What is a characteristic of a unit investment trust – Introducing the world of Unit Investment Trusts (UITs), this piece delves into the intricacies of these investment vehicles, unveiling their structure, types, advantages, disadvantages, and tax implications. Get ready for an enlightening journey into the realm of UITs!

Unit Investment Trusts (UITs) are a type of investment fund that offers a diversified portfolio of fixed-income securities or equity shares. They provide investors with a convenient and cost-effective way to access a variety of investments.

Characteristics of a Unit Investment Trust (UIT)

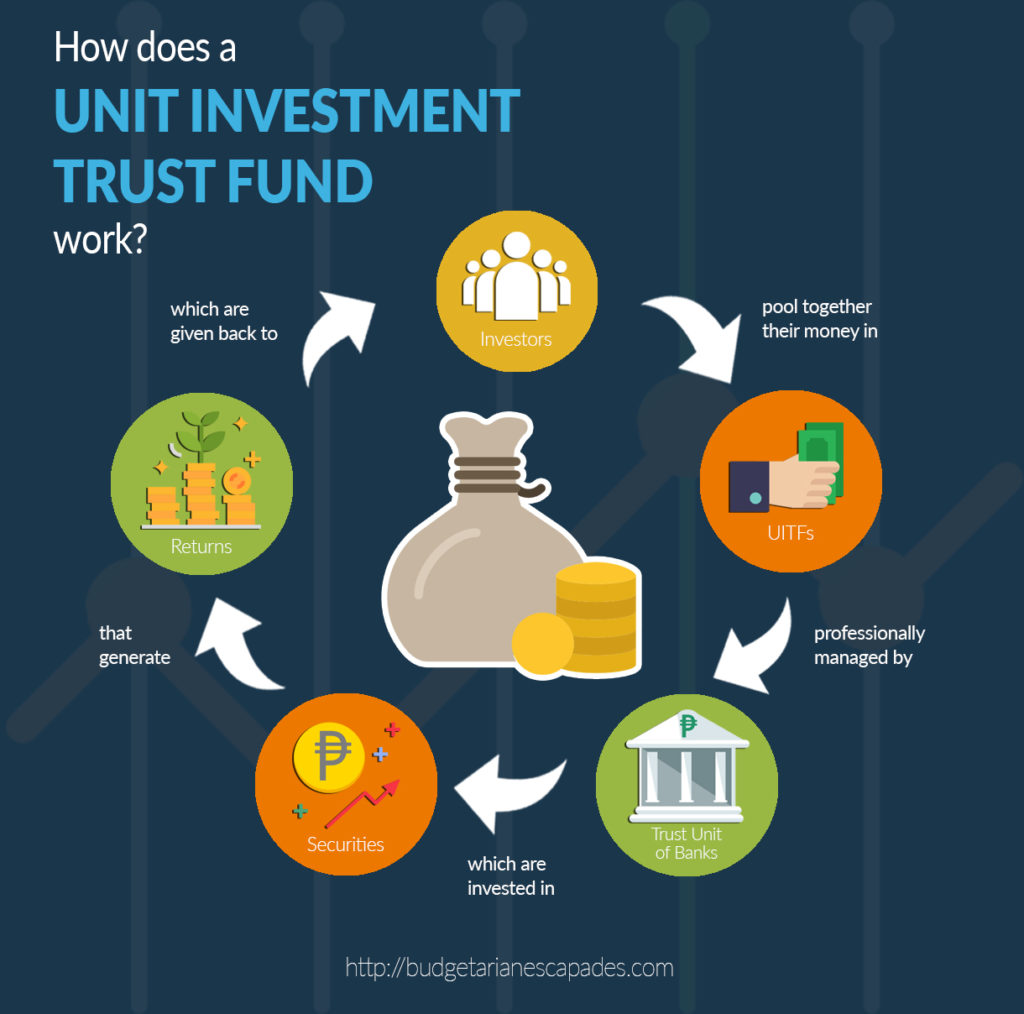

A Unit Investment Trust (UIT) is a type of investment fund that pools investor money to purchase a fixed portfolio of securities, typically stocks or bonds. UITs offer investors diversification and professional management, but they also have some limitations.

UITs are structured as trusts, with a trustee responsible for managing the fund’s assets. The trustee typically selects the securities for the portfolio and distributes income and capital gains to investors.

UITs are typically closed-end funds, meaning that they do not issue new shares after their initial offering. This means that the number of shares outstanding remains constant, and the price of the shares is determined by supply and demand in the secondary market.

