Should I Invest in a Mutual Fund or ETF? This is a question that plagues many investors, both seasoned and novice. In this article, we will delve into the intricacies of these two investment vehicles, exploring their unique characteristics, advantages, and potential drawbacks.

Deciding between investing in a mutual fund or an ETF depends on your financial goals and risk tolerance. If you’re looking for a diversified portfolio with professional management, a mutual fund might be a good option. On the other hand, if you prefer more control over your investments and lower fees, an ETF could be a better choice.

For those seeking specific investment opportunities, exploring what are good stocks to invest in right now can provide valuable insights. Ultimately, the decision between a mutual fund and an ETF should be based on your individual circumstances and investment objectives.

By the end of this comprehensive guide, you will be equipped with the knowledge to make an informed decision about which investment option best aligns with your financial goals and risk tolerance.

Mutual funds and ETFs offer distinct advantages and cater to different investment strategies. Understanding the nuances of each will empower you to optimize your portfolio and maximize your investment returns.

Investment Objectives

When investing, it’s crucial to define your financial goals and risk tolerance. These factors will determine the types of mutual funds or ETFs that align with your investment objectives.

| Investment Objective | Mutual Fund Option | ETF Option |

|---|---|---|

| Growth | Large-cap growth fund | S&P 500 Growth ETF |

| Income | Bond fund | Corporate bond ETF |

| Stability | Money market fund | Short-term Treasury ETF |

Asset Allocation

Asset allocation is key to diversifying your investments and reducing risk. Different asset classes, such as stocks, bonds, and real estate, have varying potential returns and risks.

- Stocks: Higher potential returns but also higher risk

- Bonds: Lower potential returns but lower risk

- Real estate: Tangible asset with potential for appreciation and rental income

Fund Performance

Comparing the historical performance of mutual funds and ETFs can help you make informed investment decisions. Factors to consider include average returns, volatility, and expense ratios.

| Fund Type | Average Return | Volatility | Expense Ratio |

|---|---|---|---|

| Large-cap growth mutual fund | 10% | 15% | 1% |

| S&P 500 Growth ETF | 9% | 14% | 0.5% |

| Bond fund | 5% | 5% | 0.75% |

Final Wrap-Up

Ultimately, the decision between investing in a mutual fund or an ETF depends on your individual circumstances and investment objectives. By carefully considering the factors discussed in this guide, you can make an informed choice that aligns with your financial goals and risk tolerance.

Remember, investing involves both potential rewards and risks, and it’s crucial to conduct thorough research and seek professional advice when necessary.

FAQ Summary: Should I Invest In A Mutual Fund Or Etf

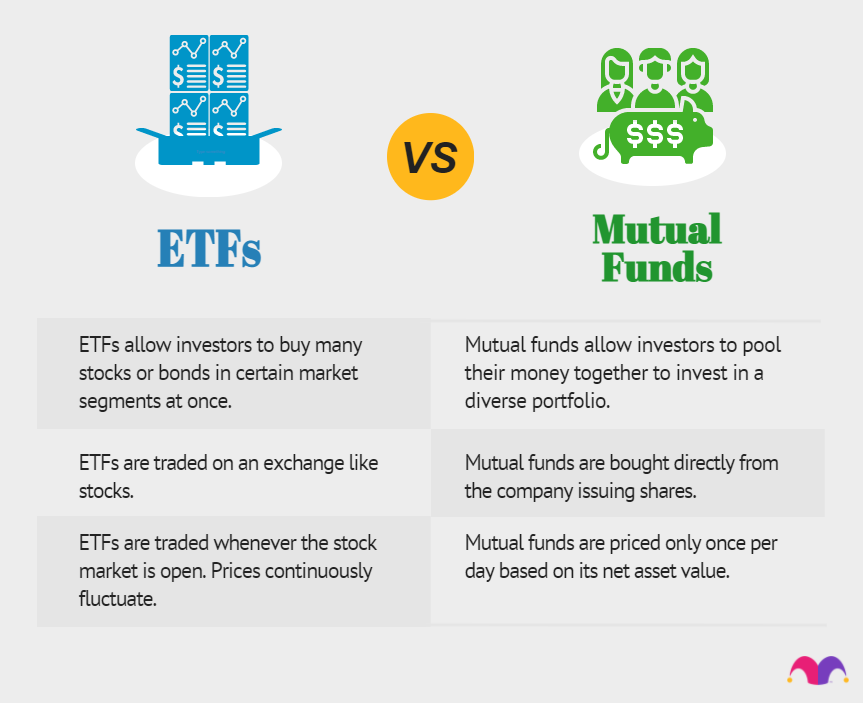

What are the key differences between mutual funds and ETFs?

Mutual funds are actively managed by a fund manager, while ETFs are passively managed and track an underlying index or asset class. Mutual funds typically have higher expense ratios than ETFs, but they offer more flexibility and investment options.

Which investment is better for long-term growth?

Both mutual funds and ETFs can provide long-term growth potential. The best choice for you will depend on your individual circumstances and investment goals.

How do I choose the right mutual fund or ETF for me?

Consider your investment objectives, risk tolerance, and time horizon when selecting a mutual fund or ETF. It’s also important to research the fund’s past performance, expense ratio, and investment strategy.