Some investments in the stock market have earned 10 annually – Some investments in the stock market have earned 10% annually, a remarkable feat that has captivated the attention of investors seeking financial growth. This intriguing topic invites us on a journey to explore the strategies, risks, and rewards associated with achieving such impressive returns.

Throughout history, the stock market has consistently delivered substantial returns, making it an attractive investment option for those seeking long-term wealth creation. Understanding the factors that have contributed to these high returns in the past can provide valuable insights into potential future performance.

Historical Returns: Some Investments In The Stock Market Have Earned 10 Annually

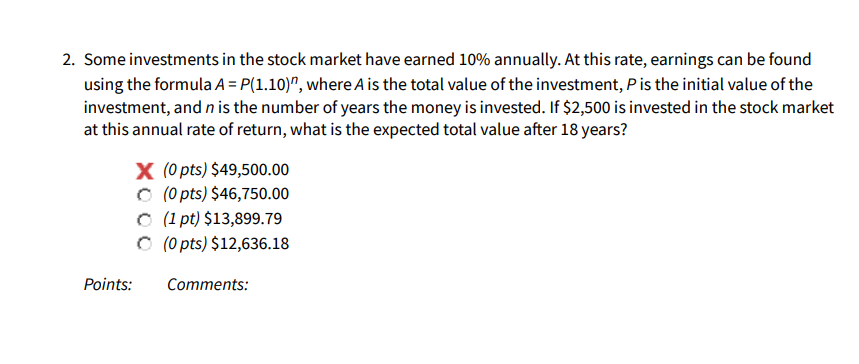

Historically, the stock market has provided investors with significant returns. Over the past century, the S&P 500 index has returned an average of 10% annually. This means that an investment of $1,000 made in the stock market 100 years ago would be worth over $1 million today.

While past performance is not a guarantee of future results, it does provide some indication of what investors can expect from the stock market over the long term. The factors that have contributed to high returns in the past include economic growth, corporate profits, and technological innovation.

Some investments in the stock market have earned 10% annually, which can be a significant return on your investment. If you’re interested in learning more about how much you need to invest in stocks to achieve your financial goals, you can find helpful information here . With the right strategy, you can potentially earn a substantial return on your investment in the stock market.

Risk and Return, Some investments in the stock market have earned 10 annually

There is a direct relationship between risk and return in the stock market. The higher the risk, the higher the potential return. However, there is also the potential for greater losses.

Diversification is one way to reduce risk. By investing in a variety of different stocks, investors can reduce the impact of any one stock’s performance on their overall portfolio.

There are a number of different investment strategies that investors can use to balance risk and return. Some investors prefer to invest in stocks that pay dividends, while others prefer to invest in growth stocks that have the potential for higher returns.

Summary

In conclusion, achieving 10% annual returns in the stock market requires a comprehensive understanding of risk and return, a well-defined investment strategy, and a keen eye on market conditions. By carefully considering these factors and implementing appropriate strategies, investors can position themselves to capitalize on the potential for significant financial growth.

Key Questions Answered

What are the key factors that have contributed to high returns in the stock market?

Economic growth, technological advancements, and favorable market conditions have all played significant roles in driving high returns in the stock market.

How can investors reduce risk in their stock market investments?

Diversification, asset allocation, and risk management strategies can help investors mitigate risk and protect their portfolios.

What are some examples of successful investment strategies for achieving high returns?

Value investing, growth investing, and income investing are all strategies that have been used to generate substantial returns in the stock market.