Under the partial equity method of accounting for an investment, a nuanced approach is adopted to reflect the complexities of real-world financial relationships. This method provides a comprehensive framework for recognizing and reporting the impact of investments where the investor exercises significant influence, offering valuable insights into the true nature of these financial arrangements.

As we delve into the intricacies of this method, we will explore its application in various scenarios, examining the initial recognition of investments, the recognition of income, and the consolidation of financial statements. We will also discuss impairment considerations and compare the partial equity method to other investment accounting methods, providing a holistic understanding of its advantages and disadvantages.

Partial Equity Method of Accounting for Investments

The partial equity method of accounting is used to account for investments in which the investor has significant influence over the investee but does not control it. This method is typically used when the investor owns between 20% and 50% of the investee’s voting stock.

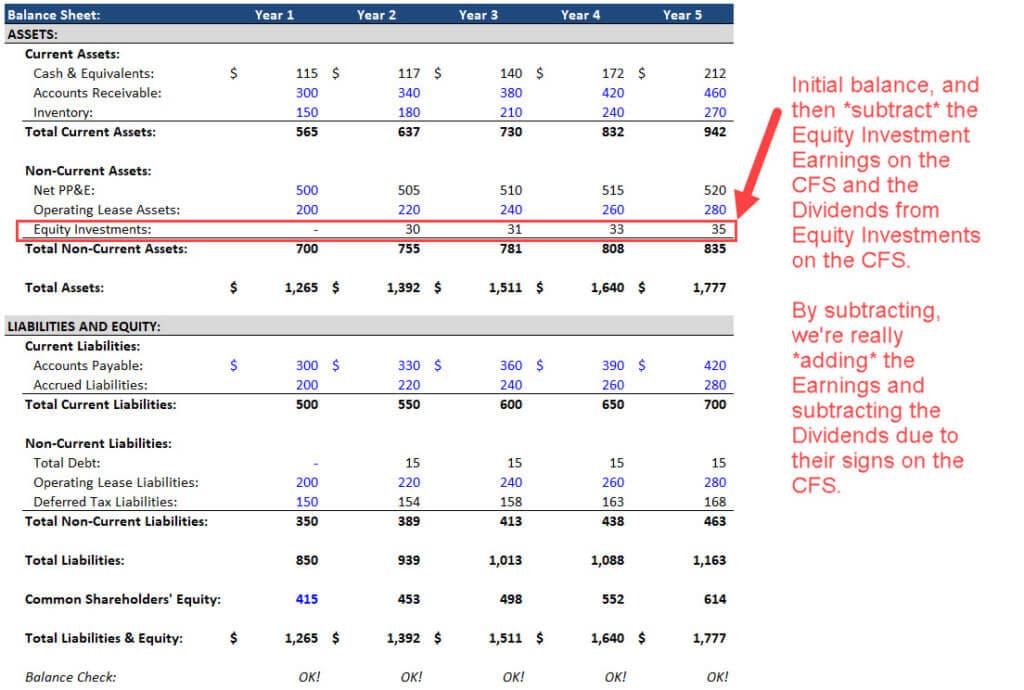

Under the partial equity method, the investment is initially recognized at cost. Subsequently, the investment is adjusted to reflect the investor’s share of the investee’s net income or loss and other comprehensive income or loss. The investor also recognizes its share of the investee’s dividends as income.

Recognition of Investment and Income, Under the partial equity method of accounting for an investment

When an investor acquires an investment in an investee under the partial equity method, the investment is initially recognized at cost. The cost of the investment includes the purchase price, any brokerage fees or commissions, and any other costs incurred to acquire the investment.

After the initial recognition, the investment is adjusted each period to reflect the investor’s share of the investee’s net income or loss. The investor’s share of the investee’s net income is calculated by multiplying the investee’s net income by the investor’s ownership percentage.

Under the partial equity method of accounting for an investment, the investor recognizes a proportionate share of the investee’s net income or loss and reports it in their own financial statements. This method is commonly used when the investor has significant influence over the investee but does not control it.

For those seeking investment opportunities, it’s crucial to stay informed about the latest market trends and identify stocks with strong fundamentals. By understanding the partial equity method and researching potential investments, investors can make informed decisions to maximize their returns.

To learn more about the best stocks to invest in right now, refer to this comprehensive guide: what is the best stock to invest in right now .

The investor also recognizes its share of the investee’s dividends as income. Dividends are recognized when they are declared by the investee.

Consolidation of Financial Statements

When an investor has significant influence over an investee, the investor may consolidate the investee’s financial statements with its own financial statements. Consolidation is the process of combining the financial statements of two or more entities into a single set of financial statements.

When consolidating financial statements, the investor must eliminate intercompany transactions and balances. Intercompany transactions are transactions between the investor and the investee. Intercompany balances are balances that arise from intercompany transactions.

Ultimate Conclusion

In conclusion, the partial equity method of accounting for investments offers a valuable tool for investors seeking to accurately portray their financial relationships and the impact of their investments. By understanding the intricacies of this method, investors can make informed decisions and provide transparent financial reporting, fostering trust and confidence in the financial markets.

Answers to Common Questions: Under The Partial Equity Method Of Accounting For An Investment

What are the key differences between the partial equity method and the cost method of accounting for investments?

The partial equity method recognizes a proportionate share of the investee’s income and expenses, while the cost method only recognizes dividends received.

How does the partial equity method affect the consolidation of financial statements?

Under the partial equity method, the investment is consolidated only to the extent of the investor’s ownership percentage, and intercompany transactions and balances are eliminated.

What are the disclosure requirements for investments accounted for using the partial equity method?

Financial statements must disclose the investor’s ownership percentage, the carrying value of the investment, and any significant transactions with the investee.