What does a mortgage real estate investment trust invest in? Mortgage real estate investment trusts (mREITs) are a type of investment vehicle that invests in mortgage-backed securities (MBSs), whole loans, and other real estate-related assets. They offer investors a way to participate in the real estate market without having to directly own property.

mREITs play a vital role in the housing market by providing liquidity to the mortgage market and making it easier for homeowners to obtain financing. They also offer investors a way to diversify their portfolios and potentially generate income.

Types of Mortgage Real Estate Investment Trusts (mREITs)

mREITs are classified into different types based on the underlying mortgages they invest in:

Agency mREITs

Invest primarily in mortgage-backed securities (MBSs) guaranteed by government-sponsored entities (GSEs) such as Fannie Mae, Freddie Mac, and Ginnie Mae.

Non-Agency mREITs

Invest in MBSs that are not backed by GSEs, which typically carry higher risk but offer higher potential returns.

Hybrid mREITs

Invest in a combination of agency and non-agency MBSs, providing a balance between risk and return.

Investment Strategies of mREITs

mREITs employ various investment strategies to generate income:

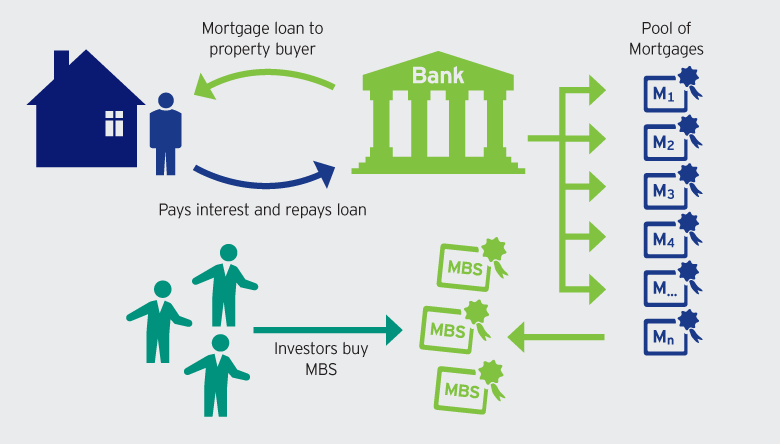

Purchasing Mortgage-Backed Securities (MBSs)

MBSs are pools of mortgages that are bundled together and sold as securities. mREITs can purchase MBSs to earn interest payments from the underlying mortgages.

A mortgage real estate investment trust (REIT) invests primarily in mortgages secured by real estate. While the performance of mortgage REITs can be influenced by factors such as interest rates and economic conditions, they can provide diversification and income potential for investors.

If you’re considering investing in a mortgage REIT, it’s important to research the company and understand its investment strategy. Is this a good time to invest in bonds ? Bonds are another investment option that can provide income and diversification, but their performance can also be affected by interest rates and economic conditions.

It’s important to consult with a financial advisor to determine which investments are right for your individual circumstances.

Investing in Whole Loans

mREITs can also invest directly in whole loans, which are individual mortgages that have not been securitized. This strategy offers higher potential returns but also carries higher risk.

Making Direct Mortgage Loans

Some mREITs originate and hold mortgage loans directly. This strategy provides mREITs with greater control over the underlying assets but requires more capital and expertise.

Factors Affecting mREIT Performance

The performance of mREITs is influenced by several key factors:

Interest Rates

Interest rate changes can impact the value of MBSs and the prepayment rates on underlying mortgages, affecting mREITs’ net interest margin (NIM).

Prepayment Rates

When homeowners refinance or sell their properties, the underlying mortgages can be prepaid, which can reduce mREITs’ income.

Credit Quality of Underlying Mortgages, What does a mortgage real estate investment trust invest in

The credit quality of the underlying mortgages determines the likelihood of defaults and losses, impacting mREITs’ profitability.

Benefits and Risks of Investing in mREITs: What Does A Mortgage Real Estate Investment Trust Invest In

Investing in mREITs offers potential benefits and risks:

Benefits

- Income generation through interest payments

- Diversification of investment portfolio

- Potential for capital appreciation

Risks

- Interest rate risk

- Credit risk

- Liquidity risk

Due Diligence for mREIT Investments

Conducting due diligence is crucial before investing in mREITs:

Key considerations include:

- Evaluating the management team

- Reviewing financial statements

- Assessing the quality of the underlying mortgage portfolio

Market Trends and Outlook for mREITs

The mREIT industry is influenced by regulatory changes, technological advancements, and economic conditions:

- Regulatory changes can impact mREITs’ investment strategies and risk profiles.

- Technological advancements can improve mREITs’ efficiency and risk management capabilities.

- Economic conditions, such as interest rate fluctuations and housing market trends, can affect mREITs’ performance.

Closure

In conclusion, mREITs are a complex and dynamic investment vehicle that can offer investors a number of potential benefits. However, it is important to understand the risks involved before investing in mREITs. Investors should carefully consider their investment goals and risk tolerance before making any investment decisions.

FAQ Guide

What are the different types of mREITs?

There are three main types of mREITs: agency mREITs, non-agency mREITs, and hybrid mREITs.

What are the risks of investing in mREITs?

The risks of investing in mREITs include interest rate risk, credit risk, and liquidity risk.

How can I invest in mREITs?

You can invest in mREITs through a broker or financial advisor.