UITs offer a number of advantages over individual securities, including:

- Diversification: UITs provide investors with instant diversification by investing in a portfolio of securities, reducing the risk of any one investment underperforming.

- Professional management: UITs are managed by professional investment managers who research and select the securities for the portfolio.

- Liquidity: UITs are traded on the secondary market, providing investors with liquidity if they need to sell their shares.

However, UITs also have some drawbacks, including:

- Limited flexibility: UITs are not as flexible as individual securities, as investors cannot choose which securities to buy or sell.

- Potential for lower returns: UITs may have lower returns than individual securities, as the fund manager’s fees and expenses can eat into the returns.

- Tax inefficiency: UITs can be tax-inefficient, as they are required to distribute all of their income and capital gains to investors, regardless of their tax status.

Types of Unit Investment Trusts

There are several different types of UITs, each with its own unique investment objectives and risk profile.

- Stock UITsinvest in a portfolio of stocks. Stock UITs can be further classified by the type of stocks they invest in, such as large-cap, mid-cap, or small-cap stocks.

- Bond UITsinvest in a portfolio of bonds. Bond UITs can be further classified by the type of bonds they invest in, such as corporate bonds, government bonds, or municipal bonds.

- Real estate UITsinvest in a portfolio of real estate properties. Real estate UITs can be further classified by the type of real estate they invest in, such as residential properties, commercial properties, or industrial properties.

- Other UITsinvest in a portfolio of other assets, such as commodities, currencies, or alternative investments.

The risk and return profile of a UIT depends on the type of assets it invests in. Stock UITs tend to be more volatile than bond UITs, but they also have the potential for higher returns. Real estate UITs can provide investors with exposure to the real estate market, but they can also be less liquid than stock or bond UITs.

Advantages and Disadvantages of UITs

UITs offer a number of advantages over individual securities, including:

- Diversification:UITs provide investors with instant diversification by investing in a portfolio of securities, reducing the risk of any one investment underperforming.

- Professional management:UITs are managed by professional investment managers who research and select the securities for the portfolio.

- Liquidity:UITs are traded on the secondary market, providing investors with liquidity if they need to sell their shares.

However, UITs also have some drawbacks, including:

- Limited flexibility:UITs are not as flexible as individual securities, as investors cannot choose which securities to buy or sell.

- Potential for lower returns:UITs may have lower returns than individual securities, as the fund manager’s fees and expenses can eat into the returns.

- Tax inefficiency:UITs can be tax-inefficient, as they are required to distribute all of their income and capital gains to investors, regardless of their tax status.

UITs can be a good investment option for investors who are looking for a diversified portfolio of securities that is managed by a professional. However, investors should be aware of the potential drawbacks of UITs before investing.

Taxation of Unit Investment Trusts

UITs are taxed as trusts, which means that they are not subject to corporate income tax. However, UITs are required to distribute all of their income and capital gains to investors, regardless of their tax status.

This can make UITs tax-inefficient for investors who are in high tax brackets. For example, if a UIT distributes a dividend of $100, an investor in the 25% tax bracket will have to pay $25 in taxes on the dividend.

There are some strategies that investors can use to reduce the tax impact of UITs. One strategy is to hold UITs in a tax-advantaged account, such as an IRA or 401(k). Another strategy is to invest in UITs that have a low turnover rate.

UITs with a low turnover rate will generate less capital gains, which can reduce the investor’s tax liability.

Wrap-Up

In summary, Unit Investment Trusts (UITs) offer a unique blend of diversification, professional management, and tax efficiency. However, their limited flexibility and potential for lower returns should be carefully considered before investing. Whether UITs align with your investment goals depends on your individual circumstances and risk tolerance.

Consult a financial advisor to determine if UITs are a suitable addition to your portfolio.

Answers to Common Questions: What Is A Characteristic Of A Unit Investment Trust

What is the structure of a UIT?

A UIT is typically structured as a trust, with a trustee responsible for managing the fund’s assets and distributing income to investors.

What are the different types of UITs?

UITs can be classified based on their underlying investments, such as UITs invested in stocks, bonds, real estate, or a combination of assets.

A unit investment trust, which pools funds from investors to purchase a fixed portfolio of securities, offers diversification but limited flexibility. However, investing in a commodity can be risky due to factors such as price volatility and supply chain disruptions ( why is it risky to invest in a commodity ). Therefore, it is crucial to consider these risks and consult with a financial advisor before investing in unit investment trusts or commodities.

What are the advantages of investing in UITs?

UITs offer diversification, professional management, and tax efficiency.

What are the disadvantages of investing in UITs?

UITs have limited flexibility and may have lower returns compared to other investment options.