When an investor sells a portion of an equity-method investment, it triggers a series of financial and accounting implications. This guide delves into the intricacies of this transaction, providing a comprehensive overview of the process, its impact on financial statements, and the relevant accounting and tax considerations.

When an investor sells a portion of an equity-method investment, the proceeds are typically reinvested in other opportunities. A popular choice for reinvestment is the Vanguard S&P 500 index fund, which offers a diversified portfolio of large-cap U.S. stocks. For guidance on how much to invest in the Vanguard S&P 500, please refer to our comprehensive article how much to invest in vanguard s&p 500 . After considering the factors outlined in the article, investors can determine an appropriate allocation for the Vanguard S&P 500 in their overall investment portfolio.

When an investor sells a portion of an equity-method investment, the proceeds can be used to rebalance their portfolio or to fund other financial goals.

Equity-method investments, commonly employed by investors to gain influence over other entities without acquiring control, are accounted for using the equity method. When a portion of such an investment is sold, the investor must recognize a gain or loss and adjust their financial statements accordingly.

This guide will explore the nuances of this process, empowering investors with the knowledge to navigate the complexities of equity-method investment sales.

Overview of Equity-Method Investments: When An Investor Sells A Portion Of An Equity-method Investment

Equity-method investments are accounting investments in which an investor acquires less than 50% of the voting stock of another company, but still has significant influence over the company’s operations. The purpose of an equity-method investment is to allow the investor to share in the earnings and losses of the investee company while maintaining its own separate identity.

Typical equity-method investments include:

- Investments in joint ventures

- Investments in associate companies

- Investments in subsidiaries that are not majority-owned

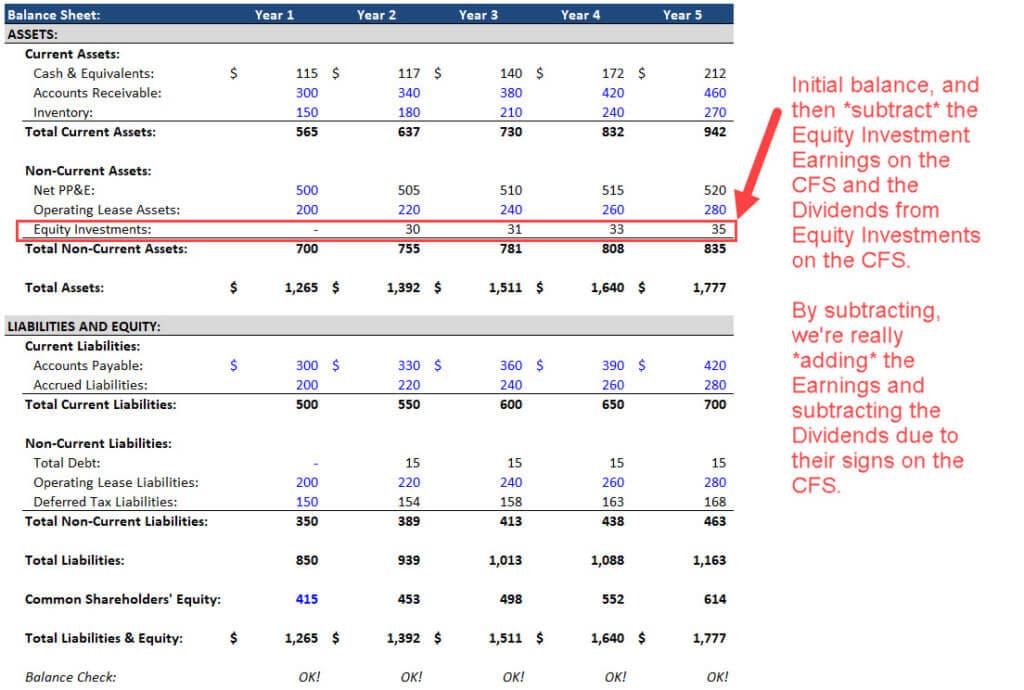

Under the equity method of accounting, the investor records its investment at cost and adjusts its investment account each period to reflect its share of the investee company’s net income or loss.

Sale of a Portion of an Equity-Method Investment

When an investor sells a portion of an equity-method investment, the investor recognizes a gain or loss on the sale. The gain or loss is calculated as the difference between the proceeds from the sale and the carrying amount of the investment.

The impact on the investor’s financial statements is as follows:

- The investment account is reduced by the amount of the proceeds from the sale.

- The gain or loss on the sale is recognized in the income statement.

- The investor’s share of the investee company’s net income or loss is reduced.

The tax implications of the sale depend on the investor’s tax status and the tax laws of the jurisdiction in which the sale occurs.

Gain or Loss on Sale

The gain or loss on the sale of a portion of an equity-method investment is calculated as follows:

Gain or Loss = Proceeds from Sale – Carrying Amount of Investment

The factors that affect the gain or loss include:

- The proceeds from the sale

- The carrying amount of the investment

- The investor’s share of the investee company’s net income or loss since the date of acquisition

For example, if an investor sells a portion of an equity-method investment for $100,000 and the carrying amount of the investment is $80,000, the investor recognizes a gain of $20,000.

Accounting for the Sale

The accounting entries to record the sale of a portion of an equity-method investment are as follows:

| Debit | Credit |

|---|---|

| Cash | $100,000 |

| Investment in Investee Company | $80,000 |

| Gain on Sale of Investment | $20,000 |

The impact on the investor’s balance sheet and income statement is as follows:

- The investment account is reduced by the amount of the proceeds from the sale.

- The gain on the sale is recognized in the income statement.

- The investor’s share of the investee company’s net income or loss is reduced.

Disclosure Requirements, When an investor sells a portion of an equity-method investment

The disclosure requirements for the sale of a portion of an equity-method investment are as follows:

- The nature of the transaction

- The date of the transaction

- The proceeds from the sale

- The carrying amount of the investment

- The gain or loss on the sale

The purpose of these disclosure requirements is to provide investors with the information they need to understand the impact of the sale on the investor’s financial statements.

Special Considerations

There are a number of special considerations that may arise when selling a portion of an equity-method investment. These considerations include:

- The tax implications of the sale

- The impact on the investor’s relationship with the investee company

- The potential for the sale to trigger a change in the investor’s accounting treatment of the investment

It is important for investors to carefully consider these special considerations before selling a portion of an equity-method investment.

Epilogue

In summary, the sale of a portion of an equity-method investment requires careful consideration of accounting principles, tax implications, and potential risks. By understanding the intricacies of this transaction, investors can make informed decisions, mitigate potential pitfalls, and optimize the outcome of their investment strategies.

Query Resolution

What are the tax implications of selling a portion of an equity-method investment?

The tax implications depend on the investor’s tax status and the nature of the investment. Generally, gains from the sale of equity investments are taxed as capital gains, while losses may be deductible against capital gains or ordinary income.

How is the gain or loss on the sale of an equity-method investment calculated?

The gain or loss is calculated as the difference between the proceeds from the sale and the investor’s carrying value of the investment. The carrying value is typically the original cost of the investment, adjusted for any dividends or other distributions received.

What are the special considerations that may arise when selling a portion of an equity-method investment?

Special considerations may include potential restrictions on the sale, the impact on the investor’s relationship with the investee, and the potential for contingent liabilities.