How to calculate a rate of return on an investment – In the realm of finance, understanding how to calculate a rate of return on investment (RoR) is crucial for evaluating the performance of your investments and making informed financial decisions. This guide will provide a comprehensive overview of RoR calculations, empowering you with the knowledge and tools to assess your investments effectively.

Whether you’re a seasoned investor or just starting out, this guide will delve into the different types of RoR calculations, their formulas, and practical methods for determining the return on your investments. By understanding RoR, you can make strategic investment decisions, compare different investment options, and maximize your financial growth.

Overview of Rate of Return (RoR) Calculations

Rate of Return (RoR) is a crucial metric in investment analysis, measuring the percentage return on an investment over a specific period. It helps investors assess the profitability and performance of their investments and compare different investment options.

There are various types of RoR calculations, including Simple Rate of Return (SRR), Annualized Rate of Return (ARR), and Compound Annual Growth Rate (CAGR).

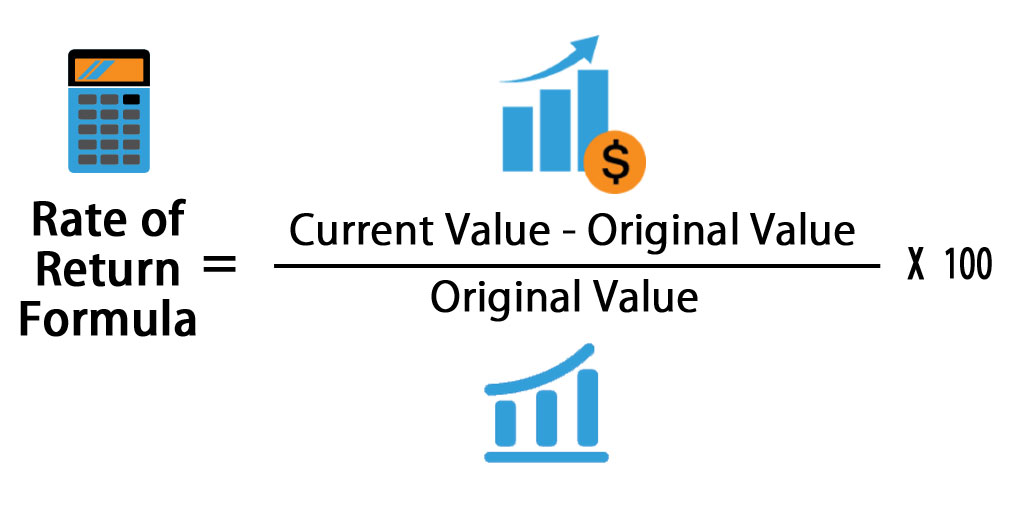

Formulae for RoR Calculations

The formula for calculating SRR is:

SRR = (Ending Value

Calculating the rate of return on an investment involves determining the percentage gain or loss over a specific period. This calculation helps investors assess the profitability of their investments. To enhance your understanding of financial concepts, we recommend exploring the Lahore University of Management Science: Leading Innovation and Excellence in Pakistan , a renowned institution dedicated to advancing knowledge in business and management.

By leveraging their expertise, you can further refine your investment strategies and maximize returns.

Beginning Value) / Beginning Value

The formula for calculating ARR is:

ARR = (Ending Value / Beginning Value)^(1 / Number of Years)

1

The formula for calculating CAGR is:

CAGR = (Ending Value / Beginning Value)^(1 / Number of Years)

1

Methods for Calculating RoR

SRR Method

- Subtract the beginning value from the ending value.

- Divide the result by the beginning value.

- Multiply the result by 100 to express it as a percentage.

ARR Method, How to calculate a rate of return on an investment

- Divide the ending value by the beginning value.

- Raise the result to the power of 1 divided by the number of years.

- Subtract 1 from the result and multiply by 100 to express it as a percentage.

CAGR Method

- Subtract the beginning value from the ending value.

- Divide the result by the beginning value.

- Raise the result to the power of 1 divided by the number of years.

- Subtract 1 from the result and multiply by 100 to express it as a percentage.

Examples of RoR Calculations

| Investment Amount | Return | RoR |

|---|---|---|

| $10,000 | $2,000 | 20% |

| $50,000 | $10,000 | 20% |

| $100,000 | $25,000 | 25% |

- An investment of $10,000 that yields a return of $2,000 has a RoR of 20%.

- An investment of $50,000 that generates a return of $10,000 also has a RoR of 20%.

- An investment of $100,000 that earns a return of $25,000 has a RoR of 25%.

Factors Influencing RoR

Several factors can impact the RoR of an investment:

- Investment horizon: Longer investment horizons generally lead to higher RoR due to the compounding effect.

- Risk tolerance: Higher-risk investments typically offer the potential for higher RoR, but also carry greater risk of loss.

- Market conditions: Economic growth and favorable market conditions can positively influence RoR, while downturns and recessions can lead to lower RoR.

Applications of RoR in Investment Decisions: How To Calculate A Rate Of Return On An Investment

RoR is a valuable tool for investors to:

- Evaluate the performance of their investments and make informed decisions.

- Compare different investment options and select those with the highest potential for return.

- Track their investment progress and make adjustments as needed.

Concluding Remarks

Calculating a rate of return on investment is an essential skill for any investor. By understanding the concepts, formulas, and methods presented in this guide, you can accurately assess the performance of your investments and make informed decisions that align with your financial goals.

Remember, RoR is a valuable tool that can help you evaluate the effectiveness of your investment strategies and achieve long-term financial success.

FAQ Resource

What is the difference between simple rate of return (SRR) and annualized rate of return (ARR)?

SRR is calculated over a single period, while ARR is calculated over multiple periods and takes into account the effect of compounding.

How do I calculate the compound annual growth rate (CAGR)?

CAGR is calculated using the formula: CAGR = (Ending Value / Beginning Value)^(1 / Number of Years) – 1.

What factors can affect the rate of return on an investment?

Factors that can affect RoR include investment horizon, risk tolerance, market conditions, and investment strategy.