Property tax in New York City is a complex and multifaceted subject that can have a significant impact on homeowners and businesses alike. This comprehensive guide will provide you with everything you need to know about property taxes in the Big Apple, from the assessment process to payment options and exemptions.

Understanding the intricacies of property tax in New York City is essential for making informed decisions about your finances and property. This guide will empower you with the knowledge you need to navigate the system effectively and ensure that you are paying your fair share of taxes.

Property Tax Assessment

Property tax assessment in New York City is a process by which the city determines the value of a property for the purpose of taxation. The assessed value is based on a number of factors, including the property’s size, location, and condition.

The city’s Department of Finance is responsible for assessing property values. The department uses a variety of methods to determine the value of a property, including comparable sales data, income data, and cost data.

Property taxes in New York City are notoriously high, leading some homeowners to consider selling their properties. However, for those looking to relocate, Ireland offers a more affordable real estate market with ireland real estate sale prices that are significantly lower than those in New York City.

Despite the lower property values in Ireland, it’s important to note that property taxes are still a factor to consider when making a decision about purchasing a home there.

Once the city has determined the assessed value of a property, it will send a property tax bill to the owner. The property tax bill will include the amount of property tax that the owner owes.

Factors that can affect property tax assessments, Property tax in new york city

- The property’s size

- The property’s location

- The property’s condition

- The property’s age

- The property’s use

Property Tax Rates

Property tax rates in New York City vary based on the property’s type and location. Residential properties have a lower tax rate than commercial properties.

