Hamilton county oh property tax – Welcome to our comprehensive guide to property taxes in Hamilton County, Ohio. This guide will provide you with everything you need to know about how property taxes are assessed, collected, and exempted in Hamilton County. We will also discuss the different payment options available and the consequences of not paying your property taxes on time.

Whether you are a homeowner, a business owner, or a renter, understanding property taxes is essential. This guide will help you make informed decisions about your property taxes and ensure that you are paying your fair share.

Hamilton County Property Tax Overview

Property taxes are a major source of revenue for local governments in Hamilton County, Ohio. They are used to fund essential services such as schools, roads, and public safety. Property taxes are assessed on the value of your property, and the amount you owe is determined by the tax rate in your municipality.

Property taxes are collected by the county treasurer. You can pay your property taxes online, by mail, or in person at the treasurer’s office. If you do not pay your property taxes on time, you may be subject to penalties and interest charges.

Property Tax Rates in Hamilton County, Hamilton county oh property tax

Property tax rates in Hamilton County vary from municipality to municipality. The following table shows the property tax rates for some of the largest municipalities in the county:

| Municipality | Property Tax Rate |

|---|---|

| Cincinnati | 2.4% |

| Hamilton | 2.2% |

| Fairfield | 2.1% |

| West Chester | 2.0% |

| Mason | 1.9% |

The property tax rate in your municipality is determined by a number of factors, including the cost of providing local services, the amount of debt the municipality has, and the value of property in the municipality.

Property Tax Assessment Process

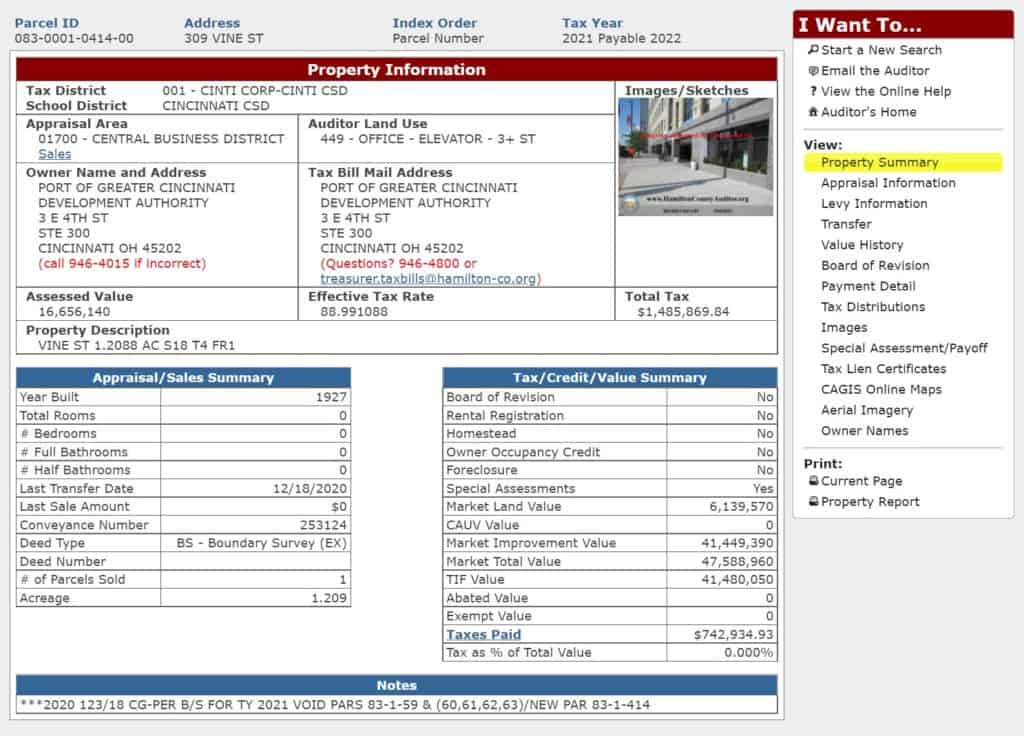

The property tax assessment process in Hamilton County is overseen by the county auditor. The auditor’s office is responsible for determining the value of all property in the county. The auditor’s office uses a variety of methods to determine the value of property, including sales data, comparable properties, and income data.

Once the auditor’s office has determined the value of your property, you will receive a property tax bill in the mail. The property tax bill will show the amount of property taxes you owe, as well as the deadline for paying your taxes.

If you’re a homeowner in Hamilton County, Ohio, you’re likely familiar with the property tax you pay each year. However, did you know that the property tax rates in DuPage County, Illinois, are significantly different? To learn more about dupage county real estate tax , click the link provided.

Upon returning to the Hamilton County, Ohio property tax topic, it’s important to note that timely payments are crucial to avoid penalties and interest charges.

Property Tax Exemptions

There are a number of property tax exemptions available in Hamilton County. These exemptions include:

- Homestead exemption

- Senior citizen exemption

- Disability exemption

- Veteran’s exemption

To qualify for a property tax exemption, you must meet certain eligibility requirements. For more information about property tax exemptions, please contact the Hamilton County Auditor’s office.

Concluding Remarks: Hamilton County Oh Property Tax

Thank you for reading our guide to property taxes in Hamilton County, Ohio. We hope that this guide has been helpful and informative. If you have any further questions, please do not hesitate to contact the Hamilton County Auditor’s Office.

FAQ Overview

What is the property tax rate in Hamilton County, Ohio?

The property tax rate in Hamilton County, Ohio varies depending on the municipality in which you live. The average property tax rate in Hamilton County is 1.65% of the assessed value of your property.

How can I get a property tax exemption in Hamilton County, Ohio?

There are a number of property tax exemptions available in Hamilton County, Ohio, including exemptions for homeowners over the age of 65, disabled veterans, and low-income families. To apply for a property tax exemption, you must contact the Hamilton County Auditor’s Office.

What are the consequences of not paying my property taxes on time?

If you do not pay your property taxes on time, you may be subject to late fees, penalties, and interest charges. In addition, your property may be subject to foreclosure.