Decision making in finance future value of an investment plays a crucial role in shaping the financial well-being of individuals and organizations. By understanding the concepts and processes involved, investors can make informed decisions that maximize the potential value of their investments.

This comprehensive guide explores the intricacies of decision making in finance, examining the factors that influence investment decisions and the techniques used to calculate future value. Case studies and examples illustrate the practical application of these concepts, providing valuable insights for investors of all levels.

Decision Making in Finance: Decision Making In Finance Future Value Of An Investment

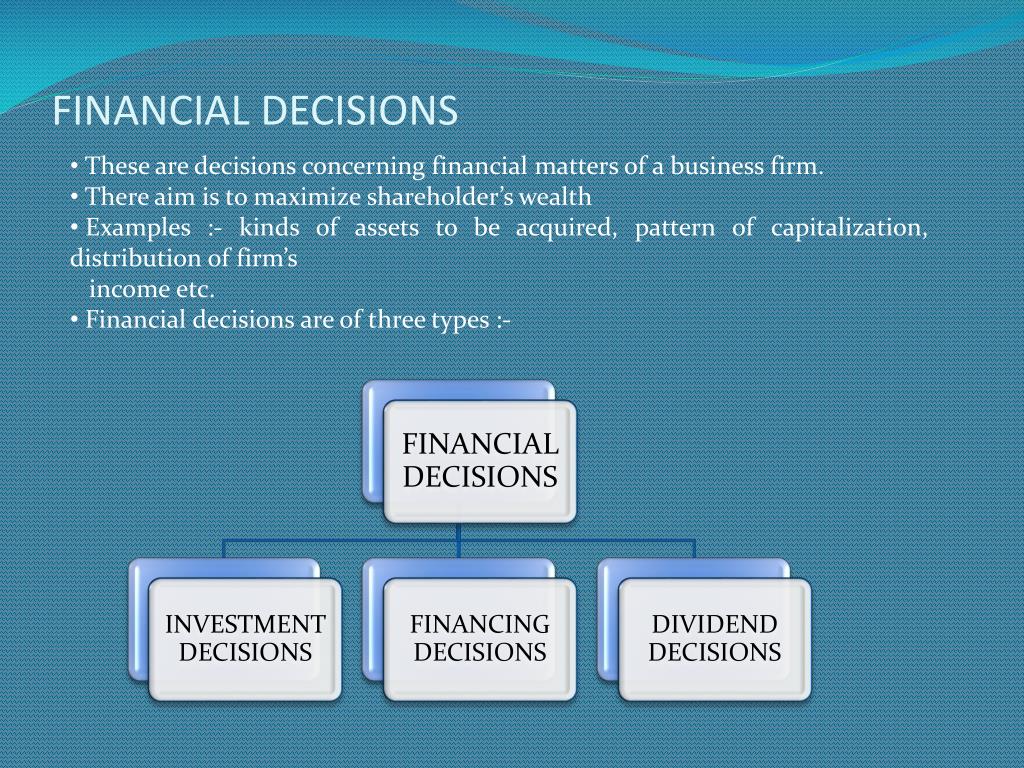

Decision making in finance is the process of making choices that affect the financial future of an individual or organization. It involves identifying financial goals, assessing risks, and selecting the best course of action to achieve those goals.

Effective decision making in finance is crucial for managing wealth, maximizing returns on investments, and minimizing financial risks. It requires a thorough understanding of financial concepts, market trends, and economic principles.

Factors Influencing Decision Making in Finance

- Financial goals and objectives

- Risk tolerance and appetite

- Investment horizon

- Tax implications

li>Market conditions and economic outlook

Future Value of an Investment

The future value of an investment is the amount of money an investment is expected to be worth at a specified future date, taking into account the effects of compounding interest or inflation.

In the realm of finance, decision-making plays a crucial role in determining the future value of an investment. Investment bankers, who serve as intermediaries between investors and companies, generate revenues for their firms through a variety of strategies. By understanding how investment bankers generate revenues , individuals can gain insights into the financial markets and make informed decisions regarding their investments, ultimately maximizing their returns.

Calculating the future value of an investment involves using the following formula:

FV = PV

(1 + r)^n

where:

- FV is the future value

- PV is the present value

- r is the annual interest rate

- n is the number of years

Factors Affecting the Future Value of an Investment, Decision making in finance future value of an investment

- Interest rate

- Investment period

- Inflation rate

- Risk

- Taxes

Closure

In the ever-evolving landscape of finance, effective decision making is paramount. By embracing a structured approach, leveraging data and technology, and continuously adapting to market trends, investors can navigate the complexities of the financial world and unlock the full potential of their investments.

User Queries

What is the importance of decision making in finance?

Decision making in finance is critical for allocating resources, managing risk, and achieving financial goals. It enables individuals and organizations to make informed choices that optimize their financial outcomes.

How is the future value of an investment calculated?

The future value of an investment is calculated using the formula: FV = PV – (1 + r)^n, where PV is the present value, r is the annual interest rate, and n is the number of years.

What factors influence the future value of an investment?

The future value of an investment is influenced by factors such as the initial investment amount, the interest rate, the investment horizon, and the risk tolerance of the investor.