Difference between long term investment and short term investment – In the realm of finance, understanding the difference between long-term and short-term investments is crucial for making informed financial decisions. This guide delves into the key distinctions, guiding you through the intricacies of each investment type and its implications for your financial goals.

Whether you are a seasoned investor or just starting out, this comprehensive exploration will provide you with the knowledge and insights you need to navigate the investment landscape effectively.

Long-Term and Short-Term Investments

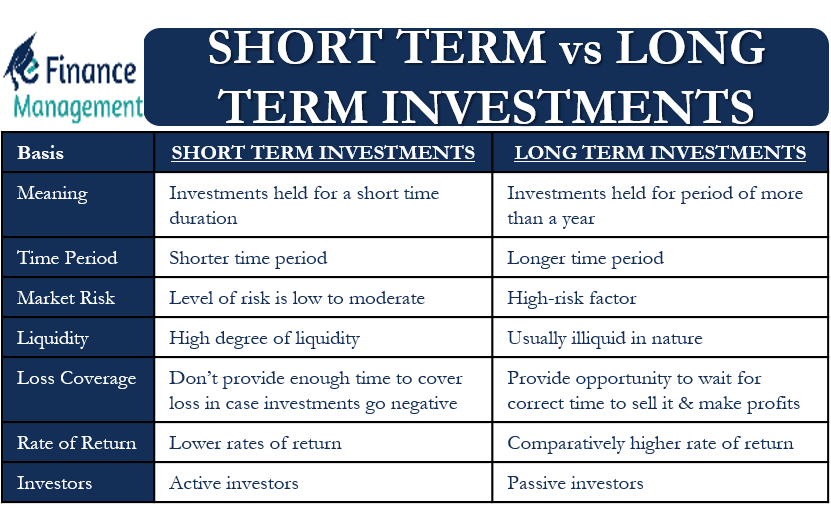

Investing involves allocating funds with the goal of generating financial growth. Investments can be classified as either long-term or short-term based on the time frame for which they are held.

Long-term investments typically have a holding period of more than one year, while short-term investments are held for less than a year. The type of investment, time horizon, risk, return, liquidity, tax implications, investment goals, and investment strategies all play crucial roles in determining the suitability of an investment for an individual’s financial objectives.

To make informed investment decisions, it’s crucial to understand the difference between long-term and short-term investments. Long-term investments typically span years or decades, aiming for steady growth and compounding returns. In contrast, short-term investments seek quick profits over days or weeks.

For those interested in exploring stock market investments in the popular game GTA 5, a helpful guide can be found here . Returning to our main topic, long-term investments involve a higher tolerance for risk and potential for substantial returns, while short-term investments offer lower risk but also lower potential rewards.

Types of Investments

Long-Term Investments

- Stocks: Represent ownership in a company and offer potential for capital appreciation and dividends.

- Bonds: Loan agreements with companies or governments that pay regular interest payments and return the principal at maturity.

- Real Estate: Property that can generate rental income, capital appreciation, or both.

Short-Term Investments

- Money Market Accounts: Interest-bearing accounts that offer liquidity and low risk.

- Certificates of Deposit (CDs): Time deposits with fixed interest rates and penalties for early withdrawal.

Time Horizons

The time horizon for an investment is the period of time over which it is expected to be held. Long-term investments typically have time horizons of more than one year, while short-term investments are held for less than a year.

The time horizon impacts investment strategies. Long-term investments allow for greater risk tolerance and potential for higher returns, while short-term investments prioritize liquidity and stability.

Risk and Return, Difference between long term investment and short term investment

Risk refers to the potential for an investment to lose value, while return is the potential gain or income generated by an investment.

Long-term investments generally have higher risk but also higher potential returns. Stocks, for example, can experience significant price fluctuations but have historically outperformed other investments over long periods.

Short-term investments typically have lower risk and lower returns. Money market accounts and CDs offer low volatility and modest interest earnings.

Liquidity

Liquidity refers to the ease with which an investment can be converted into cash. Liquid investments can be sold or redeemed quickly, while illiquid investments may take time to sell or may not be readily marketable.

Long-term investments, such as real estate, can be illiquid and may require significant time and effort to sell.

Tax Implications

Tax implications vary depending on the type of investment and the holding period. Long-term investments held for more than one year may qualify for favorable tax treatment, such as lower capital gains rates.

Short-term investments, on the other hand, are taxed at ordinary income rates.

Investment Goals

Investment goals refer to the specific financial objectives that an investor is seeking to achieve. Common investment goals include:

- Retirement: Saving for a comfortable retirement.

- Education: Funding higher education expenses.

- Homeownership: Purchasing a home.

Both long-term and short-term investments can be used to achieve different investment goals, depending on the time horizon and risk tolerance of the investor.

Investment Strategies

Investment strategies involve the allocation of funds among different types of investments to achieve specific financial goals.

Long-term investment strategies typically focus on asset allocation and diversification. Asset allocation involves dividing investments among different asset classes, such as stocks, bonds, and real estate, to manage risk and enhance returns.

Short-term investment strategies prioritize liquidity and stability. They may involve investing in money market accounts, CDs, or other low-risk, liquid investments.

Case Studies

Numerous real-world examples demonstrate the effectiveness of both long-term and short-term investment strategies. Successful long-term strategies often involve investing in a diversified portfolio of stocks and bonds over many years.

Short-term strategies may involve investing in money market accounts or CDs to preserve capital and generate modest returns over shorter periods.

Closing Notes: Difference Between Long Term Investment And Short Term Investment

In conclusion, the choice between long-term and short-term investments depends on your individual circumstances, risk tolerance, and financial objectives. By understanding the key differences Artikeld in this guide, you can make informed decisions that align with your long-term financial aspirations.

FAQ Compilation

What is the primary difference between long-term and short-term investments?

The primary difference lies in the time horizon for which the investment is held. Long-term investments are typically held for years or decades, while short-term investments are held for a period of less than a year.

Which type of investment is generally considered less risky?

Long-term investments are generally considered less risky than short-term investments due to the potential for market fluctuations to average out over a longer period.

How can I determine which type of investment is right for me?

The best type of investment for you depends on your individual circumstances, risk tolerance, and financial goals. Consider consulting with a financial advisor to determine the most suitable investment strategy for your needs.