Best mortgage rates with 10 percent deposit – When it comes to securing a mortgage, obtaining the best possible rates is crucial, especially if you have a 10% deposit. In this comprehensive guide, we delve into the factors that influence mortgage rates, provide strategies for finding the most favorable terms, and explore the loan options available with a 10% down payment.

By understanding these aspects, you can navigate the mortgage market confidently and secure the best deal for your financial needs.

Understanding the current mortgage market and interest rate trends is essential for making informed decisions. Various factors, such as credit score, loan-to-value ratio, and loan term, significantly impact mortgage rates. Moreover, a 10% deposit can influence these factors and affect your eligibility for certain loan programs.

Best Mortgage Rates with 10 Percent Deposit

Securing the best mortgage rates with a 10% deposit is crucial for minimizing the overall cost of homeownership. With interest rates constantly fluctuating, it’s essential to understand the factors that influence mortgage rates and explore strategies to find the most favorable terms.

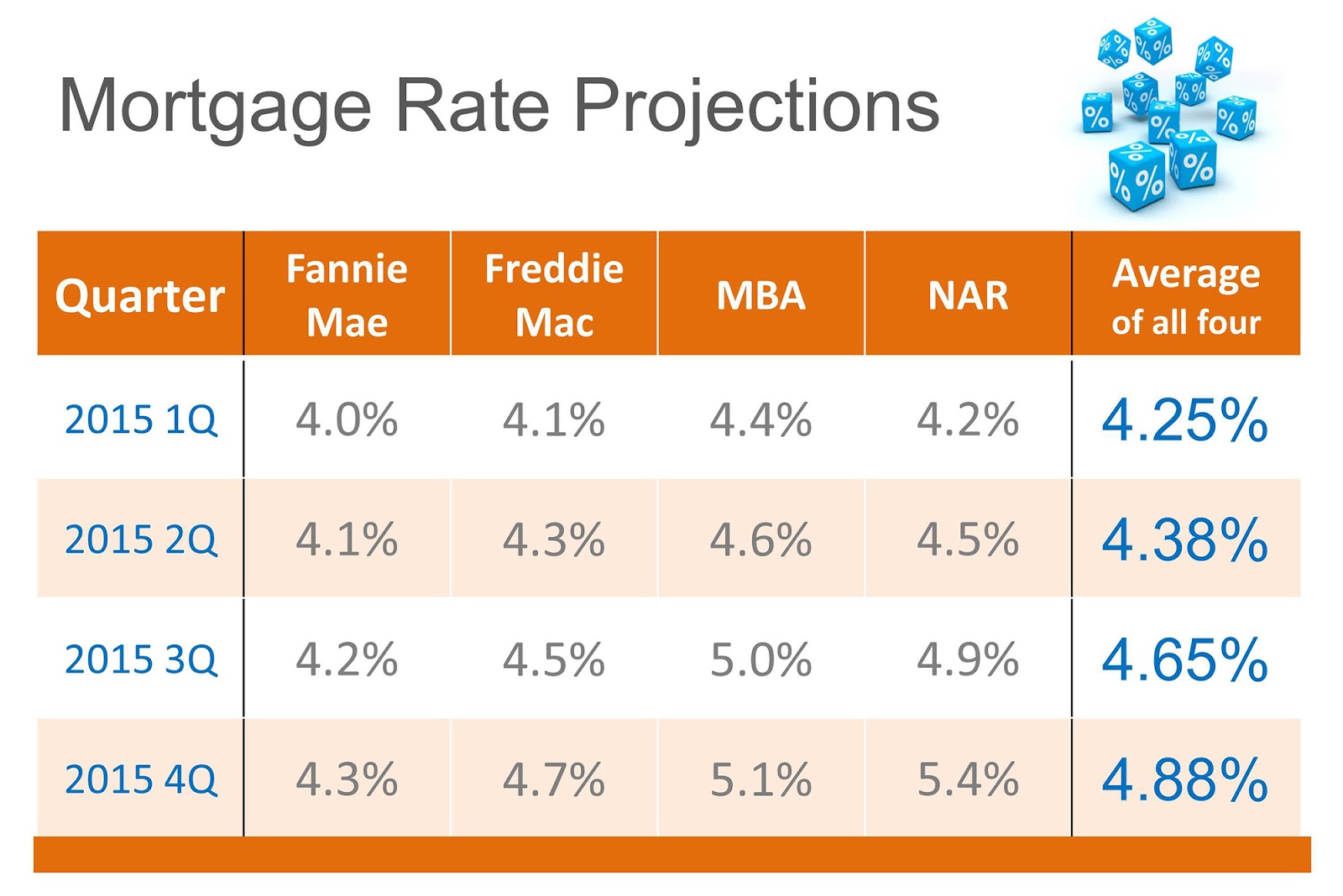

The current mortgage market exhibits a dynamic landscape, influenced by economic conditions, government policies, and global events. Interest rates have been on a gradual upward trend in recent months, making it more important than ever to secure a competitive rate with a 10% deposit.

