Holding investments in an llc is not owning a business – In the realm of investing and business, a clear distinction exists between holding investments in a Limited Liability Company (LLC) and owning a business outright. This article delves into the nuances of these two entities, exploring their differences in legal implications, financial management, and risk assessment, providing valuable insights for investors and business owners alike.

While both LLCs and traditional business structures offer unique advantages, understanding their fundamental distinctions is crucial for informed decision-making.

Understanding the Distinction: Holding Investments In An Llc Is Not Owning A Business

Holding investments in an LLC is fundamentally different from owning a business. In an LLC, the members hold ownership interests but do not actively participate in the day-to-day operations or decision-making. They are essentially investors who share in the profits and losses of the LLC.

Conversely, business owners have full control over the operations and management of their companies. They are responsible for making all decisions and承担 the risks and rewards associated with the business.

Examples

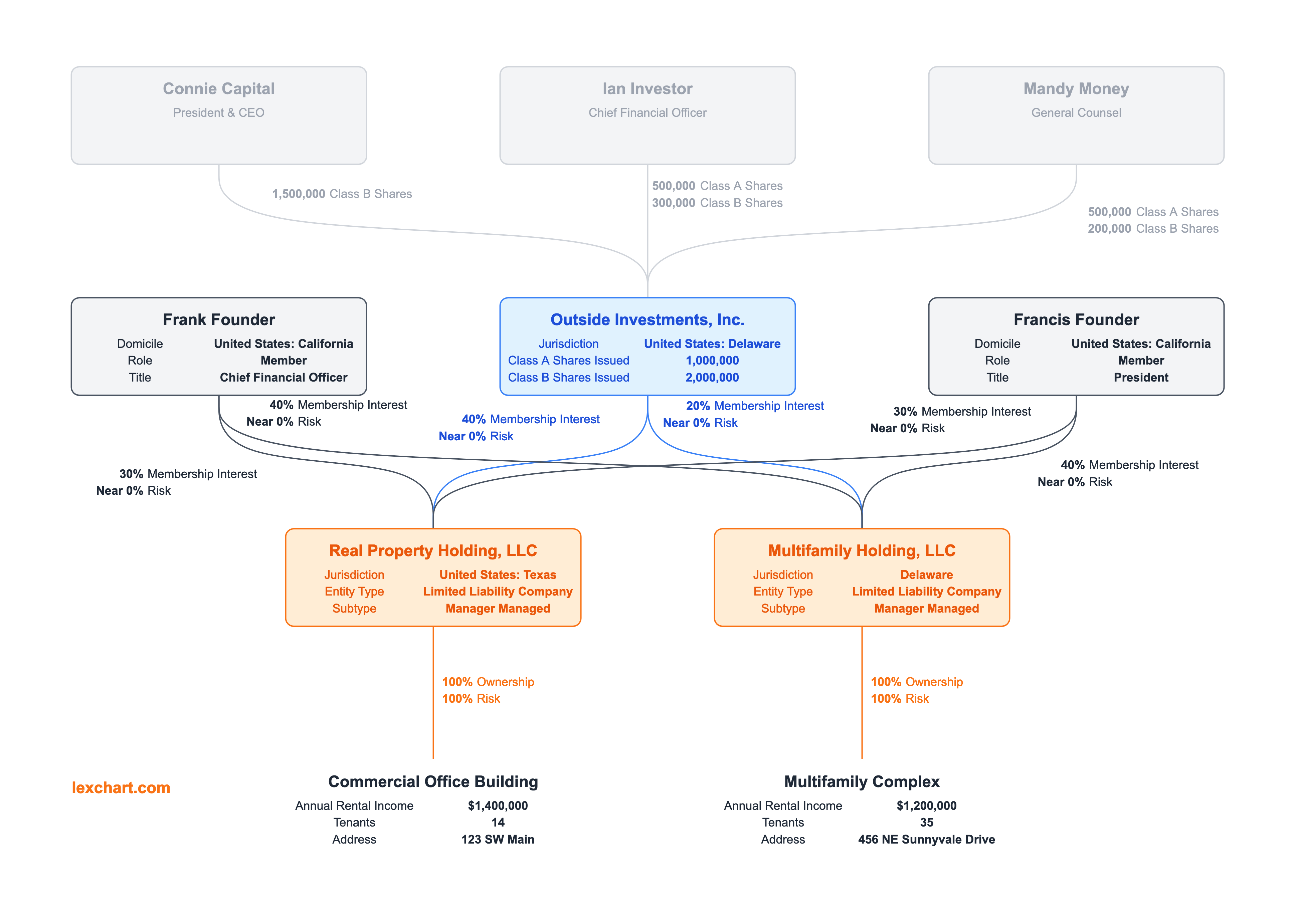

- An LLC might be formed to hold a portfolio of rental properties. The members would not be involved in managing the properties or collecting rent. Instead, they would receive regular distributions from the LLC’s rental income.

- A business owner, on the other hand, would be actively involved in all aspects of their business, including product development, marketing, and sales.

Legal Considerations

The legal implications of holding investments in an LLC differ from owning a business in several key ways.

While holding investments in an LLC does not equate to owning a business, the information provided in what does the information demonstrate about gale’s investments sheds light on the nature of Gale’s financial involvements. Understanding the distinction between investment and ownership is crucial in assessing the extent of one’s involvement in a business entity.

Liability Protections, Holding investments in an llc is not owning a business

LLCs provide liability protection to their members, meaning that they are not personally liable for the debts and obligations of the LLC. This is a significant advantage over owning a business, where the owner is personally liable for all business debts.

Tax Treatment

LLCs are taxed as pass-through entities, meaning that the profits and losses of the LLC are passed through to the members and reported on their individual tax returns. This can be advantageous for businesses that generate losses in their early years.

Financial Management

The financial management practices for holding investments in an LLC differ from owning a business in several ways.

Accounting Methods

LLCs can choose to use either the cash basis or accrual basis of accounting. The cash basis method is simpler and more commonly used by small businesses, while the accrual basis method is more complex but provides a more accurate picture of the LLC’s financial performance.

