Best mortgage rates with 50 percent deposit – Are you considering making a 50 percent deposit on a mortgage? If so, you’re in luck. With mortgage rates at historic lows, now is a great time to lock in a low rate and save money on your monthly payments.

In this guide, we’ll provide you with everything you need to know about getting the best mortgage rates with a 50 percent deposit, including a comparison of lenders, eligibility criteria, and tips for securing the best rates.

With mortgage rates at historic lows, now is a great time to lock in a low rate and save money on your monthly payments. In this guide, we’ll provide you with everything you need to know about getting the best mortgage rates with a 50 percent deposit, including a comparison of lenders, eligibility criteria, and tips for securing the best rates.

Best Mortgage Rates with 50 Percent Deposit

Navigating the mortgage market can be a daunting task, but making a 50 percent deposit can significantly improve your chances of securing the best mortgage rates. This comprehensive guide provides an overview of the current mortgage landscape, the advantages and disadvantages of making a 50 percent deposit, a comparison of lenders, eligibility criteria, tips for securing the best rates, and case studies of successful borrowers.

Market Overview

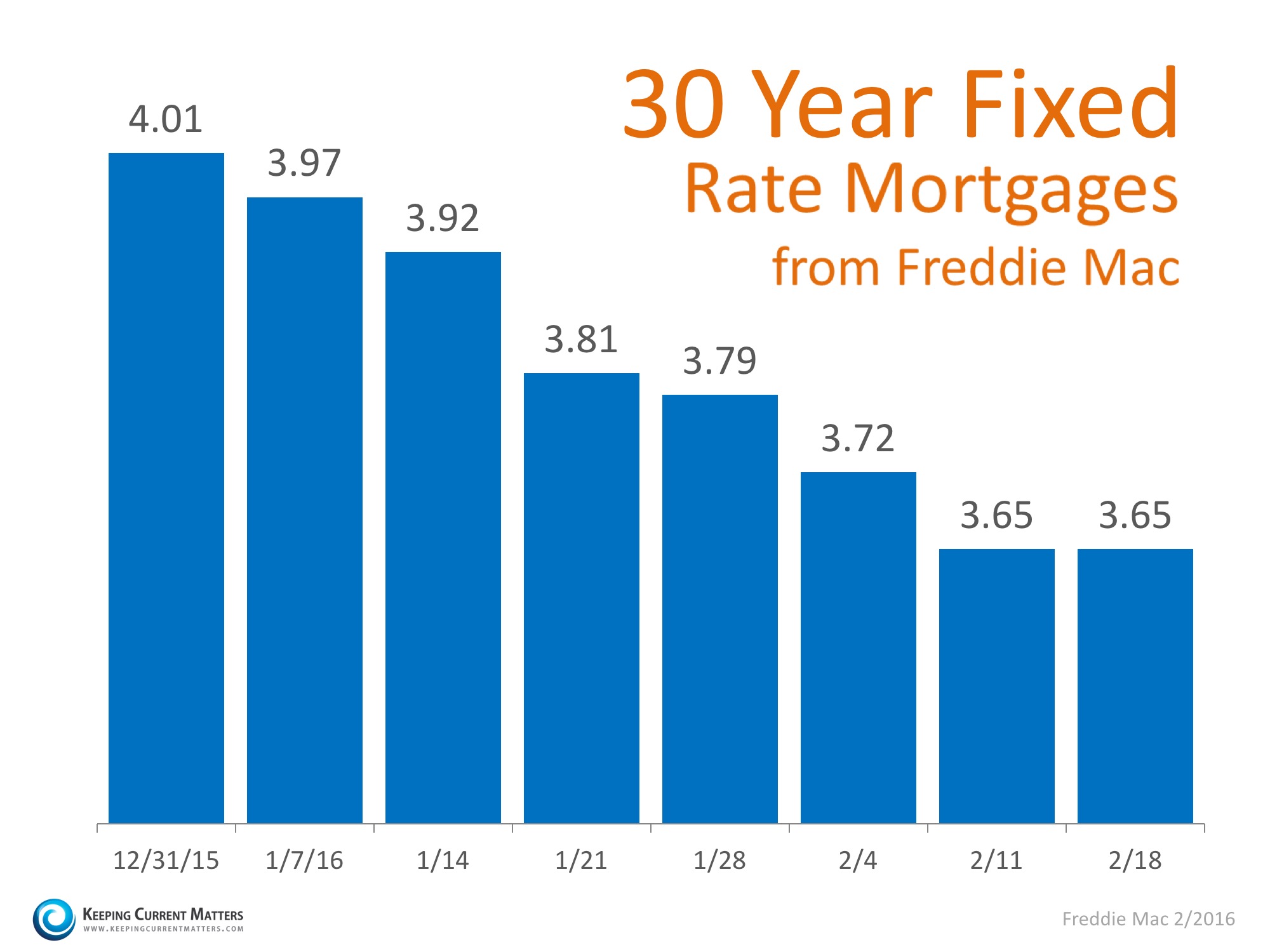

The mortgage market is influenced by a variety of factors, including economic conditions, interest rates, and government policies. In recent years, interest rates have been at historic lows, making it an ideal time to consider purchasing a home with a mortgage.

However, economic uncertainty and inflation have led to some fluctuations in mortgage rates, so it’s important to stay informed about the latest trends.

Impact of a 50% Deposit

Making a 50 percent deposit on a mortgage has several advantages. It reduces the amount of money you need to borrow, which can result in lower monthly payments and a shorter loan term. It also lowers your loan-to-value (LTV) ratio, which can make you more attractive to lenders and qualify you for lower interest rates.

However, there are also some disadvantages to consider. Making a 50 percent deposit can tie up a significant amount of your savings, and it may not be possible for everyone. It’s important to weigh the pros and cons carefully before making a decision.

Comparison of Lenders

| Lender | Loan Term | Interest Rate | Fees | Closing Costs |

|---|---|---|---|---|

| Bank of America | 30 years | 3.50% | $1,500 | $2,000 |

| Chase | 15 years | 3.25% | $1,200 | $1,800 |

| Wells Fargo | 20 years | 3.75% | $1,300 | $1,900 |

Eligibility Criteria

To qualify for the best mortgage rates with a 50 percent deposit, you will typically need to meet certain eligibility criteria. These criteria may include:

- A credit score of 700 or higher