Factors Affecting Mortgage Rates

Several key factors influence mortgage rates, including:

- Credit Score:A higher credit score indicates a lower risk to lenders, resulting in lower interest rates.

- Loan-to-Value Ratio (LTV):The LTV, which represents the ratio of the loan amount to the property value, impacts mortgage rates. A higher LTV typically leads to higher interest rates.

- Loan Term:The length of the mortgage term also affects interest rates, with shorter terms generally having lower rates than longer terms.

A 10% deposit can positively impact these factors by reducing the LTV and potentially qualifying for lower interest rates.

Strategies for Finding the Best Rates

To find the best mortgage rates with a 10% deposit, consider the following strategies:

- Compare Rates from Multiple Lenders:Contact several lenders to obtain quotes and compare their interest rates and terms.

- Use a Mortgage Broker:Mortgage brokers have access to a wider range of lenders and can negotiate favorable rates on behalf of their clients.

- Explore Online Mortgage Marketplaces:Online marketplaces allow you to compare mortgage rates from various lenders in one place.

Loan Options with a 10% Deposit, Best mortgage rates with 10 percent deposit

Several mortgage loan options are available with a 10% deposit, including:

- Conventional Loans:These loans are not backed by the government and typically require a higher credit score and lower LTV.

- FHA Loans:Backed by the Federal Housing Administration, FHA loans are designed for borrowers with lower credit scores and higher LTVs.

- VA Loans:Available to eligible veterans and active-duty military members, VA loans offer competitive rates and no down payment requirement.

Additional Considerations

In addition to finding the best mortgage rates, consider the following:

- Pre-Approval:Getting pre-approved for a mortgage demonstrates your financial readiness to lenders and can strengthen your negotiating position.

- Closing Costs:Factor in closing costs, such as appraisal fees, title insurance, and attorney fees, when budgeting for a mortgage.

- Negotiation:Don’t hesitate to negotiate with lenders to secure the best possible deal on your mortgage.

Epilogue

Finding the best mortgage rates with a 10% deposit requires careful consideration and a proactive approach. By comparing rates from multiple lenders, utilizing mortgage brokers or online marketplaces, and negotiating effectively, you can secure the most favorable terms for your mortgage.

Remember, getting pre-approved, understanding closing costs, and exploring loan options tailored to your financial situation are crucial steps in this process. By following these strategies and seeking professional guidance when needed, you can navigate the mortgage market with confidence and secure the best possible deal for your dream home.

To secure the best mortgage rates with a 10 percent deposit, it’s crucial to stay informed about the latest property market trends. Our comprehensive property insights provide valuable guidance on market conditions, investment opportunities, and expert analysis. By leveraging this knowledge, you can make informed decisions that align with your financial goals and secure the most favorable mortgage rates for your 10 percent deposit.

FAQ Resource: Best Mortgage Rates With 10 Percent Deposit

What is the impact of a 10% deposit on mortgage rates?

For those seeking the best mortgage rates with a 10 percent deposit, it’s crucial to explore Unveiling the Secrets of Central Valley Property Management: A Comprehensive Guide . This valuable resource offers insights into the local property market, helping you make informed decisions about your mortgage options.

With its in-depth analysis and expert guidance, you’ll be well-equipped to secure the most favorable mortgage rates for your 10 percent deposit.

A 10% deposit generally results in higher mortgage rates compared to larger down payments. This is because lenders perceive borrowers with lower down payments as having a higher risk profile.

What are the benefits of using a mortgage broker?

Mortgage brokers have access to a wide range of lenders and loan programs, which can increase your chances of finding the best rates and terms. They can also guide you through the mortgage process and provide personalized advice.

What are the key factors that affect mortgage rates?

Credit score, loan-to-value ratio, loan term, and current interest rate trends are the primary factors that influence mortgage rates.