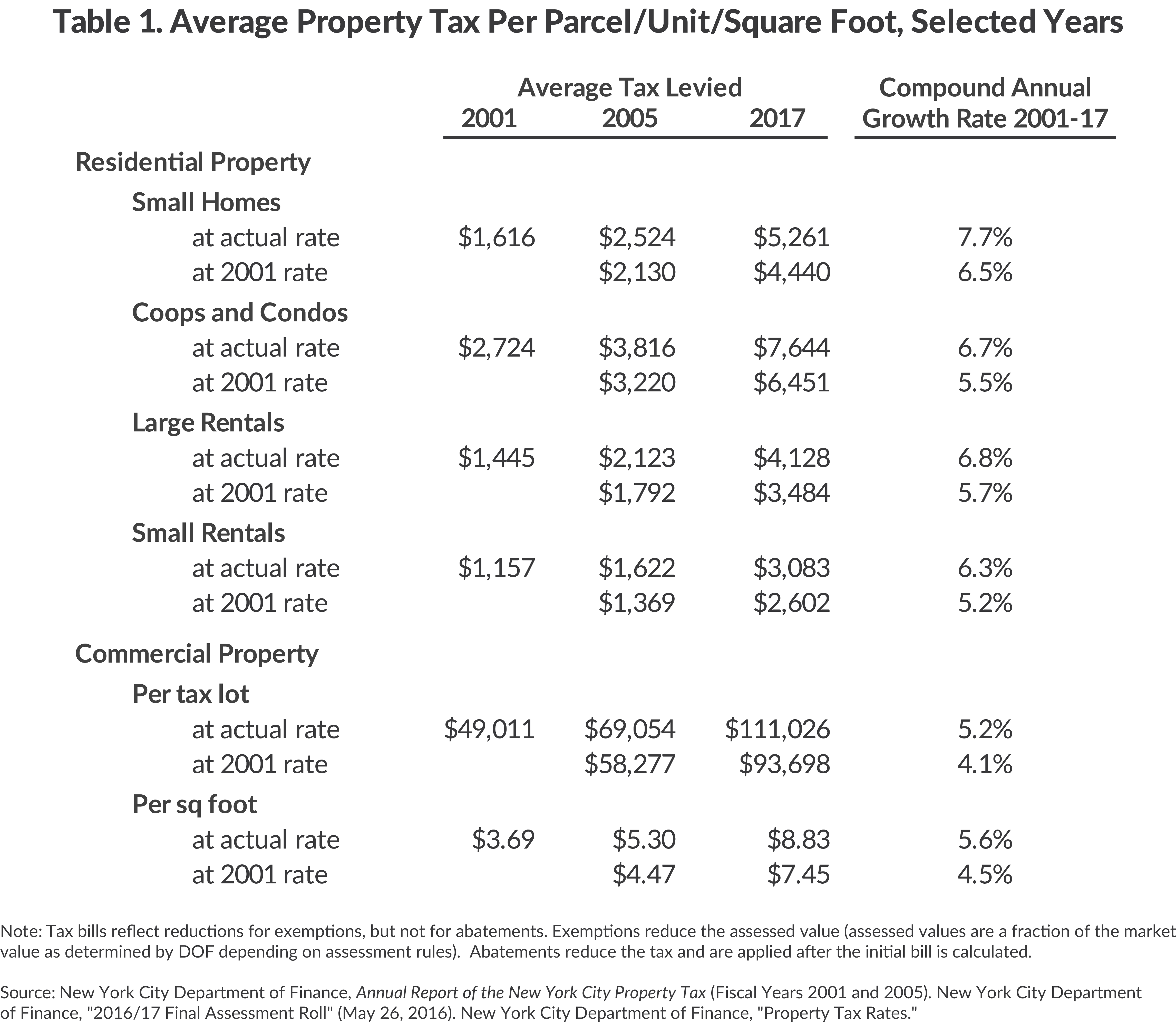

The following table shows the property tax rates for different property types in New York City:

| Property Type | Tax Rate |

|---|---|

| Residential | 1.95% |

| Commercial | 2.50% |

| Industrial | 2.85% |

Property Tax Exemptions

There are a number of property tax exemptions available in New York City. These exemptions can reduce the amount of property tax that a property owner owes.

The following are some of the most common property tax exemptions in New York City:

- The homestead exemption

- The senior citizen exemption

- The veteran’s exemption

- The disability exemption

Property Tax Payment

Property taxes in New York City are due on July 1st and January 1st. Property owners can pay their property taxes online, by mail, or in person at a city tax office.

Property owners who do not pay their property taxes on time will be subject to late payment penalties and interest charges.

Property Tax Appeals

Property owners who believe that their property has been assessed at an incorrect value can appeal their assessment. The appeal process is complex and can take several months to complete.

The following are some of the grounds for appeal:

- The property’s assessed value is not based on its market value

- The property’s assessed value is not uniform with the assessed values of similar properties

- The property’s assessed value is discriminatory

Property Tax History

Property taxes have been a part of New York City’s history since the city’s founding in 1624.

The city’s first property tax was a flat tax of 1% of the value of all property.

Over the years, the city’s property tax system has been revised and reformed several times.

Property Tax Impact: Property Tax In New York City

Property taxes are a major source of revenue for New York City. The city uses property tax revenue to fund a variety of public services, including education, public safety, and transportation.

Property taxes can also have a significant impact on homeowners. High property taxes can make it difficult for homeowners to afford their homes.

Final Wrap-Up

Property tax in New York City is a complex and ever-changing landscape. By staying informed about the latest laws and regulations, you can ensure that you are taking advantage of all available exemptions and deductions. This guide has provided you with a comprehensive overview of property tax in New York City.

Armed with this knowledge, you can confidently navigate the system and make informed decisions about your property taxes.

Expert Answers

What is the property tax rate in New York City?

The property tax rate in New York City varies depending on the type of property and its location. Residential properties have a lower tax rate than commercial properties, and properties in Manhattan typically have higher tax rates than properties in other boroughs.

How can I get a property tax exemption?

There are a number of property tax exemptions available in New York City, including exemptions for homeowners over the age of 65, veterans, and clergy members. To apply for an exemption, you must submit an application to the New York City Department of Finance.

What happens if I don’t pay my property taxes?

If you don’t pay your property taxes, the city can place a lien on your property. This means that the city can seize and sell your property to satisfy the debt. You may also be charged late payment penalties and interest.