What capital gains are excluded from net investment income tax? Understanding the nuances of this tax can be a daunting task. This guide will delve into the intricacies of capital gains, net investment income tax (NIIT), and the specific exclusions that can significantly impact your tax liability.

By exploring these exclusions, you’ll gain valuable insights into tax planning strategies that can optimize your financial outcomes.

As we navigate this topic, we’ll uncover the criteria that determine which capital gains are exempt from NIIT, empowering you with the knowledge to make informed decisions and maximize the benefits of these exclusions.

Capital gains from the sale of a principal residence, up to a certain amount, are excluded from net investment income tax. This exclusion helps to encourage homeownership and provides a tax break for those who sell their homes. In contrast, foreign investment in certain industries, such as tobacco and mining, may be restricted in some countries.

Other capital gains, such as those from the sale of stocks or bonds, are subject to net investment income tax.

What are Capital Gains?: What Capital Gains Are Excluded From Net Investment Income Tax

Capital gains refer to the profit earned when you sell an asset, such as stocks, bonds, or real estate, for more than its original purchase price. These gains can be categorized as either short-term or long-term.

Short-term capital gains are generated from the sale of an asset held for one year or less, while long-term capital gains arise from the sale of an asset held for more than one year. The tax treatment of these gains varies depending on your income and filing status.

Net Investment Income Tax (NIIT)

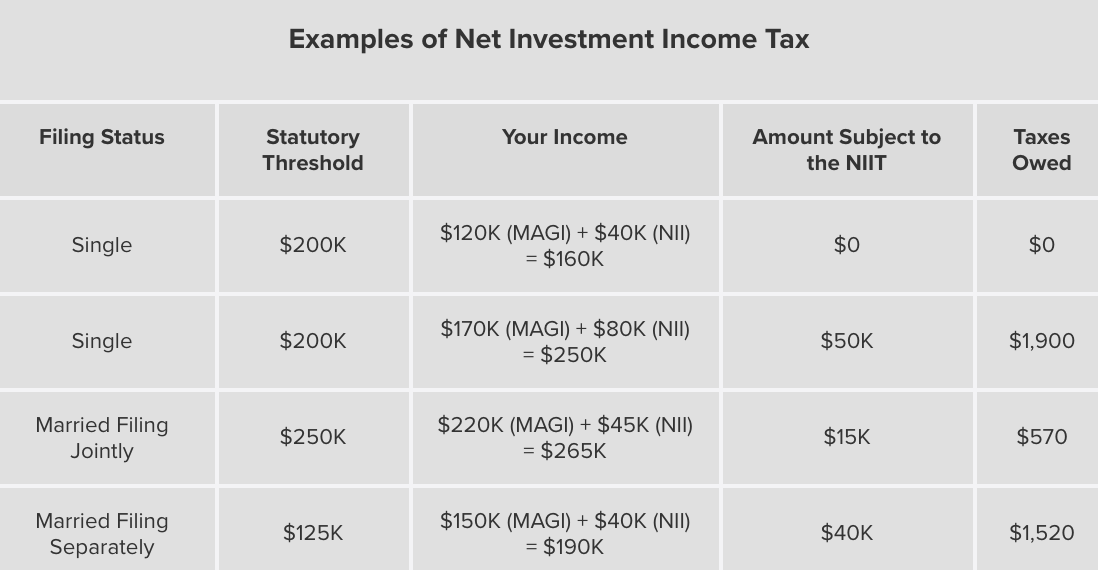

The Net Investment Income Tax (NIIT) is a 3.8% surtax imposed on investment income earned by high-income taxpayers. This tax applies to certain types of income, including interest, dividends, capital gains, and rental income.

The NIIT is designed to generate additional revenue for Medicare, the federal health insurance program for the elderly and disabled. It was enacted as part of the Affordable Care Act (ACA) in 2010.

Exclusions from NIIT for Capital Gains

Not all capital gains are subject to the NIIT. The following types of capital gains are excluded from the NIIT:

- Gains from the sale of a primary residence, up to a certain amount ($250,000 for single filers and $500,000 for married couples filing jointly)

- Gains from the sale of qualified small business stock

- Gains from the sale of certain types of municipal bonds

- Gains from the sale of inherited property, up to a certain amount

Impact of Exclusions on Tax Liability

The exclusions from the NIIT can significantly reduce your tax liability. For example, if you sell your primary residence for a gain of $200,000, you will not owe any NIIT on that gain. This is because the gain is excluded from the NIIT.

However, if you sell your primary residence for a gain of $300,000, you will owe NIIT on the portion of the gain that exceeds the exclusion amount ($50,000). In this case, you would owe NIIT of $1,900 (3.8% x $50,000).

Planning Strategies, What capital gains are excluded from net investment income tax

There are a number of planning strategies that you can use to maximize the benefits of the NIIT exclusions. These strategies include:

- Selling your primary residence before the exclusion amount is reduced

- Investing in qualified small business stock

- Investing in certain types of municipal bonds

- Inheriting property from a deceased relative

Closure

In conclusion, the exclusions from NIIT for certain capital gains provide taxpayers with opportunities to reduce their tax burden and enhance their financial well-being. By understanding these exclusions and implementing effective planning strategies, you can navigate the complexities of the tax code and optimize your investment returns.

Remember, staying informed and consulting with a qualified tax professional can ensure that you fully leverage these exclusions and minimize your tax liability.

FAQ Corner

What is the difference between short-term and long-term capital gains?

Short-term capital gains are profits from the sale of assets held for one year or less, while long-term capital gains are profits from assets held for more than one year.

Which types of capital gains are excluded from NIIT?

Exclusions include gains from the sale of personal residences, qualified small business stock, and certain municipal bonds.

How can I avoid triggering NIIT on capital gains?

Strategies include holding assets for more than one year to qualify for lower long-term capital gains rates and utilizing tax-advantaged accounts like IRAs and 401(k)s.