Embark on a comprehensive exploration of Indiana property tax, a crucial aspect of homeownership and real estate investment. This guide delves into the intricacies of property tax assessment, exemptions, appeals, and more, empowering you with the knowledge to navigate this complex system effectively.

Uncover the factors that determine your property’s assessed value and the nuances of various tax rates across Indiana’s counties and municipalities. Discover the range of exemptions available to homeowners, businesses, and other property owners, and learn how to maximize your savings.

Indiana Property Tax Overview

Indiana property taxes are assessed and collected by local governments to fund essential services such as schools, roads, and public safety. The assessment process involves determining the fair market value of a property, which is then multiplied by the applicable tax rate to calculate the property tax liability.

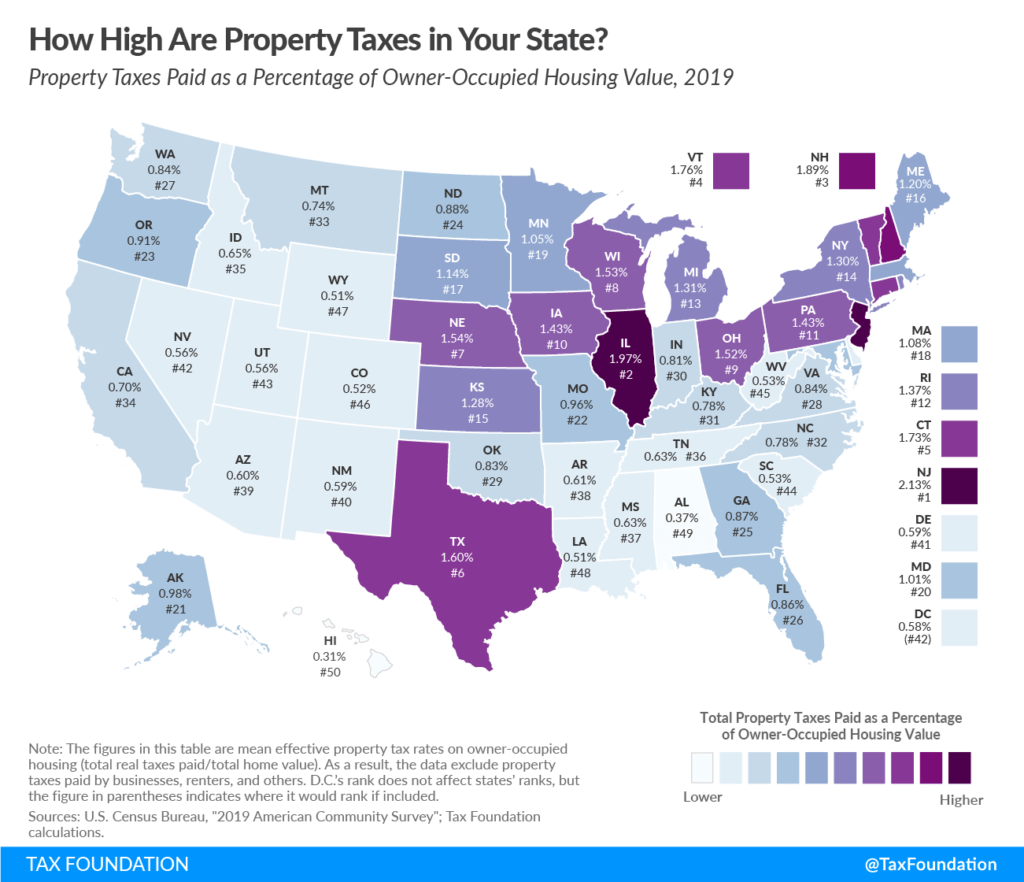

Property tax rates vary across Indiana, with each county and municipality setting its own rates. The average effective property tax rate in Indiana is approximately 1.06%, which is slightly below the national average.

Property Tax Exemptions and Deductions, Indiana property tax

- Homestead Exemption: Homeowners may qualify for a homestead exemption that reduces the assessed value of their primary residence, resulting in lower property taxes.

- Senior Citizen Deduction: Senior citizens over the age of 65 may be eligible for a deduction from their property taxes.

- Disabled Veteran Exemption: Disabled veterans may qualify for an exemption from property taxes on their primary residence.

- Agricultural Exemption: Land used for agricultural purposes may be eligible for an exemption from property taxes.

Property Tax Assessment Appeals

Property owners who believe their property has been overassessed may file an appeal with the local county assessor. The appeal must be filed within a specified timeframe and should be supported by evidence that the assessed value is inaccurate.

The appeal process typically involves a hearing before a county board of review, where the property owner can present their case and provide evidence to support their appeal.

Property Tax Delinquency and Foreclosure

Failure to pay property taxes on time can result in penalties and interest charges. If property taxes remain unpaid for an extended period, the county may initiate foreclosure proceedings.

During the foreclosure process, the county will sell the property at a public auction to satisfy the unpaid property taxes. The former owner may have the right to redeem the property within a specified redemption period by paying the outstanding taxes and associated costs.

Epilogue: Indiana Property Tax

Whether you’re a seasoned homeowner or a first-time property investor, this guide equips you with the essential knowledge to understand, manage, and potentially reduce your property tax burden. Stay informed about current and historical property tax reform initiatives, and engage in informed discussions about the fairness, efficiency, and transparency of Indiana’s property tax system.

FAQ Section

What factors determine my property’s assessed value?

Factors such as location, size, age, condition, and recent sales of comparable properties influence your property’s assessed value.

Understanding Indiana property tax laws is crucial for property owners. For those interested in pursuing a career in real estate, obtaining a real estate Georgia license is essential. With the right knowledge and licensing, individuals can navigate the complexities of Indiana property tax and ensure compliance with legal requirements.

How do I apply for a property tax exemption?

Contact your local county assessor’s office to inquire about available exemptions and the application process.

What are the consequences of failing to pay property taxes?

Unpaid property taxes can lead to penalties, interest charges, and eventually foreclosure.