How much can you invest in 529 per year – When it comes to saving for your child’s college education, 529 plans are a popular and tax-advantaged option. But how much can you invest in a 529 plan each year? The answer depends on several factors, including the state in which you live and the type of 529 plan you choose.

In this article, we’ll explore the contribution limits for 529 plans and provide some tips on how to maximize your savings.

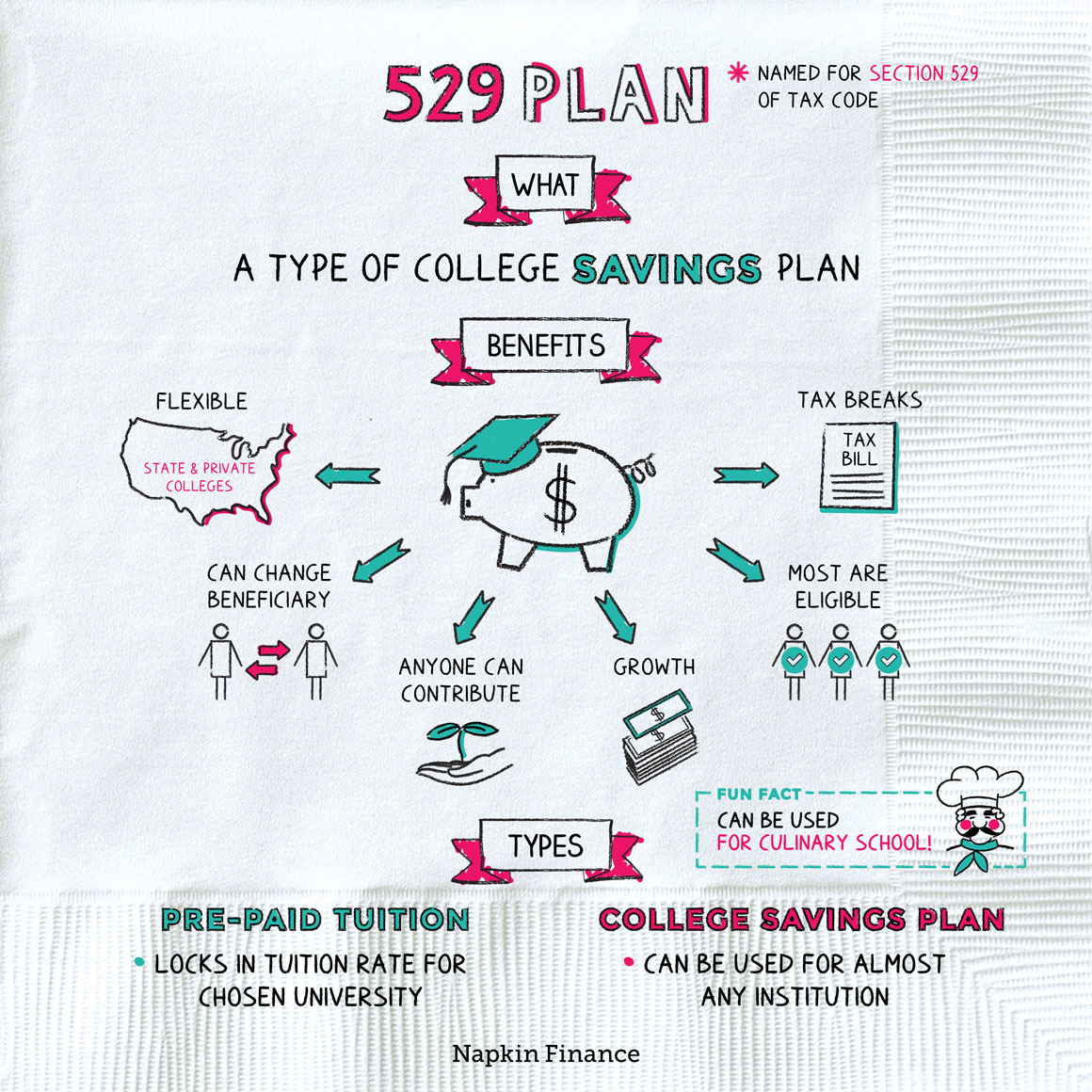

529 plans are state-sponsored savings plans that allow you to save for college costs on a tax-advantaged basis. There are two main types of 529 plans: prepaid tuition plans and college savings plans. Prepaid tuition plans allow you to lock in today’s tuition rates at participating colleges.

College savings plans allow you to invest in a variety of investment options, such as mutual funds and index funds.

Contribution Limits

Annual contribution limits for 529 plans vary by state and are set by each state’s legislature. In general, the limits are quite generous, allowing families to save substantial amounts for college expenses.

