Where does short term investments go on a balance sheet – Delving into the intricacies of financial reporting, we embark on an exploration of where short-term investments find their place on the balance sheet. This journey will shed light on their classification, valuation, and the disclosures required to ensure transparency in financial statements.

Short-term investments, characterized by their liquidity and maturity within a year, occupy a distinct position on the balance sheet. Understanding their location and treatment is crucial for financial analysts, investors, and stakeholders alike.

Location of Short-Term Investments on the Balance Sheet

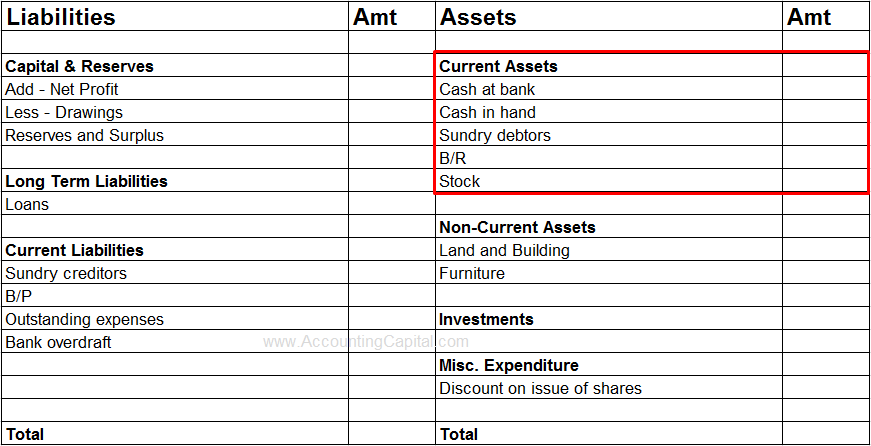

Short-term investments are typically reported on the balance sheet under the current assets section. This section includes assets that are expected to be converted into cash or used up within one year or the operating cycle of the business, whichever is longer.

Examples of specific line items or sections where short-term investments may appear include:

- Marketable securities

- Short-term investments in debt securities

- Short-term investments in equity securities

- Money market instruments

- Certificates of deposit

Classification of Short-Term Investments

Short-term investments are classified as such based on the following criteria:

- Maturity date:Investments with a maturity date of less than one year or the operating cycle of the business, whichever is longer, are considered short-term.

- Intent:The investment must be intended to be held for a short period of time, typically for liquidity purposes or to generate short-term income.

- Marketability:The investment must be readily marketable, meaning it can be easily converted into cash without significant loss of value.

Valuation of Short-Term Investments

Short-term investments are typically valued at fair value, which is the price at which the investment could be sold in an orderly transaction between market participants at the reporting date. Fair value accounting aims to provide a more accurate representation of the current value of the investment and reduce the potential for overstatement or understatement of assets.

Disclosures Related to Short-Term Investments, Where does short term investments go on a balance sheet

Accounting standards require the following disclosures regarding short-term investments:

- A description of the nature and purpose of the investments

- The carrying amount and fair value of the investments

- Any unrealized gains or losses on the investments

- The maturity dates of the investments

- Any restrictions on the sale or use of the investments

Comparison with Other Assets

Short-term investments are similar to other current assets in that they are expected to be converted into cash within a short period of time. However, they differ from other current assets in the following ways:

- Risk:Short-term investments are generally considered to be less risky than other current assets, such as inventory or accounts receivable.

- Return:Short-term investments typically provide a lower return than other current assets, such as marketable securities or accounts receivable.

- Liquidity:Short-term investments are highly liquid, meaning they can be easily converted into cash without significant loss of value.

Impact on Financial Analysis

Short-term investments can affect financial ratios and other metrics used in financial analysis. For example, a high level of short-term investments can increase a company’s liquidity ratios, such as the current ratio and quick ratio. Additionally, short-term investments can impact profitability ratios, such as the profit margin and return on assets, by providing a source of income.

Epilogue

In conclusion, short-term investments play a significant role in shaping a company’s financial health. Their presence on the balance sheet provides valuable insights into a company’s liquidity, risk tolerance, and overall financial strategy. By understanding their classification, valuation, and disclosure requirements, we gain a deeper comprehension of a company’s financial position and its ability to meet its short-term obligations.

When considering short-term investments, it’s crucial to understand their placement on a balance sheet. These investments are typically categorized as current assets, indicating their liquidity and expected conversion into cash within a year. In the realm of current assets, cryptocurrencies have emerged as a popular investment option.

To stay informed about the latest trends and identify the best cryptocurrency to invest in right now, refer to this comprehensive guide: what is the best cryptocurrency to invest in right now . By understanding the placement of short-term investments on a balance sheet and exploring the dynamic cryptocurrency market, you can make informed decisions to maximize your returns.

FAQ Resource: Where Does Short Term Investments Go On A Balance Sheet

What is the typical location of short-term investments on the balance sheet?

Short-term investments are typically reported under the current assets section of the balance sheet, alongside other assets that are expected to be converted into cash within a year.

How are short-term investments classified?

Short-term investments are classified based on their maturity date, liquidity, and risk profile. Common categories include marketable securities, money market instruments, and short-term loans.

What methods are used to value short-term investments?

Short-term investments are typically valued at fair value, which reflects the current market price or an estimate of their realizable value.