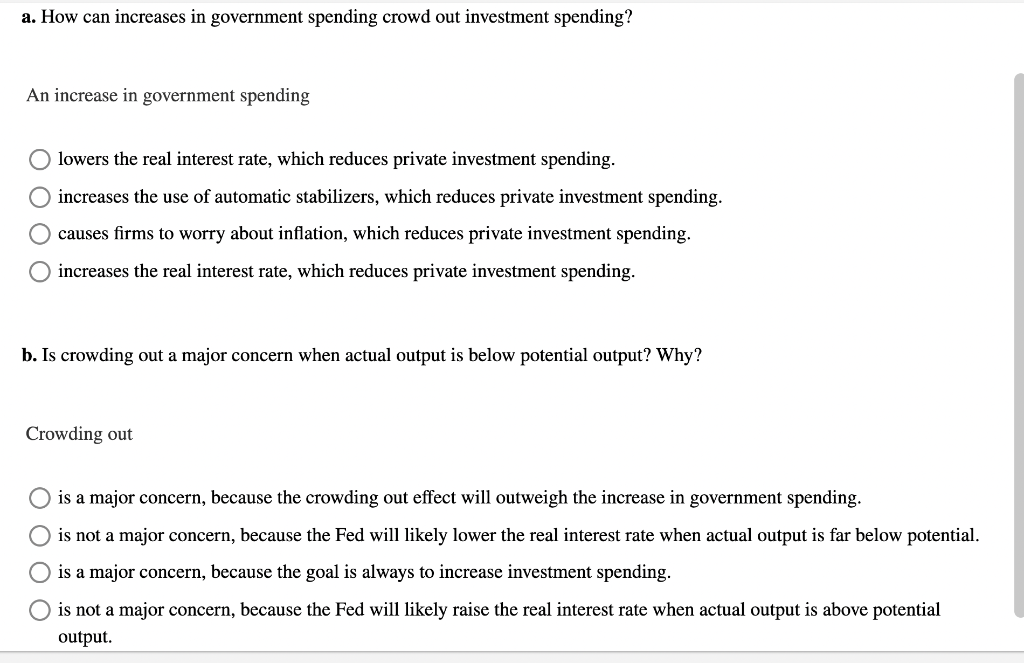

How can increases in government spending crowd out investment spending? This question has been a subject of debate among economists for decades. In this article, we will explore the concept of crowding out, its mechanisms, and its implications for economic growth.

Crowding out occurs when government borrowing or spending drives up interest rates, making it more expensive for businesses to invest. This can lead to a reduction in private investment, which can have a negative impact on economic growth.

1. Definition of Crowding Out Effect

The crowding out effect refers to a phenomenon in which government spending displaces private investment spending in the economy. When the government increases its spending, it can lead to a decrease in private investment as interest rates rise, inflation increases, or fiscal policy becomes more restrictive.

This effect can have implications for economic growth and productivity.

Mechanisms of Crowding Out

There are several mechanisms through which government spending can lead to crowding out:

- Interest rate effects:Government borrowing to finance spending can increase interest rates, making it more expensive for businesses to invest.

- Inflation effects:Increased government spending can lead to inflation, eroding the real value of returns on investment.

- Fiscal policy effects:Expansionary fiscal policy, such as increased government spending, can lead to higher taxes or reduced government borrowing, both of which can reduce the incentive for private investment.

Factors Affecting Crowding Out

The magnitude and likelihood of crowding out depend on several factors:

- Economic conditions:Economic growth and inflation can influence the extent to which government spending crowds out investment.

- Fiscal policy stance:The size and composition of government spending and taxation can affect the crowding out effect.

- Structure of the economy:The level of financial development, the availability of credit, and the efficiency of capital markets can influence the response of private investment to government spending.

Consequences of Crowding Out, How can increases in government spending crowd out investment spending

Crowding out can have several potential consequences for the economy:

- Reduced economic growth:Crowding out can reduce investment and capital accumulation, which can hinder economic growth.

- Lower productivity:Reduced investment can lead to lower productivity and technological progress.

- Long-term investment distortions:Crowding out can discourage long-term investment, which can have negative effects on innovation and economic development.

Policy Implications

Policymakers can take several measures to mitigate the negative effects of crowding out:

- Fiscal discipline:Maintaining fiscal discipline by controlling government spending and reducing budget deficits can help reduce the crowding out effect.

- Structural reforms:Implementing structural reforms to improve the efficiency of capital markets and reduce barriers to investment can reduce the impact of crowding out.

- Monetary policy:Coordinated monetary policy can help mitigate the interest rate effects of government spending and reduce crowding out.

End of Discussion

The crowding out effect is a complex issue with important implications for economic policy. By understanding the mechanisms and consequences of crowding out, policymakers can design policies that mitigate its negative effects and promote economic growth.

FAQ Compilation: How Can Increases In Government Spending Crowd Out Investment Spending

What is the crowding out effect?

One potential consequence of increased government spending is the crowding out of investment spending. This occurs when government borrowing leads to higher interest rates, making it more expensive for businesses to borrow money to invest. However, there are ways to invest with limited funds, such as through real estate.

By exploring options like how to invest in real estate with little money , individuals can potentially mitigate the impact of government spending on investment spending and pursue their financial goals.

The crowding out effect occurs when government borrowing or spending drives up interest rates, making it more expensive for businesses to invest. This can lead to a reduction in private investment, which can have a negative impact on economic growth.

What are the mechanisms of crowding out?

There are two main mechanisms of crowding out: the interest rate effect and the fiscal policy effect. The interest rate effect occurs when government borrowing increases the demand for loanable funds, which drives up interest rates. The fiscal policy effect occurs when government spending increases the demand for goods and services, which also drives up interest rates.

What are the consequences of crowding out?

The consequences of crowding out can include a reduction in private investment, a slowdown in economic growth, and an increase in the cost of capital.

How can crowding out be mitigated?

There are a number of ways to mitigate the negative effects of crowding out, including fiscal discipline, structural reforms, and monetary policy.