rate mortgages have an interest rate that stays the same for the entire term of the loan. This means that your monthly mortgage payments will be the same every month, regardless of what happens to interest rates.

Variable-rate mortgages have an interest rate that can change over time, based on the Bank of England’s base rate. This means that your monthly mortgage payments could go up or down, depending on what happens to interest rates.

Halifax Mortgage Rates

Halifax is one of the largest mortgage lenders in the UK, and it offers a wide range of mortgage products. Halifax mortgage rates are generally competitive with other UK lenders, and the lender offers a number of features that can make it a good choice for borrowers.

For example, Halifax offers a number of fee-free mortgages, and it also offers a range of mortgage products that are designed for first-time buyers.

One of the benefits of getting a mortgage from Halifax is that the lender has a strong track record of customer service. Halifax has been awarded the Which? Mortgage Provider of the Year award for the past five years, and it has also been rated as one of the top mortgage lenders in the UK by Moneyfacts.

However, there are also some drawbacks to getting a mortgage from Halifax. One of the main drawbacks is that Halifax’s mortgage rates are not always the lowest in the market. Additionally, Halifax can be slow to process mortgage applications, and it can sometimes be difficult to get in touch with the lender’s customer service team.

Examples of Halifax Mortgage Products, Best mortgage rates uk halifax

- Fixed-rate mortgages: Halifax offers a range of fixed-rate mortgages, with terms ranging from two to five years. The current two-year fixed-rate mortgage rate is 2.5%, and the current five-year fixed-rate mortgage rate is 2.8%.

- Variable-rate mortgages: Halifax also offers a range of variable-rate mortgages, with terms ranging from two to five years. The current two-year variable-rate mortgage rate is 2.25%, and the current five-year variable-rate mortgage rate is 2.5%.

- First-time buyer mortgages: Halifax offers a range of mortgages that are designed for first-time buyers. These mortgages typically have lower interest rates and fees than standard mortgages.

How to Get the Best Mortgage Rate

There are a number of things you can do to improve your chances of getting the best mortgage rate. First, you should make sure that you have a good credit score. Lenders use your credit score to assess your risk as a borrower, and borrowers with higher credit scores are typically offered lower interest rates.

You can check your credit score for free at a number of websites, such as Credit Karma and Experian.

Another way to improve your chances of getting a good mortgage rate is to shop around for a mortgage. Don’t just accept the first mortgage rate that you’re offered. Take the time to compare rates from different lenders, and make sure that you’re getting the best possible deal.

Finally, you may want to consider using a mortgage broker. Mortgage brokers can help you compare rates from different lenders, and they can also help you negotiate the best possible deal on your mortgage.

Closing Summary

In summary, Halifax offers a compelling suite of mortgage products with competitive rates and flexible options. By understanding the factors influencing mortgage rates, exploring Halifax’s offerings, and seeking professional guidance when needed, you can increase your chances of securing the best mortgage rate for your specific circumstances.

Remember, the mortgage market is constantly evolving, so staying informed and regularly reviewing your options can help you optimize your financial position and achieve your homeownership goals.

Essential Questionnaire: Best Mortgage Rates Uk Halifax

What factors influence mortgage rates?

Mortgage rates are influenced by various factors, including the Bank of England’s base rate, economic conditions, the lender’s risk assessment of the borrower, and the type of mortgage product.

How can I improve my credit score to qualify for a better mortgage rate?

To improve your credit score, consider paying your bills on time, reducing your credit utilization, and avoiding unnecessary credit inquiries.

What are the different types of mortgage rates available?

There are two main types of mortgage rates: fixed rates, which remain the same throughout the mortgage term, and variable rates, which can fluctuate based on market conditions.