Tax Reporting

LLCs are required to file an annual tax return with the IRS. The tax return reports the LLC’s income, expenses, and profits and losses. The members of the LLC are then responsible for reporting their share of the LLC’s income and losses on their individual tax returns.

Cash Flow Management

LLCs have more flexibility in managing their cash flow than businesses. This is because LLCs are not subject to the same corporate income taxes as businesses. As a result, LLCs can retain more of their earnings and use them to fund their operations.

Investment Strategies

There are a variety of potential investment strategies for holding investments in an LLC.

- Passive investing: This involves investing in assets that generate income without requiring active management, such as rental properties or dividend-paying stocks.

- Active investing: This involves investing in assets that require active management, such as growth stocks or private equity.

- Hybrid investing: This involves a combination of passive and active investing.

The best investment strategy for an LLC will depend on the goals of the members and the LLC’s investment horizon.

Risk Assessment

There are a number of risks associated with holding investments in an LLC.

- Investment risk: This is the risk that the value of the LLC’s investments will decline.

- Management risk: This is the risk that the LLC’s management will make poor decisions that could lead to losses.

- Legal risk: This is the risk that the LLC will be sued or otherwise held liable for damages.

The best way to mitigate these risks is to conduct thorough due diligence before investing in an LLC and to have a well-diversified portfolio of investments.

Final Summary

In conclusion, holding investments in an LLC offers a distinct set of benefits and considerations compared to owning a business. By carefully weighing the legal, financial, and risk implications Artikeld in this discussion, investors can make informed choices that align with their specific investment goals and risk tolerance.

Questions Often Asked

What are the key differences between holding investments in an LLC and owning a business?

Holding investments in an LLC involves owning a share of the company without actively participating in its management or operations, while owning a business entails direct involvement in decision-making and daily operations.

How do the liability protections differ between LLCs and traditional businesses?

LLCs provide limited liability protection to their members, meaning their personal assets are generally not at risk in the event of business debts or lawsuits, whereas business owners may have unlimited personal liability.

Are the tax treatments of LLCs and businesses different?

Yes, LLCs offer flexibility in choosing their tax status, allowing them to be taxed as pass-through entities or corporations, while businesses typically have fewer options.