State residency does not impact the contribution limits for 529 plans. Individuals can contribute to a 529 plan regardless of their state of residence. However, some states offer additional tax benefits for contributions made to in-state 529 plans.

Examples of Contribution Limits

- California: $37,500 per year

- New York: $55,000 per year

- Texas: $50,000 per year

- Florida: $55,000 per year

Investment Options

529 plans offer a wide range of investment options, allowing families to tailor their savings strategy to their individual risk tolerance and time horizon.

The most common types of investment vehicles available within 529 plans include:

- Mutual funds: Funds that pool money from multiple investors and invest in a diversified portfolio of stocks, bonds, or other assets.

- Index funds: Funds that track the performance of a specific market index, such as the S&P 500.

- Target-date funds: Funds that automatically adjust their asset allocation based on the beneficiary’s age and target retirement date.

Comparison of Investment Options

| Investment Option | Risk | Return |

|---|---|---|

| Mutual funds | Varies | Varies |

| Index funds | Lower | Lower |

| Target-date funds | Moderate | Moderate |

Tax Benefits

529 plans offer significant tax benefits that can help families reduce the cost of college education.

While considering how much you can invest in a 529 plan per year, it’s also important to understand how cash paid to purchase long-term investments would be reported in financial statements . This information can help you make informed decisions about your investment strategy and ensure compliance with relevant regulations.

By staying informed about both investment limits and reporting requirements, you can effectively manage your 529 plan and maximize its potential benefits.

Federal Tax Benefits:

- Contributions to 529 plans are made with after-tax dollars, but earnings grow tax-free.

- Withdrawals used to pay for qualified education expenses are tax-free.

State Tax Benefits:

- Many states offer state income tax deductions or exemptions for contributions made to in-state 529 plans.

- Some states also offer additional tax benefits for withdrawals used to pay for qualified education expenses at in-state colleges and universities.

Examples of Tax Benefits

- In California, contributions to in-state 529 plans are deductible from state income taxes, and withdrawals used to pay for qualified education expenses are tax-free.

- In New York, contributions to in-state 529 plans are exempt from state income taxes, and withdrawals used to pay for qualified education expenses are tax-free.

Withdrawal Rules

Withdrawals from 529 plans are subject to specific rules that govern the tax treatment of the funds.

Qualified Withdrawals:

- Withdrawals used to pay for qualified education expenses are tax-free.

- Qualified education expenses include tuition, fees, books, supplies, and room and board.

Non-Qualified Withdrawals:

- Withdrawals not used to pay for qualified education expenses are subject to income tax and a 10% penalty.

- The earnings portion of non-qualified withdrawals is subject to income tax, while the contributions portion is not.

Examples of Withdrawals, How much can you invest in 529 per year

- A withdrawal used to pay for tuition at a qualified college or university is a qualified withdrawal and is tax-free.

- A withdrawal used to purchase a new car is a non-qualified withdrawal and is subject to income tax and a 10% penalty.

Comparison to Other Savings Vehicles

529 plans are one of several college savings vehicles available to families.

Other college savings vehicles include:

- Coverdell ESAs: Education Savings Accounts that offer tax-free growth and withdrawals for qualified education expenses.

- UGMA/UTMA accounts: Custodial accounts that allow adults to save for a minor’s education, but earnings are subject to income tax.

Advantages and Disadvantages of Different College Savings Vehicles

| College Savings Vehicle | Advantages | Disadvantages |

|---|---|---|

| 529 plans | Tax-free growth and withdrawals for qualified education expenses | Contribution limits |

| Coverdell ESAs | No contribution limits | Lower annual contribution limits |

| UGMA/UTMA accounts | No contribution limits | Earnings subject to income tax |

Final Thoughts: How Much Can You Invest In 529 Per Year

529 plans are a great way to save for college costs. By understanding the contribution limits and investment options, you can make the most of these plans and help your child achieve their educational goals.

FAQ Corner

What are the contribution limits for 529 plans?

The annual contribution limit for 529 plans varies by state. For 2023, the contribution limit ranges from $5,500 to $17,500 per beneficiary. Some states offer higher contribution limits for residents who contribute to in-state plans.

Can I contribute to a 529 plan if I don’t have children?

Yes, you can contribute to a 529 plan even if you don’t have children. You can name any individual as the beneficiary of the plan, including yourself, a relative, or a friend.

What are the tax benefits of 529 plans?

529 plans offer several tax benefits. Earnings on investments in 529 plans grow tax-free. Withdrawals from 529 plans are also tax-free if they are used to pay for qualified education expenses, such as tuition, fees, and room and board.