Real estate encumbrances, a prevalent topic in property law, present a myriad of legal implications and can significantly impact real estate transactions. This comprehensive guide delves into the types, identification, removal, and consequences of encumbrances, providing valuable insights for buyers, sellers, and professionals alike.

As we delve into the complexities of real estate encumbrances, we will explore their impact on property ownership, marketability, and financial implications. By understanding these legal burdens, individuals can navigate real estate transactions with confidence and safeguard their interests.

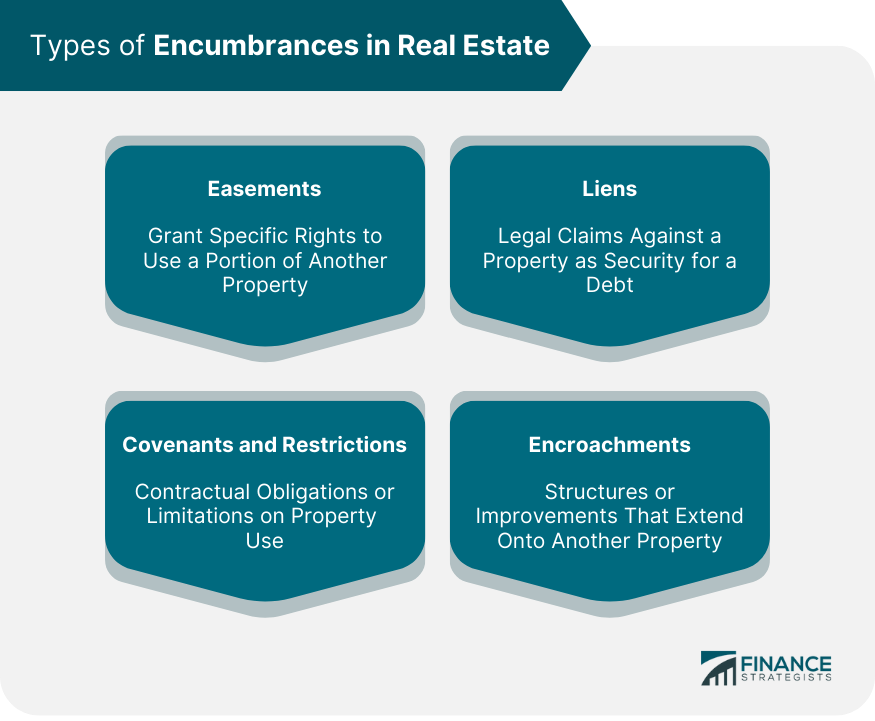

Types of Real Estate Encumbrances

Encumbrances are legal claims or interests that limit or restrict the ownership of real property. Identifying and understanding encumbrances is crucial for real estate transactions.

The following table provides a comprehensive list of common encumbrances:

| Encumbrance Type | Definition | Characteristics | Impact |

|---|---|---|---|

| Mortgage | A legal claim on a property that secures a loan. | – Typically involves a promissory note and a deed of trust.

|

– Limits the owner’s ability to sell or transfer the property without satisfying the mortgage.

|

| Lien | A legal claim against a property that secures a debt. | – Can be created by unpaid taxes, judgments, or contractor disputes.

|

– Can impair the owner’s credit and hinder the sale of the property.

|

| Easement | A legal right to use another person’s property for a specific purpose. | – Can be created by agreement, prescription, or necessity.

|

– Can limit the owner’s use and enjoyment of the property.

|

| Restrictive Covenant | A legal agreement that limits the use or development of a property. | – Typically found in deeds or subdivision agreements.

|

– Can affect the owner’s ability to use and improve the property.

|

Ultimate Conclusion: Real Estate Encumbrances

In conclusion, real estate encumbrances are a crucial consideration in property transactions, and their proper identification, disclosure, and removal are essential for protecting the rights of all parties involved. By adhering to legal requirements, seeking professional guidance, and understanding the potential implications of encumbrances, individuals can make informed decisions and mitigate risks associated with these legal burdens.

Answers to Common Questions

What are the most common types of real estate encumbrances?

Mortgages, liens, easements, restrictive covenants, and tax liens are among the most frequently encountered encumbrances in real estate transactions.

How can I identify encumbrances on a property?

Conducting a title search, reviewing property records, and obtaining a title insurance policy are effective methods for identifying encumbrances on a property.

What are the legal consequences of failing to disclose encumbrances?

Real estate encumbrances can significantly impact property value and marketability. For buyers and sellers, understanding these encumbrances is crucial. Real estate marketin professionals can provide valuable insights into encumbrances and guide clients through the process of navigating them. By addressing encumbrances proactively, buyers and sellers can make informed decisions and ensure a smooth real estate transaction.

Failure to disclose encumbrances can result in legal liability, including potential lawsuits, financial penalties, and the nullification of real estate contracts.