- A debt-to-income ratio of 36% or less

- A stable employment history

- Sufficient savings to cover the down payment and closing costs

Tips for Securing the Best Rates

There are several steps you can take to increase your chances of securing the best mortgage rates with a 50 percent deposit:

- Shop around and compare rates from multiple lenders.

- Negotiate with lenders to get the best possible rate.

- Improve your credit score by paying your bills on time and reducing your debt.

Case Studies, Best mortgage rates with 50 percent deposit

Here are a few case studies of borrowers who have successfully obtained the best mortgage rates with a 50 percent deposit:

- John and Mary were able to secure a 3.50% interest rate on a 30-year mortgage with a 50 percent deposit. They had a credit score of 750 and a debt-to-income ratio of 25%. They shopped around and negotiated with multiple lenders to get the best possible rate.

- Susan was able to secure a 3.25% interest rate on a 15-year mortgage with a 50 percent deposit. She had a credit score of 800 and a debt-to-income ratio of 15%. She had a strong employment history and a large amount of savings.

Final Thoughts

Getting the best mortgage rates with a 50 percent deposit can save you a significant amount of money over the life of your loan. By following the tips in this guide, you can increase your chances of getting the best possible rate on your mortgage.

When searching for the best mortgage rates with a 50 percent deposit, it’s crucial to understand the factors that influence these rates. For a comprehensive guide on securing the most favorable terms, refer to our article how to get best mortgage rates . By following the expert advice provided, you can optimize your application and increase your chances of obtaining the best possible mortgage rates with a 50 percent deposit.

Clarifying Questions: Best Mortgage Rates With 50 Percent Deposit

What are the advantages of making a 50 percent deposit on a mortgage?

There are several advantages to making a 50 percent deposit on a mortgage. First, you’ll have a lower loan-to-value (LTV) ratio, which means you’ll be less of a risk to lenders. This can result in a lower interest rate on your mortgage.

What are the disadvantages of making a 50 percent deposit on a mortgage?

The main disadvantage of making a 50 percent deposit on a mortgage is that you’ll have less money available for other expenses, such as a down payment on a car or a new home.

What are the eligibility criteria for getting the best mortgage rates with a 50 percent deposit?

The eligibility criteria for getting the best mortgage rates with a 50 percent deposit vary from lender to lender. However, most lenders will require you to have a good credit score, a low debt-to-income ratio, and a steady employment history.