Difference between short term investment and long term investment – Delving into the realm of investing, we encounter two distinct paths: short-term and long-term investments. Understanding the nuances between these two approaches is crucial for making informed financial decisions. This guide aims to shed light on the key differences, risk-return profiles, time horizons, liquidity, and how these factors align with investment goals and market conditions.

As we embark on this journey, we will explore the complexities of short-term investments, characterized by their shorter time horizons and higher liquidity, and delve into the world of long-term investments, known for their potential for greater returns but often accompanied by lower liquidity.

By the end of this discussion, you will be equipped with the knowledge to navigate the investment landscape with confidence.

Introduction: Difference Between Short Term Investment And Long Term Investment

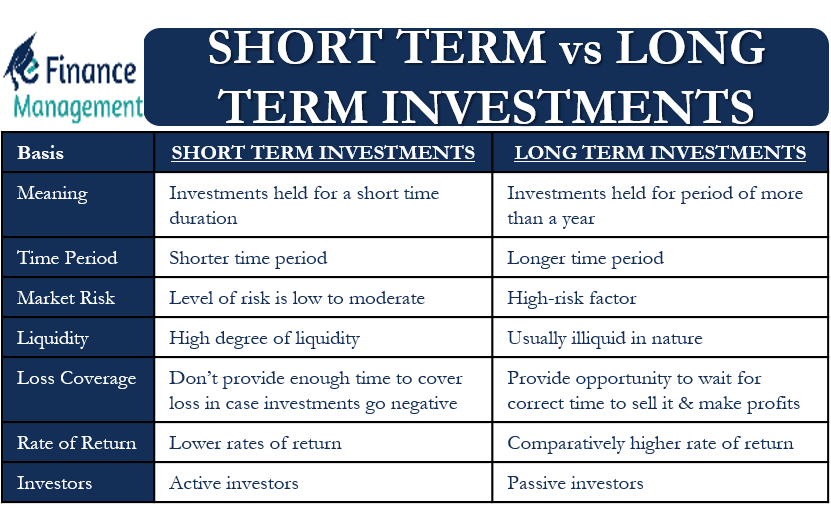

In the realm of investing, distinguishing between short-term and long-term investments is crucial. Short-term investments are designed to generate returns within a relatively short period, typically within a year or less. On the other hand, long-term investments aim to provide growth over an extended period, often spanning several years or even decades.

The primary distinction between these two investment types lies in their time horizon and the corresponding risk and return profiles. Understanding these differences empowers investors to make informed decisions aligned with their financial goals and objectives.

Risk and Return

The risk and return potential of investments varies significantly based on their time horizon. Short-term investments generally carry lower risk than long-term investments. This is because short-term fluctuations in market conditions have a less pronounced impact on the overall value of the investment.

Consequently, short-term investments tend to offer relatively stable returns, albeit with lower growth potential.

In contrast, long-term investments are inherently more volatile, exposing investors to greater risk. However, this increased risk is often accompanied by the potential for higher returns. Over extended periods, long-term investments have historically outperformed short-term investments, offering the potential for substantial capital appreciation.

Understanding the difference between short-term and long-term investments is crucial for informed financial planning. Short-term investments prioritize liquidity and stability, while long-term investments aim for growth potential over extended periods. This distinction is particularly relevant when determining the current net worth of investments, including real estate, as reported on the FAFSA ( current net worth of investments including real estate on fafsa ). By considering both short-term and long-term perspectives, investors can make informed decisions that align with their financial goals and risk tolerance.

Time Horizon, Difference between short term investment and long term investment

The time horizon of an investment plays a pivotal role in determining whether short-term or long-term investments are more appropriate. For individuals with immediate financial needs or a low risk tolerance, short-term investments may be a suitable choice. These investments provide quick access to funds and offer a reasonable level of stability.

Conversely, long-term investments are ideal for individuals with a longer investment horizon and a higher risk tolerance. These investments allow time for market fluctuations to balance out, potentially leading to significant returns in the long run.

Liquidity

Liquidity refers to the ease with which an investment can be converted into cash. Short-term investments typically offer high liquidity, meaning they can be easily sold or traded without incurring significant losses. This liquidity provides investors with flexibility and the ability to access funds quickly when needed.

Long-term investments, on the other hand, tend to have lower liquidity. These investments are often tied to specific assets or projects, making them less accessible in the short term. However, long-term investments may offer higher returns in exchange for the reduced liquidity.

Goals and Objectives

The choice between short-term and long-term investments should align with the investor’s financial goals and objectives. For individuals seeking short-term financial security or the accumulation of funds for immediate expenses, short-term investments may be appropriate.

Alternatively, long-term investments are ideal for individuals with long-term financial goals, such as retirement planning, education expenses, or wealth accumulation. These investments provide the potential for substantial growth over time, helping investors achieve their long-term financial aspirations.

Market Conditions

Market conditions can significantly impact the performance of both short-term and long-term investments. During periods of economic growth and market stability, both types of investments tend to perform well. However, during periods of economic uncertainty or market volatility, short-term investments may be less affected due to their shorter time horizon.

Investors should be aware of the potential impact of market conditions on their investments and adjust their strategies accordingly. This may involve shifting between short-term and long-term investments or diversifying their portfolio to mitigate risk.

Ultimate Conclusion

In conclusion, the choice between short-term and long-term investments hinges on a careful consideration of risk tolerance, investment goals, and time horizon. While short-term investments offer quick access to funds and potentially lower risks, long-term investments hold the promise of higher returns over extended periods.

Understanding the nuances of each approach empowers investors to make informed decisions that align with their financial aspirations. Remember, the path to investment success lies in a comprehensive understanding of the available options and a tailored strategy that aligns with your unique circumstances.

Frequently Asked Questions

What is the primary difference between short-term and long-term investments?

Short-term investments typically have a time horizon of less than a year, while long-term investments extend beyond one year.

Which type of investment generally carries higher risks?

Short-term investments tend to have lower risks compared to long-term investments, as they are less exposed to market fluctuations.

How does liquidity impact investment decisions?

Liquidity refers to the ease with which an investment can be converted into cash. Short-term investments generally offer higher liquidity, allowing for quick access to funds.